AUD/JPY Price Analysis: Extends gains toward 95.30 amid overbought momentum

- AUD/JPY was seen around the 95.20 zone on Thursday, building on bullish momentum ahead of the Asian session.

- Key support is seen near 95.20 and 94.90, while resistance stands at 95.34 and 96.43.

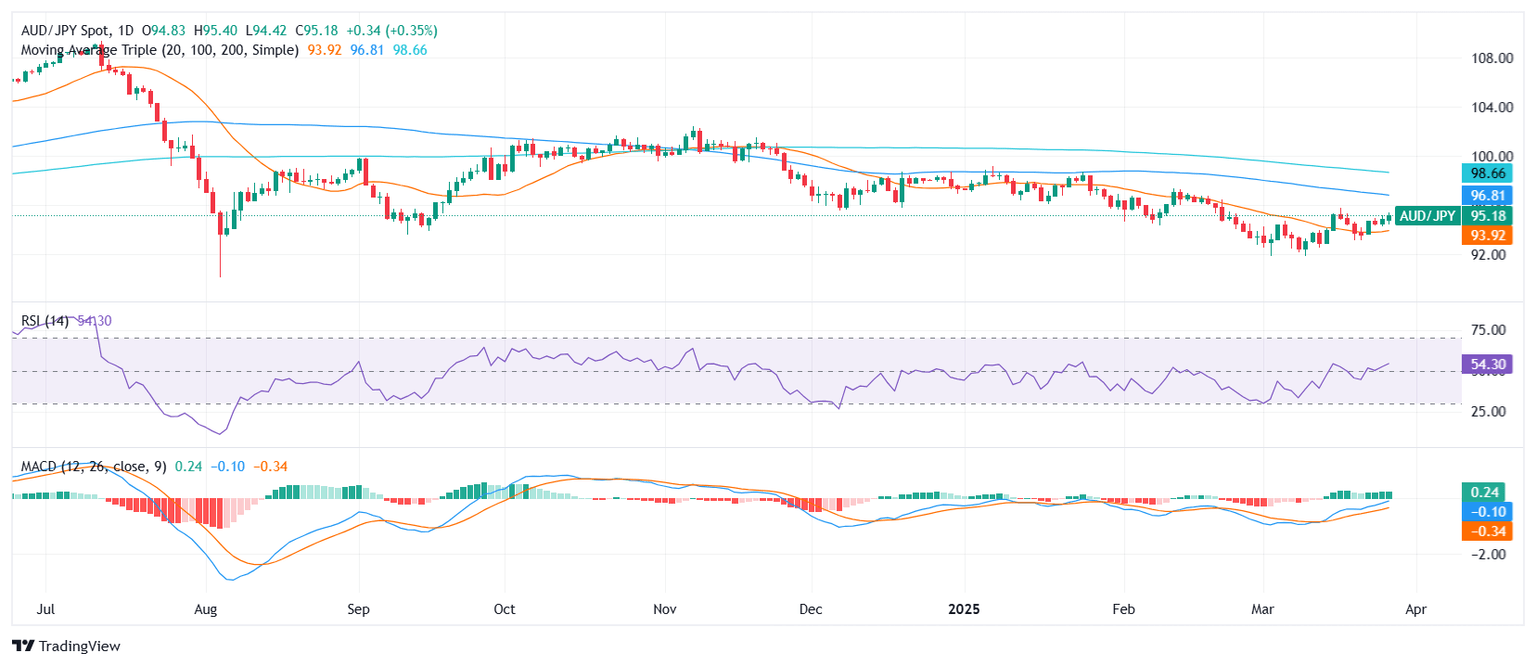

The AUD/JPY pair extended its winning streak on Thursday, advancing toward the 95.30 region after a strong daily performance. The pair is trading with a bullish tone after gaining traction during the European session, now sitting comfortably near the midpoint of its daily range between 94.42 and 95.40. This movement comes during Thursday’s session ahead of the Asian open, where momentum remains in the bulls’ favor despite signs of exhaustion.

From a technical standpoint, the short-term picture favors buyers. The 10-day Exponential Moving Average (EMA) at 94.50, 10-day Simple Moving Average (SMA) at 94.56, and 20-day SMA at 93.98 all point to continued upside pressure. Meanwhile, the Moving Average Convergence Divergence (MACD) signals a fresh buy, reinforcing the bullish structure.The Awesome Oscillator and Ultimate Oscillator (56.2) also remain neutral, hinting at the possibility of a pause or minor correction in the short term.

On the downside, immediate support aligns at 95.23, followed by 94.90 and 94.65. To the upside, resistance emerges at 95.34, with further barriers at 96.43 and 96.92. Although longer-term SMAslike the 100-day at 96.92 and 200-day at 98.75 suggest lingering bearish pressure, the current short-term outlook remains tilted in favor of continued gains, barring a reversal triggered by overbought conditions.

AUD/JPY daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.