AMC Stock News: AMC Entertainment and Ape Preferred Shares both decline despite market rally

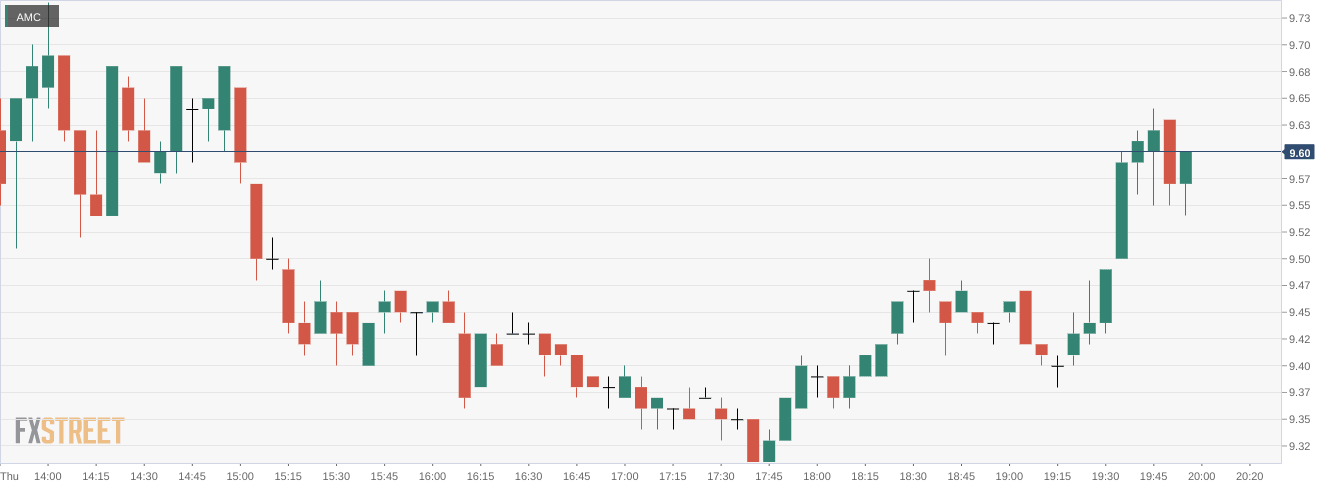

- NYSE:AMC fell by 0.10% during Thursday’s trading session.

- AMC and other theaters have felt the slow summer season this year.

- Avatar is going to do its best to bring moviegoers back to theaters.

NYSE:AMC inched lower once again despite the broader markets rallying for the second straight day ahead of Fed Chairman Jerome Powell’s speech. On Thursday, shares of AMC fell by 0.10% and closed the trading session at a price of $9.57. Stocks jumped higher into the close as the key Fed Symposium at Jackson Hole got under way. Overall, the Dow Jones added a further 322 basis points, the S&P 500 rose by 1.41%, and the NASDAQ jumped higher by 1.67% during the session.

Stay up to speed with hot stocks' news!

Overall, this summer has been a slow one for theaters, AMC included. The past two weekends have been the slowest at the box office since May, despite the summer historically being one of the busiest times of the year. Theater chains like Regal have been hit hard as its parent company Cineworld (LON:CINE) prepares to file for bankruptcy. Some studios have felt the crunch as well, with Warner Bros Discovery delaying some of its major releases until 2023. Will AMC survive this seasonal lull? Most likely. But it certainly doesn’t lend much confidence in the movie theater industry for the long-term.

AMC stock forecast

One blast from the past could help theaters regain their swagger. Avatar is being re-released in both 4K and 3D for theaters. Why is James Cameron’s all-time seller coming back to theaters? Because the long-awaited sequel is being released this December, thirteen years after the original was first released. Avatar: The Way of Water is debuting on December 16, 2022, in what should be the box office release of the holiday season.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet