Yearn.Finance Price Forecast: YFI’s uptrend is losing steam as on-chain and technicals suggest incoming correction

- YFI price had a massive 160% pump in the past week but it’s slowing down.

- Several metrics indicate that YFI is on the verge of a pullback.

After such a massive run, it’s not a surprise to see YFI price finally slow down and consolidate. On-chain and technical indicators suggest the digital asset is on the verge of a major correction as there is very little support on the way down.

YFI price is overextended and faces a pullback

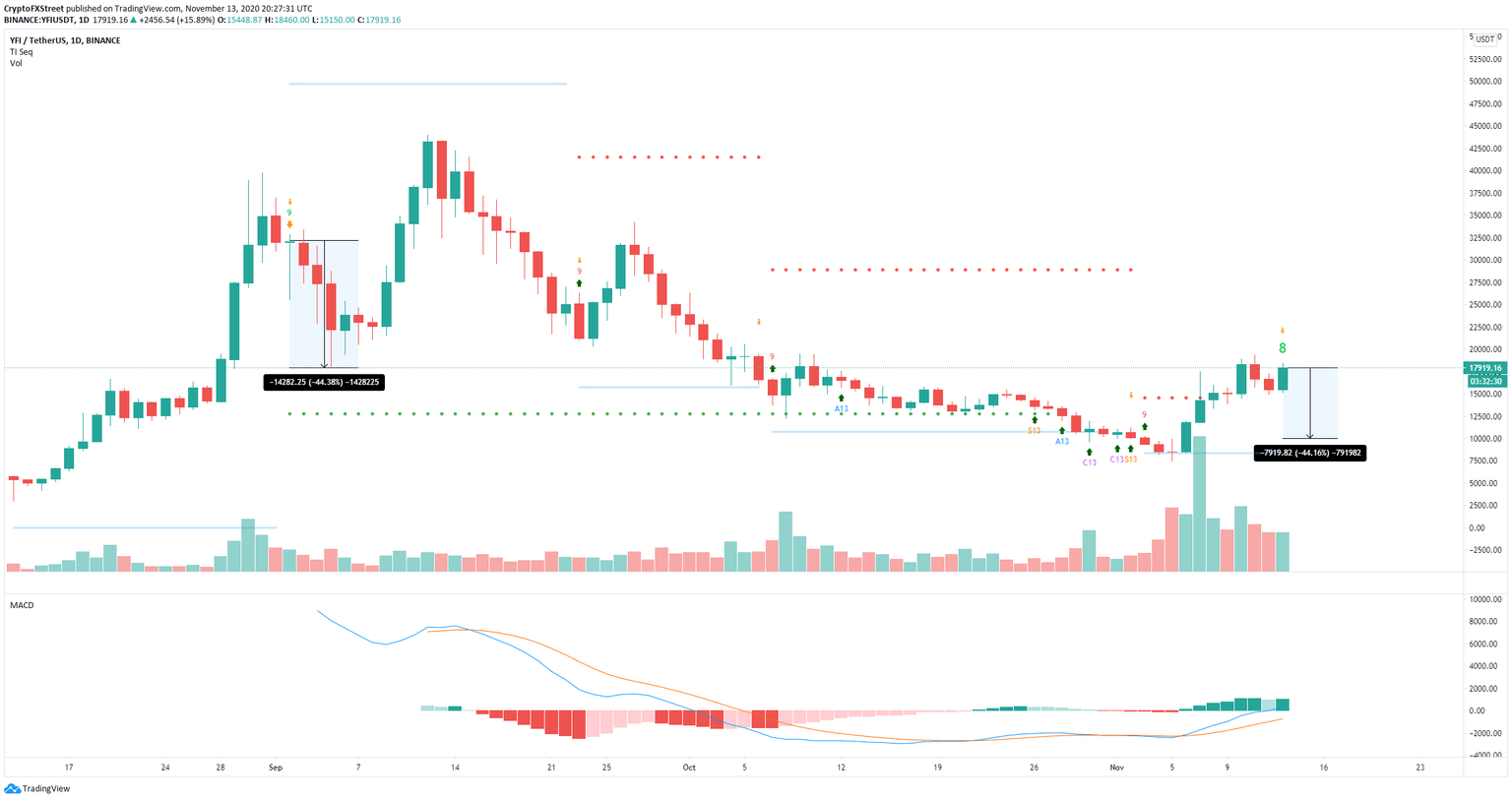

On the daily chart, the TD Sequential indicator is about to present a sell signal which would be the first one since September 2. That last call had a 44% follow-through. A similar drop will drive YFI price towards $10,000.

YFI/USD daily chart

Despite the spike in the number of new addresses joining the network on November 7, it seems that the trend is a downtrend now. In the past week, this number dropped by 14%. Similarly, the number of active addresses also dropped by 19%, indicating that investors are losing interest in YFI, despite its price growth.

YFI new and active addresses chart

However, if bulls can drive YFI price through the resistance barrier at $18,000, we could see the digital asset jump towards $20,000 in the short-term. The MACD remains quite strong on the daily chart which indicates that bulls might still have some strength left.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.