Amazon stock leads Dow Jones as equities rejoice at Trump-Xi phone call

- Amazon stock is benefiting from Anthropic's turn into national security AI models.

- Trump's successful phone call with Xi Jinping has helped equities on Thursday.

- AMZN is included in Dan Ives' new AI ETF.

- Amazon stock looks to break above the May 13 high at $214.84.

Amazon (AMZN) stock has advanced almost 2% on Thursday morning as equities rallied back after a mid-morning slump. Amazon has been bought up after Anthropic announced the deployment of its Claude Gov AI model to multiple US national security agencies with customized settings for various national security needs. Amazon is the largest single backer of Anthropic.

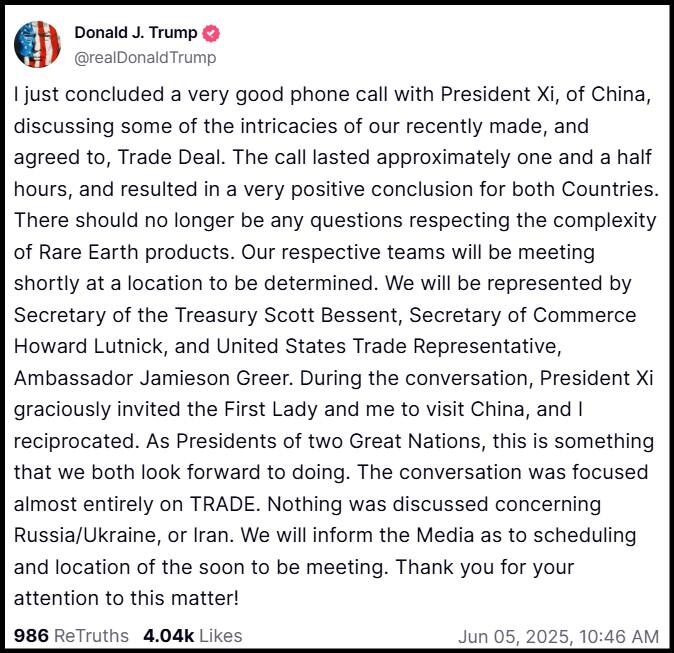

The reason for the generally positive market vibes is a successful phone call between US President Donald Trump and Chinese leader Xi Jinping. Trump had only positive things to say about the 90-minute call, specifically saying that disagreement over China's rare earth exports to the US had been largely settled.

President Trump Truth Social post shows improving relationship with China's Xi Jinping.

The Dow Jones Industrial Average (DJIA) has risen from a 0.44% intraday decline to a 0.27% gain on the news, while the NASDAQ Composite and S&P500 advance at a further clip.

The American Association of Individual Investors survey this week showed that both bullish and bearish sentiment had somewhat diminished this week as investors grow neutral in the face of forthcoming news on tariffs and Friday's Nonfarm Payrolls (NFP) report for May.

Anthropic news

Amazon was really the first major corporate backer of Anthropic, investing $4 billion in the AI firm in 2023 and 2024 before subsequent rounds this year that pushed the valuation up to $61.5 billion.

Besides its various Claude large language models that compete with OpenAI and others, Anthropic is now competing with AI heavyweights like Palantir (PLTR) when it comes to national security. Anthropic claims that its customized Claude platforms allow national security officials to access and instantly translate intelligence gathered from all over the years, making intelligence summarizing much easier.

Anthropic customized the models using feedback from US national security officials and claims they are better equipped than mainstream models to handle and understand complex classified documents, as well as offering an improved understanding of cybersecurity data.

Amazon stock news

On Wednesday, Amazon announced that its Amazon Web Services (AWS) segment would invest $10 billion to expand its data center offerings in the US state of North Carolina.

"Amazon's $10 billion investment in North Carolina underscores our commitment to driving innovation and advancing the future of cloud computing and AI technologies," said David Zapolsky, Amazon's chief global affairs & legal officer.

Speaking of artificial intelligence, star Wedbush Securities tech analyst Dan Ives has unveiled his Wedbush AI Revolution ETF, ticker symbol IVES, that will include 30 of the top AI stocks, including AMZN.

Calling AI "the most transformational force in the global economy in our lifetime," Wedbush said that the ETF offers a diversified approach to AI by investing throughout the semiconductors, hyperscalers, cloud platforms, cybersecurity, robotics, and consumer tech facets of the industry.

On Tuesday, Amazon Pharmacy announced that the 50 million Medicare Part D beneficiaries can now use its PillPack service to access their pharmaceutical benefits in pre-packaged and labeled packets.

Amazon stock forecast

Bulls look to be firmly in control as AMZN stock nears prior resistance at $214.84, the range high from May 13. A break of that level will allow bulls to make a run for the $220 support-turned-resistance level and the prior all-time high region circa $240 reached in January and February of this year.

Now rising above both the 50-day and 200-day Simple Moving Averages (SMA) after cratering during April's tariff sell-off, Amazon looks poised to further last month's rally. The Relative Strength Index (RSI) is in an upward trajectory at 64 and demonstrates that the bulls are leading the price dynamics at this juncture.

SMA support sits near $192.50 and $202, and the historical supports are now too distant to pay any mind for the moment.

AMZN daily stock chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Clay Webster

FXStreet

Clay Webster grew up in the US outside Buffalo, New York and Lancaster, Pennsylvania. He began investing after college following the 2008 financial crisis.