AMC Entertainment Holdings Stock News and Forecast: AMC stock drops below important support

- AMC stock should stage another rebound on Friday as Putin helps markets.

- AMC still struggling for momentum despite the strong box office for The Batman.

- AMC will remain bearish in the medium term unless $21.04 is broken.

Update: AMC stock is down 6.1% an hour into Friday's session. At the time of writing, shares are now going for $14.37. This is significant since $14.54 is major support. Since it has broken already, expect AMC to trend down to $10 or even $8.95. This is because volume drys up between $15 and $10, which creates a vaccum for equities. This dive is interesting since the Nasdaq has droppd just 0.3%, and both the Dow and S&P 500 are in the green. Solid attendance numbers from The Batman's first weekend do not seem to have done the trick for this stock. $258 million in global ticket sales made it the third best release since the pandemic began. AMC has also been in the news for raising its ticket prices. Neither of these items seem to be impressing the market though at present.

AMC Entertainment Holdings stock (AMC) continued lower on Thursday as the stock market continued to trade weaker on the back of rising energy prices and continued geopolitical turmoil. AMC stock closed just under 2.5% lower at $15.32. AMC is nearing a break of key support at $14.54, but Friday may see a relief rally on the back of comments today from Russian President Vladimir Putin. He is reported to have said that discussions with Ukraine have taken a positive turn. The news was originally reported by IFAX.

AMC Stock News

AMC has begun accepting Dogecoin and Shiba Inu for payment earlier than anticipated. AMC Adam Aron took to Twitter to market the occasion and to try and probably stoke some interest in both AMC and the AMC apes.

"Your replies just might break the internet, given your clear enthusiasm and interest in cryptocurrency. As promised, the https://t.co/SPYfKWXcwi website now accepts Dogecoin and Shiba Inu for online payments! A special shout out to @BitPay for helping us to make this happen"

— Adam Aron (@CEOAdam) March 10, 2022

AMC already accepts Bitcoin and has dabbled in the NFT space earlier this year. This is a nod to the massive retail investor base that AMC now has following the GameStop saga last year. However, trying to keep up with the latest trends in terms of NFTs and crypto has not stopped the AMC stock price from collapsing this year. It is now down 44% year to date and just under 70% for the last six months. Nothing in crypto or NFTs is likely to change that trend anytime soon. The tide has turned away from the frenzy around high growth stocks.

We have already seen what has happened to other noted growth stocks such as Rivian (RIVN), which had earnings last night and got hammered.

AMC Stock Forecast

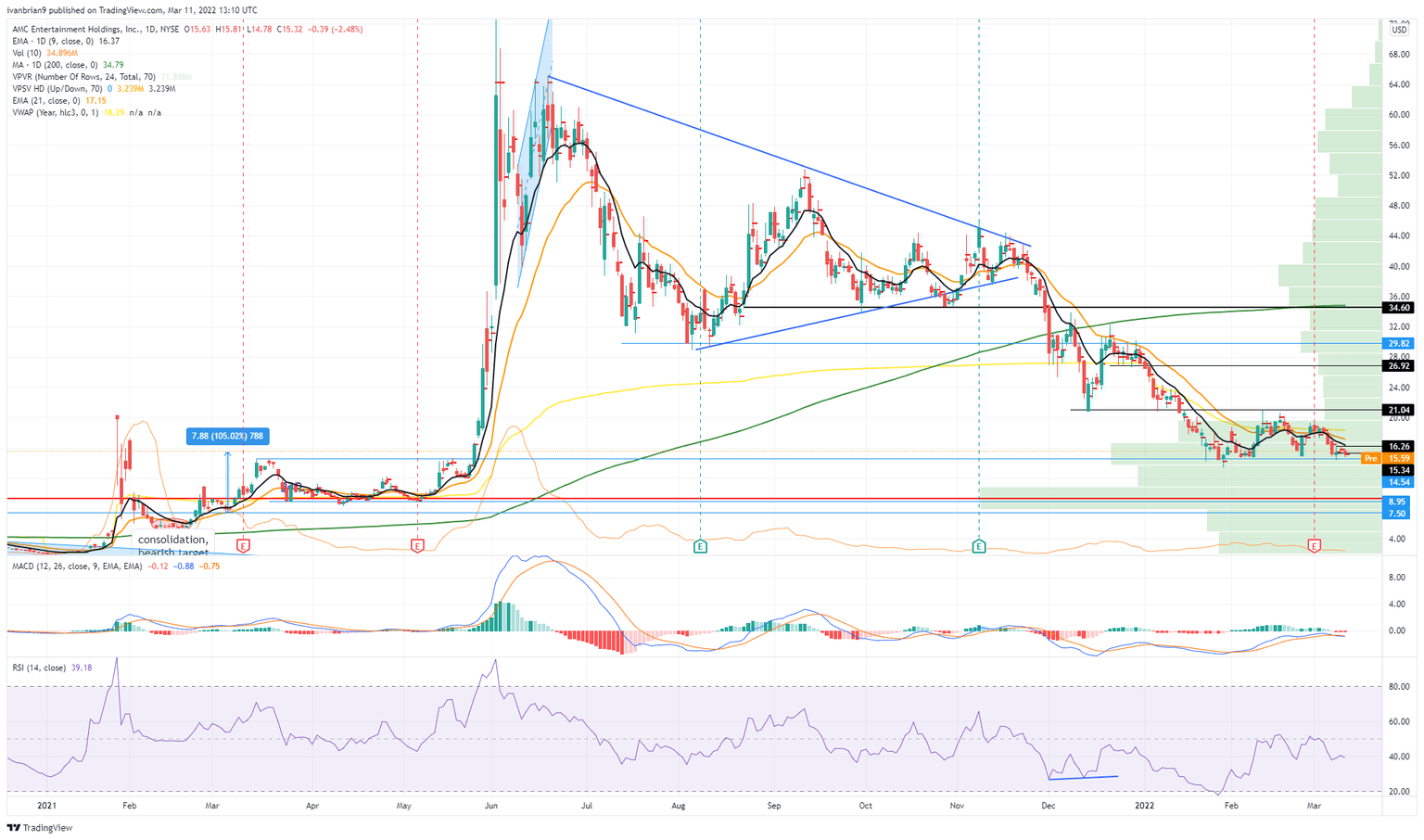

$14.54 remains the key support, but Friday should not test that now. Over the next few weeks though, it is likely to break and that will see a move to test $10 and target support at $8.95. Breaking above $21.04 ends the bearish trend.

AMC chart, daily

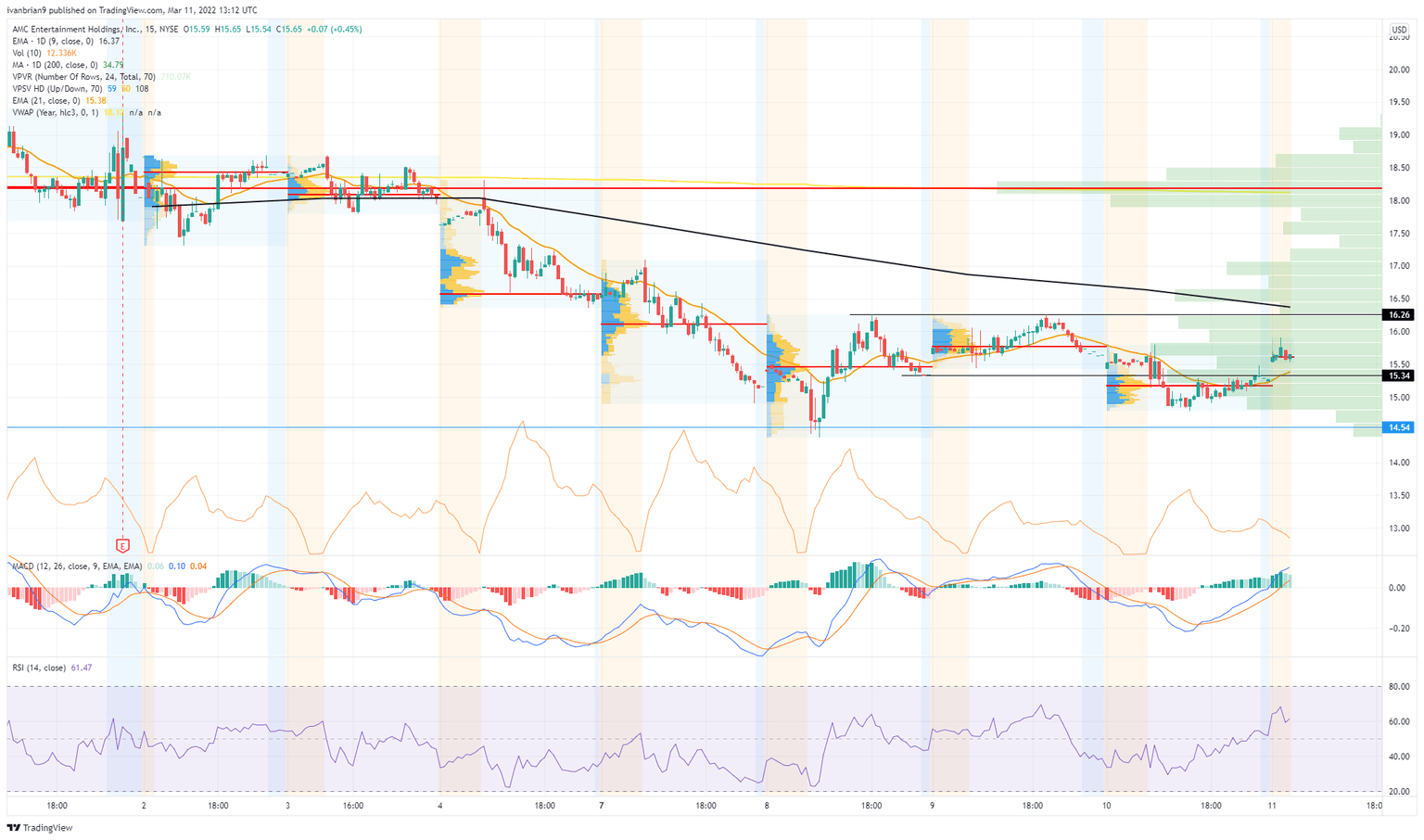

Shorter term, look for a break of $16.26 to then lead to a move to $18. Below $16.26 bears are in charge in the shorter time frame also.

AMC chart, 15-minute

Update: Even a strong open for stocks cannot halt the bearish train for AMC. The stock is already 2% lower after just a few minutes of the regular session on Friday. AMC stock is trading at $15 down 25. Earlier the stock had attempted to push better in the premarket but these gains have failed to hold. This weekend may give another boost to box office numbers for the latest Batman movie but it looks doubtful that AMC apes will be able to stem the tide of bearish sentiment. This is geopolitical in nature as well as a harsh environment for any company who's balance sheet is questionable. AMC probably has too much debt nad investors are lasering in on this problem for AMC and other high growth names. More declines are probably on the cards.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.