Reserve Bank of Australia Preview: No fireworks as the focus is on July’s meeting

- The Reserve Bank of Australia is expected to maintain its monetary policy on hold.

- Australian wage growth bounced from record lows but remains below the RBA’s target.

- AUD/USD is neutral in the near-term, the long term bias is bearish.

The Reserve Bank of Australia is having a monetary policy meeting on Thursday. Market players are expecting no fireworks, as policymakers have already anticipated that they will review its yield-curve-control policy and quantitative easing program at the July meeting. With that in mind, it is clear that this particular one will likely pass unnoticed.

The RBA would likely maintain its main rate at a record low of 0.1% and its and three-year yield target at 0.10%, despite signs of economic progress within the pandemic progress. The Australian central bank has upgraded its economic outlook in May but clarified that the ongoing ultra-loose monetary policy is set to continue until at least 2024. In July, the RBA will decide whether to shift yield curve control to target the November 2024 maturity from the current April 2024.

Inflation and employment far below RBA’s targets

Meanwhile, inflation pressures remain subdued, according to Governor Philip Lowe, which also added an employment-related condition to a tighter monetary policy: wage growth at 3%. “It was likely that wages growth would need to be sustainably above 3%,” the March RBA’s minutes said, to be consistent with the central bank’s inflation target.

Australian wage growth plummeted to record lows at the end of 2020 amid the effects of the global pandemic. The latest reading showed that the Wage Price Index inched up to 1.5%YoY in Q1 2021, halfway through the RBA’s target. The annual inflation rate in Australia rose to 1.1% in Q1 2021 from 0.9% in Q4, far below the central bank desired 2-3% range.

Comparisons are awful, but the New Zealand Central Bank had a monetary policy meeting last week, and analysts dictated it was a “hawkish” one. Australian policymakers have been generally optimistic despite cautious, but the main question is if the RBA could be as hawkish as the RBNZ. Most market participants do not believe it would be possible. Hence, the AUD can fall in a non-event meeting.

AUD/USD possible scenarios

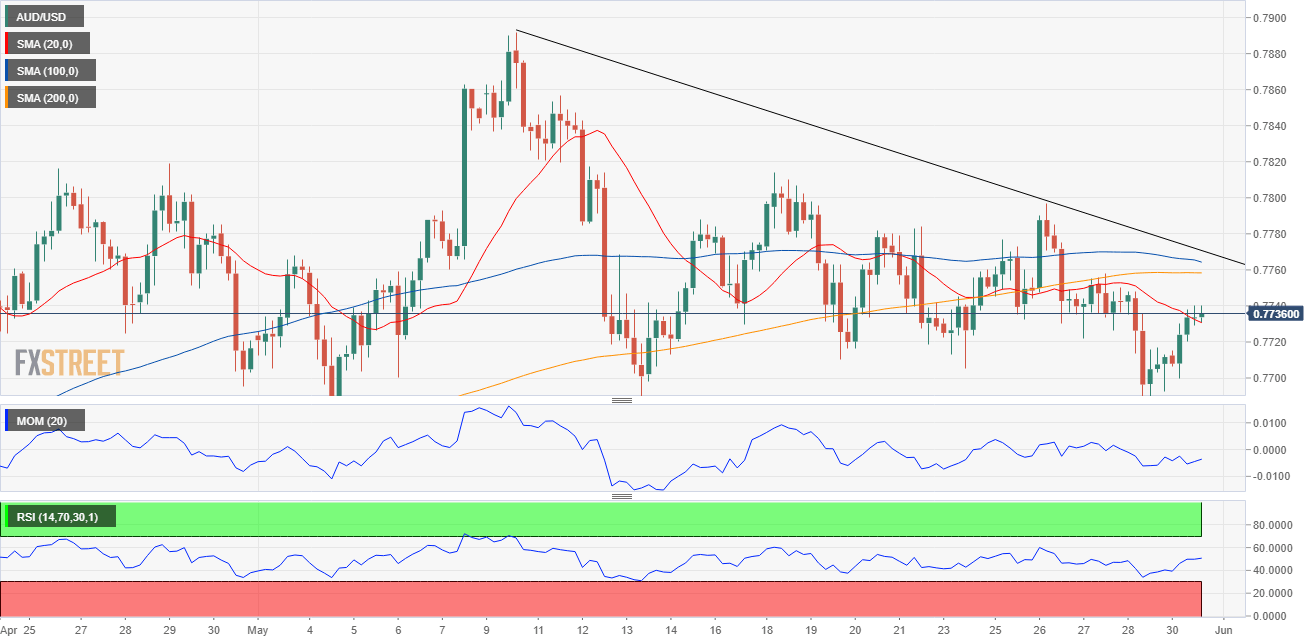

The AUD/USD is technically neutral-to-bearish ahead of the event, developing a daily descendant trend line coming from this month´s high, currently at around 0.7770. The 4-hour chart shows that the pair is currently struggling around a bearish 20 SMA, while the longer moving averages remain directionless above the current level. Technical indicators hover around their midlines without directional strength.

Bulls could have better chances on a break above the mentioned trend line, but the bullish case will be stronger if the pair advances beyond 0.7820. A critical support level comes at 0.7675, with a break below it opening the door for a steeper decline.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.