AUD/JPY Price Analysis: Flirts with short-term key support ahead of RBA

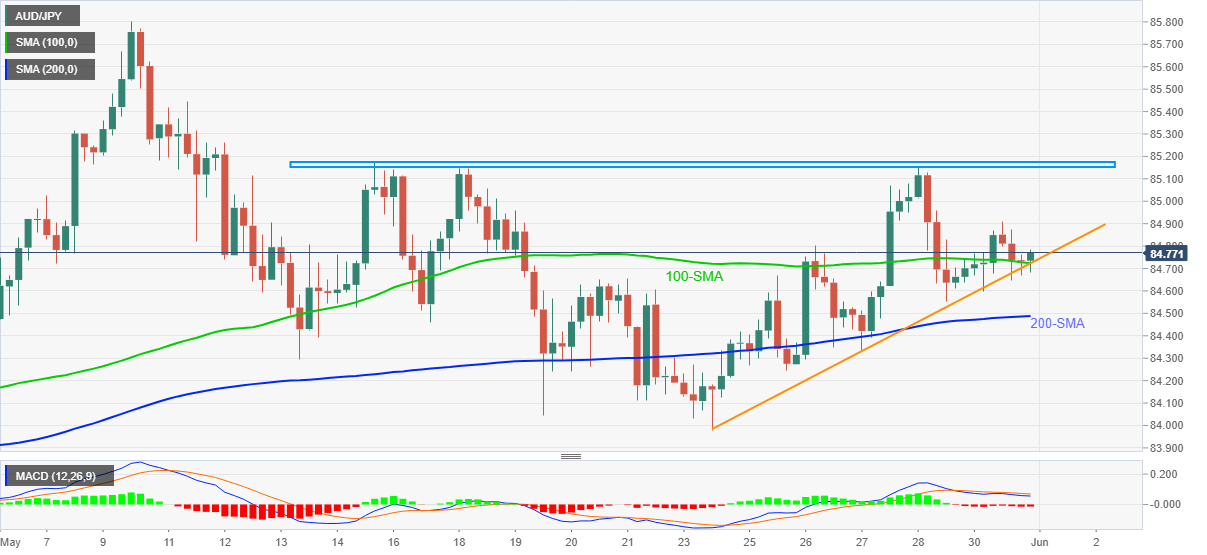

- AUD/JPY bounces off 100-SMA, weekly ascending trend line confluence.

- Bearish MACD, weakness below two-week-old horizontal resistance keeps sellers hopeful.

- RBA is widely anticipated to keep monetary policy unchanged, talks over snap lockdown, July moves eyed.

AUD/JPY extends Monday’s recovery moves to 84.75 amid the initial Asian session trading on Tuesday. In doing so, the cross-currency pair keeps corrective pullback from 100-SMA and a one-week-old support line ahead of the key Reserve Bank of Australia (RBA) monetary policy decision.

AUD/JPY sellers remain hopeful amid the recent lower high formation and bearish MACD, coupled with the sustained trading below a short-term horizontal resistance. However, a clear downside break of 84.70 becomes necessary for them to take entries.

Following that, the 200-SMA level of 84.48 may offer an intermediate halt before dragging the quote towards the 84.00 threshold and then to the monthly bottom surrounding 83.90.

Meanwhile, further recovery needs to cross the 85.00 round figure to convince buyers to attack a horizontal area surrounding 85.15-20.

It should, however, be noted that a successful run-up beyond 85.20 enables AUD/JPY to probe May’s peak of 85.80.

Read: Reserve Bank of Australia Preview: No fireworks as the focus is on July’s meeting

AUD/JPY four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.