AUD/JPY Price Analysis: Bulls step in and steal the 20-day SMA

- AUD/JPY was seen trading around the 95.30 area ahead of the Asian session, extending its rally.

- The pair climbed above the 20-day SMA, with indicators shifting into positive territory, suggesting sustained bullish momentum.

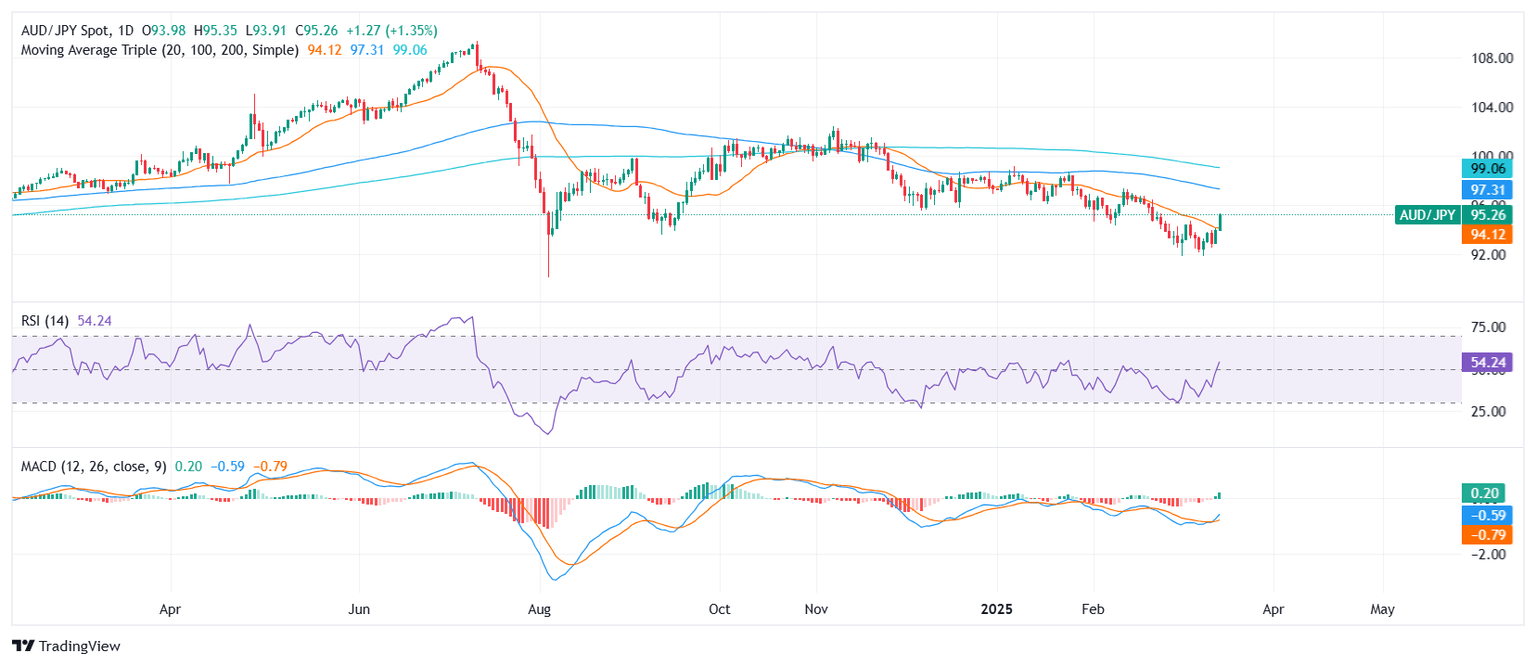

AUD/JPY surged on Monday ahead of the Asian session, gaining traction and trading near the 95.30 zone after a strong bullish advance. Buyers took control, pushing the pair beyond the 20-day Simple Moving Average (SMA), signaling a shift in momentum that could sustain further gains in the near term.

The Relative Strength Index (RSI) is trending higher in positive territory, reflecting the renewed strength of buyers, while the Moving Average Convergence Divergence (MACD) is printing rising green bars, reinforcing the improving outlook. The bullish crossover in momentum indicators suggests that the pair could maintain its upward trajectory.

Looking ahead, immediate resistance is seen at 95.50, with a breakout above this level paving the way toward 96.00. On the downside, initial support lies near 94.50, followed by a stronger floor around 94.00. As long as the pair holds above the 20-day SMA, the short-term outlook remains constructive for bulls.

AUD/JPY daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.