Alibaba Stock Price and News: BABA dumps as further Chinese regulatory concerns still weigh

- Alibaba released Q1 results on Tuesday before the market opens.

- BABA stock trades lower as investors mull over the results.

- BABA beat on EPS but misses revenue target and increases buyback.

Update: Alibaba (BABA) shares are trading 3% lower after a torrid opening to Tuesday's session. Chinese stocks are once again in the headlights with China appearing to turn its attention to gaming stocks if an article overnight is anything to go by. BABA also releases results just before the open which were mixed. EPS was ahead of estimates but revenue was lower than the forecast and regulatory concerns were mentioned on the conference call, sure to spook investors.

Alibaba stock is still trying to recover from a tough few weeks – well, a tough few months really since its October 2020 high of nearly $320. It has all been one way for the stock in 2021. Alibaba was the original lead indicator for the Chinese stock debacle as it suffered just as it was due to spin off its ANT Group subsidiary. Jack Ma of Alibaba had appeared to criticize the Chinese leadership, and the ANT Group IPO was swiftly pulled. Jack Ma disappeared out of the public spotlight. All this resulted in sharp falls for BABA stock, which traded to the low $200s. Early 2021 saw some investors return to the stock with the BABA share price rallying back to above $270, but the uncertainty surrounding Chinese names continued to be a headwind.

This was further added to recently with the DIDI stock drop, and then further culls hit Chinese stocks after more regulatory crackdowns on stocks such as Tencent Music (TME), Tencent Holdings (TCEHY), and Didi Global (DIDI). BABA cracked hard, only finding support at $180. Thankfully for our regular readers, FXStreet made that call while all were jumping for the exit, saying, "The chart looks bleak, but on the weekly we can see one potential staging area for some longs. The area around $180 is a nice volume staging point with plenty of volume to support the price. The point of control is at $180.93. This is the price with the highest level of volume since 2017." FXStreet made this call on July 26, and now BABA stock has made significant headway to trade at just over $200.

This morning Tuesday brings Q1 results from BABA, and they are slightly mixed. Earnings per share (EPS) beat, but revenue missed analyst expectations. However, BABA has increased its share buyback program by a whopping 50% to $15 billion from a previous $10 billion. Still, the stock is unloved and trades 1% lower in Tuesday's premarket.

Alibaba (BABA) key statistics

| Market Cap | $535 billion |

| Price/Earnings | 24 |

| Price/Sales | 5 |

| Price/Book | 3.5 |

| Enterprise Value | $584 billion |

| Gross Margin | 40% |

| Net Margin |

20% |

| Average Wall Street Rating and Price Target | Buy $286 |

Alibaba stock forecast

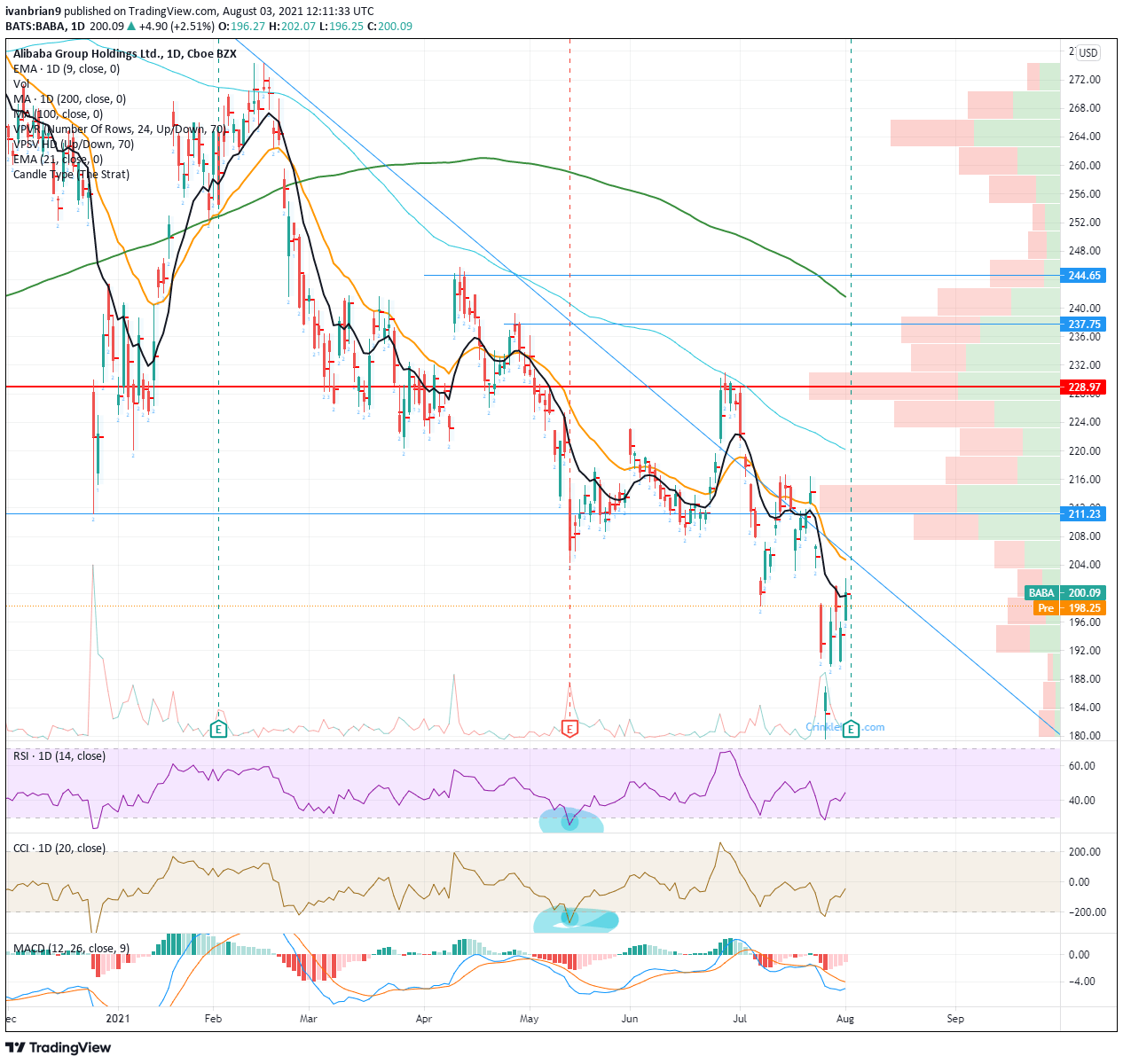

Despite the results beating on EPS, BABA remains in a classic bearish downtrend with a series of lower lows and lower highs. The Moving Average Convergence Divergence (MACD) is crossed into sell territory. To end this, Alibaba stock would need to break $216 as this would make a higher high. If this is not taken out, the downside support/target is at $170 in the short term. The bounce zone we had identified at $180 would again be a support on the way to $170.

Is this a dead cat bounce? The next resistance is at $208 and then $216 as mentioned. This zone contains a lot of volume though, so it will be hard to break through. Breaking $216 sees volume thin out, and the move shoud accelerate to $230 where volume again picks up. The high from late June is at $230.89. But the trend is still pointing lower, as are the major indicators.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637635890551749100.png&w=1536&q=95)