AUD/JPY Price Analysis: Looks to 200-DMA support ahead of Australian Employment data

- AUD/JPY stays pressured around monthly low despite avoiding daily losses the previous day.

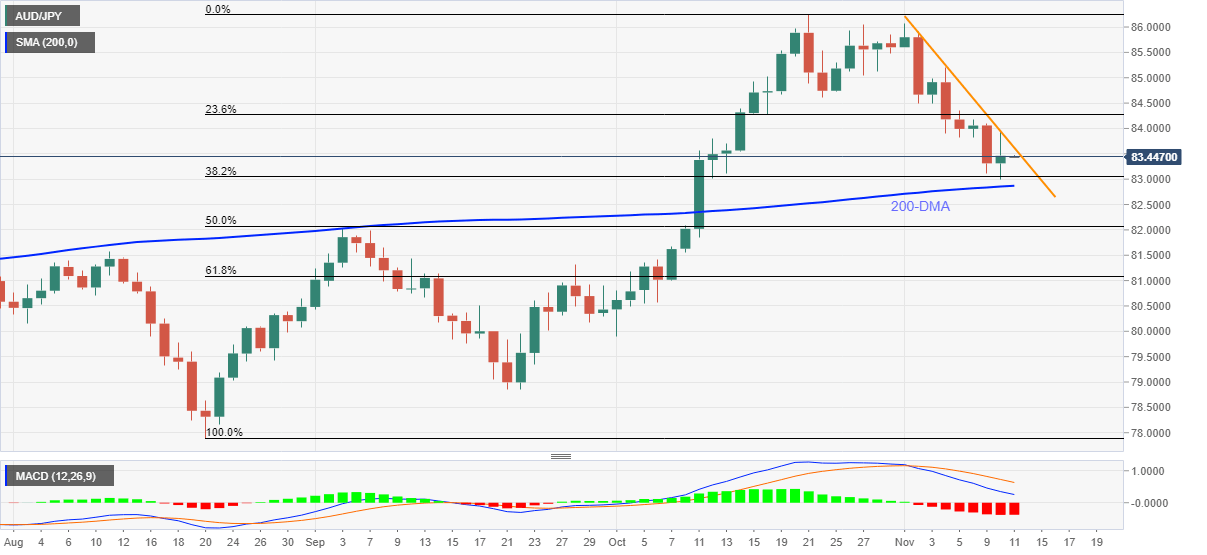

- Bearish MACD signals, immediate descending trend line favor sellers.

- Late October lows add to the upside filters.

AUD/JPY remains on the back foot around a one-month low, close to 83.45 amid the initial Asian session with a key Thursday comprising the Aussie jobs report for October.

Read: Australian Employment Preview: A positive surprise or too much optimism?

Although the cross-currency pair’s early Wednesday gains saved it from a negative daily closing, bearish MACD signals and a sustained follow-up of the descending resistance line from November 02 keep the sellers hopeful.

However, the 200-DMA level near 82.85 becomes a tough nut to crack for the bears before taking entries.

Following that, the 50%retracement of August-October upside joins October’s peak around the 82.00 threshold to challenge the AUD/JPY downturn.

Alternatively, a clear upside break of the immediate resistance line, close to 83.65 by press time, isn’t a green pass to the pair's bulls as lows marked during the late October, surrounding 84.60, adds to the upside filters.

Even if the quote manages to remain firm past 84.60, the 85.00 round figure and multiple tops near 86.00 will be challenging the AUD/JPY bulls before driving them to the last month’s peak of 86.25.

AUD/JPY: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.