Apple (AAPL) Stock Price and Forecast: Apple iPhone chip shortages highlighted in earnings

- Apple stock closes down on Monday after disappointing earnings.

- AAPL stock looks to have set a lower high and entered bear mode.

- Apple iPhone sales were hit by legacy chip issues.

Apple earnings last week have given the Apple chart a somewhat bearish slant now with a disappointing release having seen some volatility shoot up and now price declines seem inevitable. Apple iPhone revenue was hit by chip issues with CEO Tim Cook telling Reuters, "Most of what we design are leading-edge (chip manufacturing) nodes, but all of the products have some legacy node components in them as well. And so that [shortage] continues into [fiscal] Q1, and we'll see what it looks like beyond that. It's very difficult to call." Apple derives most of its revenue from iPhone sales. Other areas such as Mac sales did actually come in ahead of expectations.

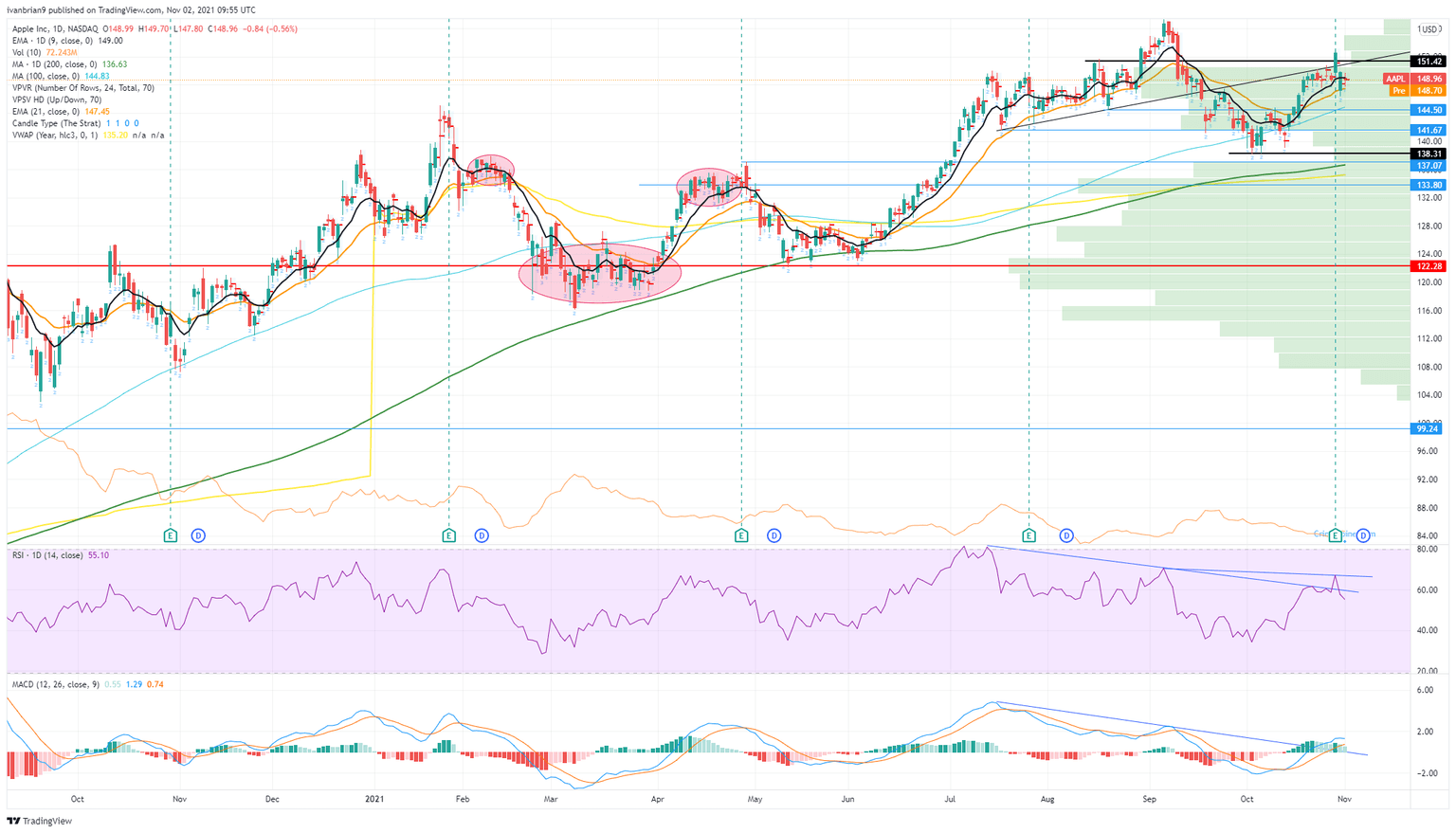

The Apple chart below shows the spike lower on the earnings release. Crucially, this move has consolidated and not retraced back higher. This is a continuation pattern, so we expect further declines.

AAPL 15-minute chart

Apple stock news

Apple saw an immediate drop in the aftermath of the earnings release, but the overall froth in the equity market has seen those losses limited so far on Monday. Apple registered a small loss of just 0.56% and closed at $148.96. It was a strong performance then, given the uncertainty surrounding the stock and the known supply chain and chip issues. We will have to wait to see how this one plays out.

Usually when a stock reacts well to bad news, it is a sign not to fight the trend, but with yields rising it may be time to ride the bull train through other means or just step away if you do not like the overall feel of the market. Apple today is trading slightly lower in the premarket, but European markets are steady with yields falling back slightly.

Apple stock forecast

The Apple chart now begins to look like it has more bearish potential post-earnings, but this is yet to be confirmed. The lack of bearish follow through on Monday was somewhat surprising and a warning sign. If ever bears had reason to push Apple lower, the earnings release was it. So far they have not done this. A confirmation move is needed, otherwise, it is a false break lower to shake out bears. This current zone from $150 to $142 has high volume and so high support. Breaking out of this will bring a quick test of the 200-day moving average at $136 with the yearly VWAP also down here adding to support. The MACD and RSI are still trending lower despite the peak just before the earnings release.

FXStreet View: Bearish but looking for confirmation with a break of the 100-day moving average at $145 to confirm.

AAPL 1-day chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637714424712082031.png&w=1536&q=95)