Seven million dollars fall for Mark

Social networks Facebook, Instagram and WhatsApp have fallen globally and as never before as the social networks began to have intermittent problems since yesterday during the day, but as of today left 2.9 billion Facebook users, 2000 million WhatsApp users and the same from Instagram were unable to access the services . The most reported problems for Facebook are 56% of the desktop website, 24% with connections to the server and 20% in the application, for WhatsApp 37% sending messages and Instagram with 36% in the app.

“We are aware that some people have problems accessing our applications and products. We are working to get everything back to normal as soon as possible and we apologize for any inconvenience.” as published in the Facebook account in Twitter.

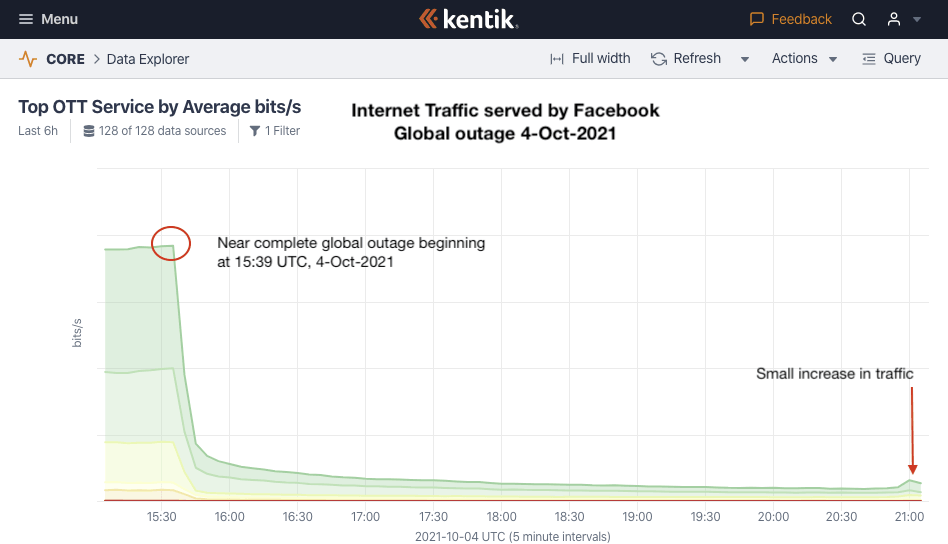

Internet traffic server Source :https://krebsonsecurity.com/2021/10/what-happened-to-facebook-instagram-whatsapp/

After 6 hours, very slowly and intermittently, the network connections began to be reestablished, saying with a message to users and workers on Twitter: ”To the great community of people and companies around the world that depend on we are sorry. We have been working hard to restore access to our applications and services and we are pleased to report that they are now back online. Thanks for supporting us.”

At first the issue was not very clear at all, although it was later confirmed according to reporter Brian Krebs on Twitter: ”Confirmed: DNS records that tell systems how to find http://facebook.com or http://Instagram.com were removed this morning from the global routing tables. Can you imagine working on FB right now, when your email is no longer working and all your internal FB-based tools are crashing?” In addition, the director of Kentik, Doug Madory said that, someone on Facebook had an update made to the company’s Border Gateway Protocol (BGP) records which is a mechanism through which the world’s Internet service providers share information about which providers are responsible for routing Internet traffic to which specific groups of Internet addresses. All this means that someone from Facebook deleted the Internet BGP tables (basically they deleted themselves from the Internet, removing all possible connections) and no one could gain access to reconfigure the BGPs because Facebook hosts its own DNS servers and therefore, their own emails, which led to Facebook employees not being able to communicate with each other.

Source: https://finviz.com/map.ashx?t=sec

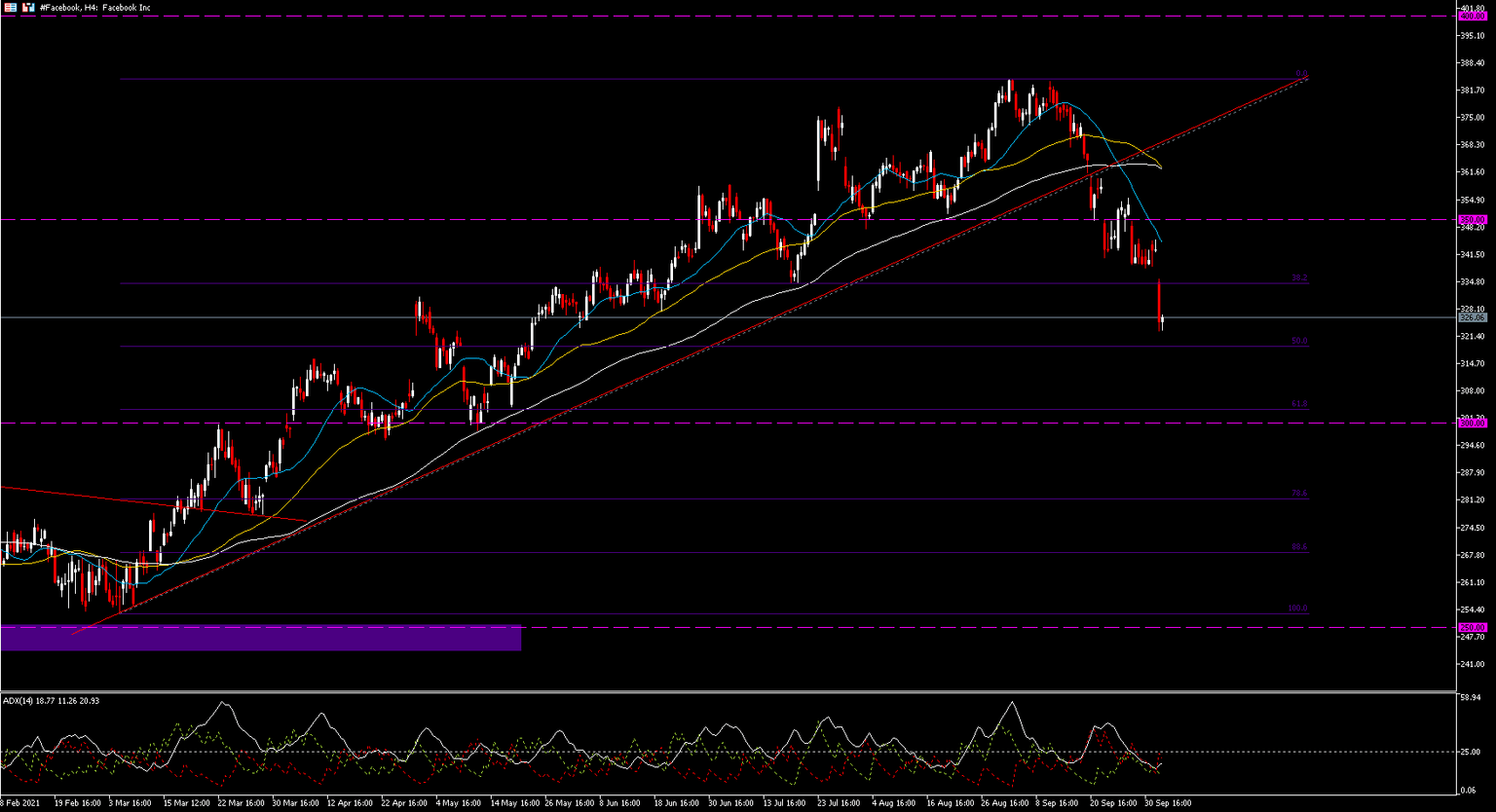

Mark Zuckerberg throughout September lost $19 billion dollars, and that, coupled with the huge amount of $7 billion dollars in a matter of hours of this incident, cut his fortune to $121,600 billion dollars, leaving Mark in fifth place on the Bloomberg Billionaires Index. At the same time, Facebook fell -5.26% to $324.98 but managed to recover to -4.89% leaving the price at $326.23. In addition, as a whole, the shares of the networks have accumulated losses of -15.22% in one month due to the increase in the yield of the Treasury bonds.

On the other hand, the Wall Street Journal published “The Facebook Files” on the damage to mental health that Instagram produces in adolescents and other obscure data, along with the existence of a group of five million famous Facebook users who are not subjected to the same criteria of moderation as the rest, in addition to facing the misinformation it caused in the 2016 elections where Donald Trump won. Added to the Capitol riots in January 2021, where Facebook was also accused of causing misinformation and allowing the spread of far-right speeches, it has not been the best year for Facebook.

H4 technical analysis

Facebook stock reacted strongly to this issue, and the bullish rally that Facebook has had since March has staggered leaving a high at $384.41, marking a double top and outlining a fall that has not only broken the 21.50-period SMA and 100-period in 4H chart (in addition to a possible golden cross), but also the psychological level of $350. The price has left a minimum of $322.65 and is currently at $326.06. Next support is at 50% Fib. level at $318.86, followed by the range between the psychological and key level of $300 on 61.8% Fib. level at $303.38 and from there to the 78.6% Fib level at $281.36. Resistances on the broken 38.2% Fib. level the psychological level of $350, the 50- period SMA in 4-hour chart and the highs at $384.41.

ADX is at 18.77 with + DI at 11.26 and -DI at 20.93 outlining the beginning of a downtrend if it crosses 25.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.