AMD Stock Forecast: Advanced Micro Devices Inc may surge on Jim Cramer's call, global chip shortage

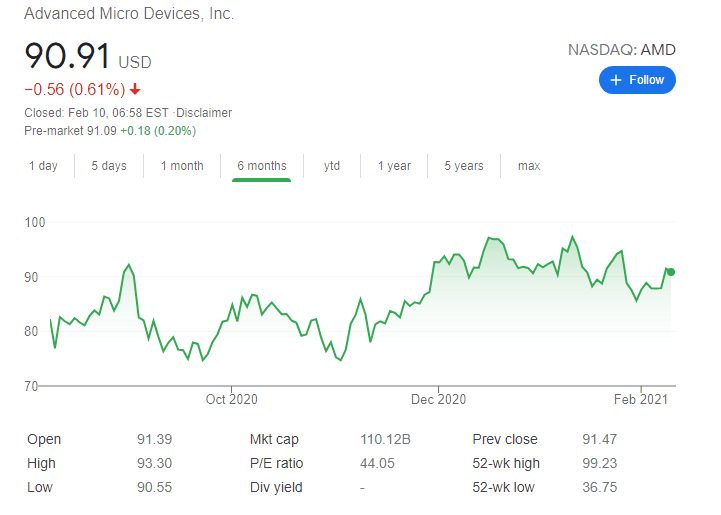

- NASDAQ: AMD is set to rise on Wednesday according to premarket figures.

- CNBC's Jim Cramer has given Advanced Micro Devices, Inc and CEO Lisa Su a ringing endorsement.

- The global chip shortage may lift all manufacturers of these critical components.

Is it time to ride the lightning and buy NASDAQ: AMD? The answer is yes according to Jim Cramer of CNBC. The colorful stock expert has given a ringing endorsement to Advanced Micro Devices, reiterating his long-running buy recommendation. In an answer to a viewer on his "Lightning Round" show,

Cramer praised the company and especially CEO Lisa Su for her leadership in the industry. In a world dominated by social media – such as Reddit's WallStreetBets – rather than television, the outspoken commentator may have less influence. Nevertheless, some may opt to add AMD to their portfolios, only due to the mention.

AMD Stock Buy or Sell

Veteran investors may remember that Cramer does not always get things right – but there are other reasons to like AMD. First, its larger rival Intel is struggling to keep up to speed with the latest chip technologies, which are becoming smaller and smaller. The smaller Silicon Valley veteran – both firms were founded in the 1960s – is gaining ground.

Another reason to like AMD is also more related to the broader industry. A global shortage in microchips has been causing disruptions, such as that in Ford's factories. The large automaker is one of several companies calling on President Joe Biden to provide some relief and help ramp up supply.

Strong demand for AMD's products and low supply seems like a perfect mix for shares to resume their gains. Wednesday's premarket is showing that AMD is set to recapture the $91 level after declining on Tuesday.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.