Apple Inc. (AAPL) Elliott Wave technical analysis [Video]

![Apple Inc. (AAPL) Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/Computer-with-Chart_2_XtraLarge.png)

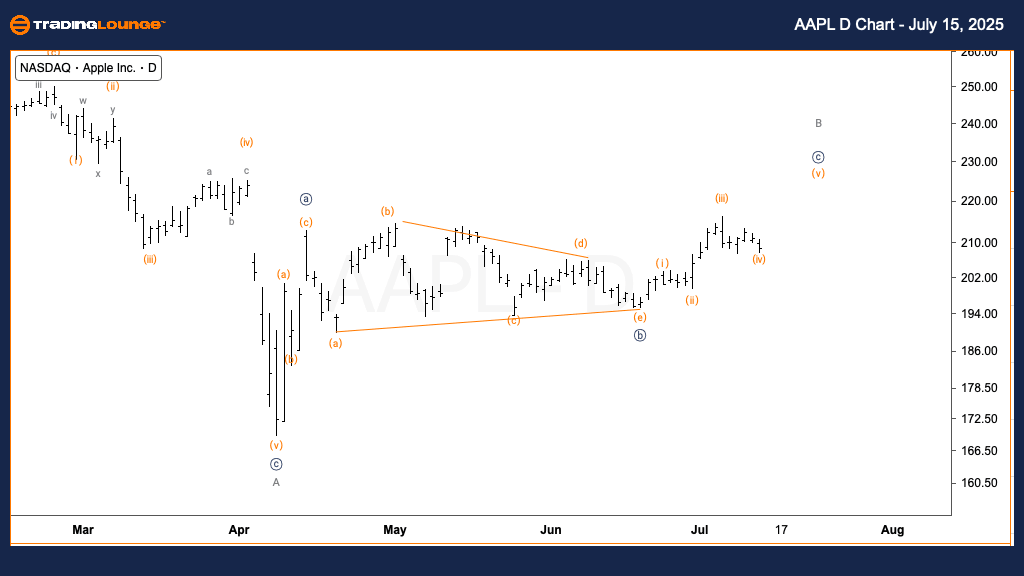

AAPL Elliott Wave technical analysis – Daily chart

Function: Counter trend.

Mode: Corrective.

Structure: Flat.

Position: Wave {c} of B.

Direction: Upside in {c}.

Details: Expecting further upside in wave {c}, with key Fibonacci targets at $224 (0.618 projection) and $244 (equality to wave {a}).

The daily chart of Apple Inc. (AAPL) shows a corrective countertrend move currently unfolding as wave {c} of B. This structure is part of a broader flat correction. Based on Fibonacci measurements, potential resistance targets include $224 and $244, representing 0.618 and 1.000 extensions of wave {a}, respectively. The outlook indicates more upside before the correction finalizes and the main trend direction resumes.

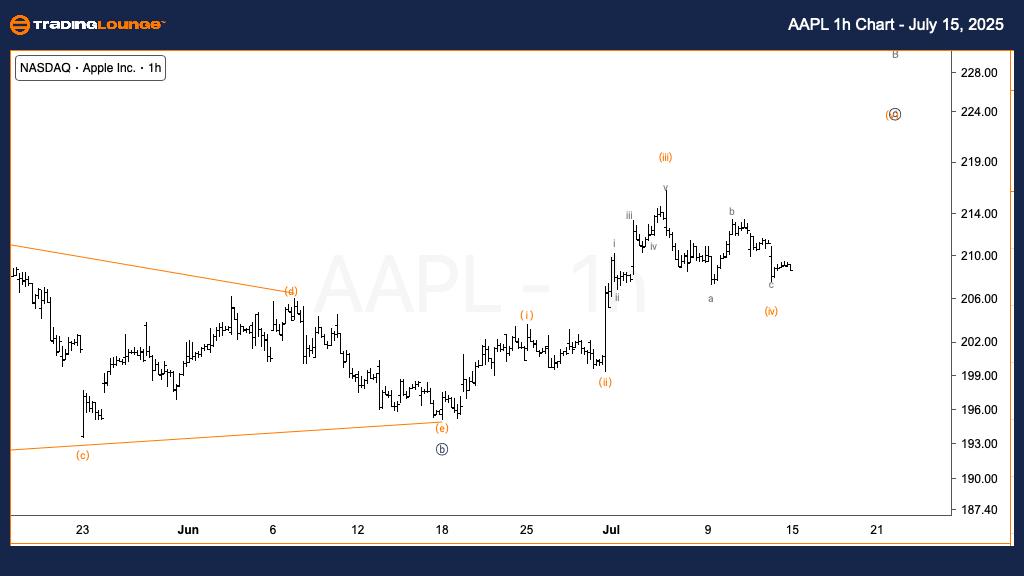

AAPL Elliott Wave technical analysis – One-hour chart

Function: Counter trend.

Mode: Corrective.

Structure: Flat.

Position: Wave (iv) of {c}.

Direction: Upside in {c}.

Details: Wave (iv) may have already bottomed after a clear three-wave decline. Now anticipating wave (v) of {c} to rise. As wave (iii) was not shorter than wave (i), wave (v) could extend.

The 1-hour chart indicates that wave (iv) of {c} may have completed, setting the stage for a final push higher in wave (v). Given that wave (iii) exceeded wave (i) in length, an extension in wave (v) is possible. This favors a bullish short-term view, with traders watching for a strong move into the $224–$244 target zone to complete wave {c}.

Apple Inc. (AAPL) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.