AI boom or bubble? Three convictions for investors

Key points

- AI 2.0 = from “build it” to “prove it”: Big Tech’s AI investment is already in the hundreds of billions, but monetization remains modest. The cycle is shifting from spending on capacity to delivering productivity and revenue impact.

- Infrastructure is where scarcity lies: Memory chips, packaging, grid capacity, and data-center space are the new constraints. For investors, utilities, power infrastructure, and data-center REITs may offer steadier upside than unproven software bets.

- China offers and efficiency and valuation arbitrage: With DeepSeek highlighting lower-cost innovation and giants like Alibaba, Tencent, Baidu, and Meituan trading at discounts to U.S. peers, China tech could attract flows if policy and geopolitical risks remain contained.

Why the hype cycle hit a wall

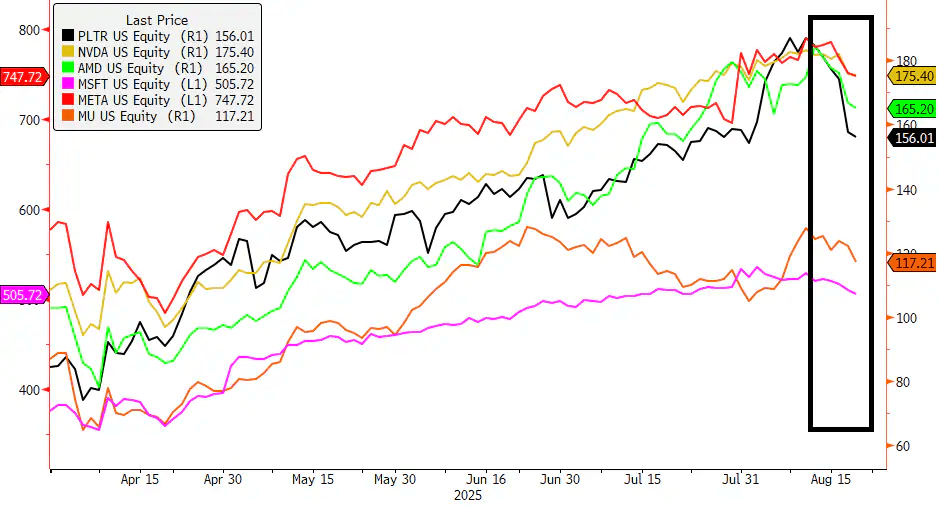

After an extraordinary rally since April, tech stocks have stumbled in recent days, reminding investors that markets may have run ahead of themselves in the AI boom story. The trigger was a blunt MIT report revealing that 95% of corporate spending on generative AI is yielding little to no measurable returns—a sobering statistic for a sector priced for perfection.

Adding to the caution, Sam Altman warned that valuations have become “insane” amid investor over-exuberance, further stoking fears that parts of the market are moving faster than the technology’s ability to deliver tangible gains.

The selloff underscores the fragility of the AI narrative: while capital expenditure on chips, models, and infrastructure has surged, evidence of broad-based monetization is still thin. Investors are beginning to differentiate between hype and hard returns—pushing the sector into what looks more like a “prove-it” phase than an outright bubble burst.

Source: Bloomberg

Where does AI go from here?

1. From capex to monetization

The easy phase, spending on GPUs and pilots, is over. The next phase of the AI cycle will be defined by proof, not promise. Tech giants have poured an immense wave of capital expenditure into AI, but monetization hasn’t yet caught up.

- In 2025, Big Tech has already spent some $155 billion on AI, with projections soaring beyond $400 billion as firms build out data centers and procure AI chips across the ecosystem.

- Microsoft alone is set to spend around $80 billion on AI infrastructure this year; Amazon, Alphabet, and Meta each have capex in the $60–100 billion range.

But returns are far smaller:

- Microsoft says it netted over $500 million in cost savings from AI-powered call centers and development tools.

- Meta links its AI-driven ad products to strong revenue gains—but for the broader market, ROI remains elusive, and boardrooms may soon shift from “build fast” to “prove or pause.”

Enterprises are shifting from pilot projects to demanding productivity gains or new revenue streams. Companies that show real customer uptake, pricing power, or opex savings from AI will stand apart from those still peddling narratives.

Without measurable ROI, boardrooms may start tightening budgets.

2. From models to infrastructure

While competition between AI models is fierce, the bottlenecks are shifting to infrastructure. Memory chips (HBM), advanced packaging, data-center space, and even electricity supply are increasingly scarce and increasingly valuable. It is estimated that the U.S. grid is under pressure: data centers could consume up to 12% of electricity by 2028, with 20GW of new load expected by 2030.

Utilities and power infrastructure firms delivering grid upgrades, data-center REITs and hardware firms specializing in cooling, power distribution, and packaging may capture more sustainable gains than speculative AI software plays in the near term.

3. US vs. China tech

The U.S. still dominates the AI landscape, but the China tech story is resurfacing and catching up. Models like DeepSeek, trained for a fraction of the cost (built at an estimated cost under US $6 million versus over $100 million for GPT‑4), triggered a global rethink of AI margins and monetization.

China also benefits from robust energy infrastructure including hydropower and nuclear, creating a structural advantage for AI expansion.

The U.S. AI trade remains dominant, led by Nvidia and the hyperscalers, but with valuations stretched, attention could rotate back to China’s cheaper but more efficient tech sector. Chinese tech giants like Alibaba, Tencent, Meituan, Baidu, and Xiaomi, often referred to as the “Terrific Ten”, offer valuation arbitrage and regained investor attention.

If U.S.–China tensions ease, capital could increasingly flow eastward, seeking AI exposure via cheaper, domestically scaling names.

What to watch next

- Nvidia earnings (Aug 27): Guidance on Blackwell ramp, China demand, and gross margins will set the tone for the entire sector.

- Enterprise ROI stories: Look for concrete case studies of AI monetization in software updates or earnings calls.

- Infrastructure signals: Supply of high-bandwidth memory, packaging capacity, and power contracts are the new canaries in the coal mine.

- China policy and flows: Any continuation of tariff truces or capital easing could revive foreign appetite for China tech.

- Macro overlay: Interest rates, energy prices, and regulation, all can swing the capex-to-ROI balance.

The bottom line

The AI trade is not over, but it is entering a “prove-it” phase. Investors will reward quality infrastructure and platforms with clear monetization paths while punishing “AI-adjacent” hype.

For investors, the key is to distinguish between narratives priced for perfection and businesses delivering returns today. Dispersion, not collapse, is the story of the next AI chapter.

Read the original analysis: AI boom or bubble? Three convictions for investors

Author

Saxo Research Team

Saxo Bank

Saxo is an award-winning investment firm trusted by 1,200,000+ clients worldwide. Saxo provides the leading online trading platform connecting investors and traders to global financial markets.