All the Democrat presidents since 1980 have left the job with a stronger USD than when they started – SocGen

Which presidents have been good for the Dollar? Economists at Société Générale analyze USD performance between elections.

Credit spreads have widened in the run-up to elections, narrowing in the aftermath

The Dollar’s fate doesn’t depend on who the president is. Still, if I use the election as the day to begin measuring a presidency, all the Democrat presidents since 1980 have left the job with a stronger USD than when they started. The only Republican president who left with a stronger Dollar was Ronald Reagan, and that was a close-run thing as his second term almost completely wiped out the huge gains seen in his first!

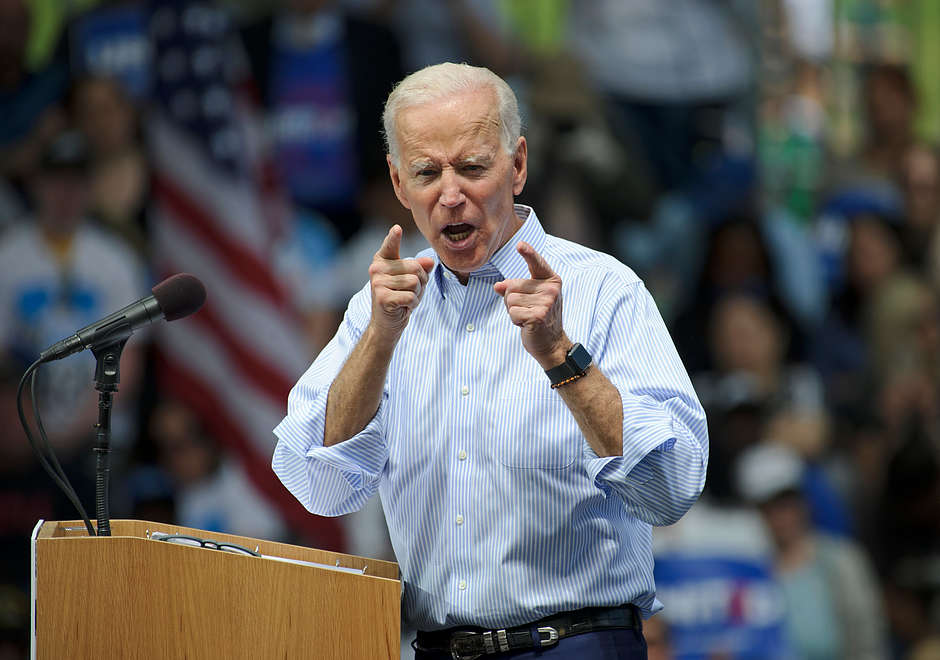

The run-up to elections, in recent years, has seen credit spreads widen, while the aftermath has tended to see them narrow. That should be helpful for the Dollar ahead of elections, and negative afterwards, as risk sentiment improves. But while you can see short-term signs of that in the Dollar, it didn’t prevent George W. Bush from presiding over the biggest presidential Dollar fall of all of them, while the second terms of Clinton and Obama were notably Dollar friendly. President Biden, however, has already seen the Dollar rally by 13%.

Author

FXStreet Insights Team

FXStreet

The FXStreet Insights Team is a group of journalists that handpicks selected market observations published by renowned experts. The content includes notes by commercial as well as additional insights by internal and external analysts.