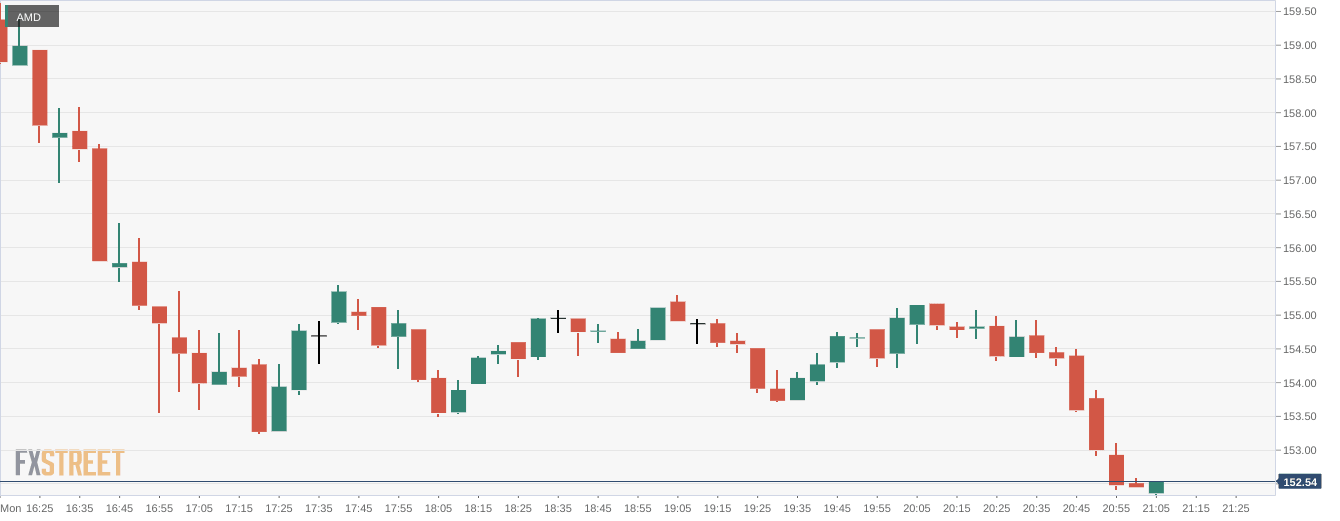

AMD Stock Price: Advanced Micro Devices tumbles into the close to start the week

- NASDAQ:AMD fell by 1.86% during Monday’s trading session.

- Semiconductor stocks fell off a cliff during afternoon trading.

- The Metaverse has AMD and NVIDIA as the new industry leaders.

NASDAQ:AMD appeared to be having another strong session to start the week but the market had other plans after lunch. Shares of AMD fell by 1.86% on Monday, and closed the first trading session of the week at $152.52. AMD has been one of hottest stocks over the past year, so shareholders won’t get much sympathy from those who missed the gains. Shares of AMD are up a whopping 65% so far in 2021, and an even more impressive 78% over the past 52-weeks. Needless to say, AMD is trading well above both of its 50-day and 200-day moving averages as it continues to hit all the right notes with investors.

Stay up to speed with hot stocks' news!

Semiconductor stocks hit a wall in the afternoon on Monday, as both AMD and chief rival NVIDIA (NASDAQ:NVDA) tumbled into the closing bell. It was a generally weak session overall for growth sectors, as the market saw the ten-year treasury bond yield surge. Other stocks that saw the drop include Broadcom (NASDAQ:AVGO) and Taiwan Semiconductor (NYSE:TSM), although the latter company managed to still close the day in the green.

AMD stock forecast

Despite the one day dip on Monday, AMD is still riding high off of its recently announced partnership with Facebook (NASDAQ:FB) or as it will soon be called, Meta. The Metaverse is looking like it will be one of the great tech evolutions of our lifetime, and the true next iteration of the internet. NVIDIA is also looking to be a leader in the Metaverse space after CEO Jensen Huang gave a high-tech presentation in the form of his Omniverse Avatar. Huang and NVIDIA envision the Metaverse being a crucial collaborative tool for the future of enterprise operations.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet