XRP/USD Elliott Wave technical analysis [Video]

![XRP/USD Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/XRP-bearish-realist-1_XtraLarge.png)

XRP/USD Elliott Wave technical analysis – Daily chart

-

Function: Follow Trend.

-

Mode: Motive.

-

Structure: Impulse.

-

Position: Wave 2.

-

Direction next higher degrees: Pending confirmation.

-

Wave cancel invalidation level: $1.613.

XRP/USD trading strategy

XRP reached a peak of $2.656 in May and has been undergoing a correction phase. From the Elliott Wave perspective, this correction is identified as wave ② within a larger upward trend. Currently, the price appears to be in the final segment of the corrective wave (C).

Trading strategies

-

Strategy outline:

-

For short-term traders (swing trade):

-

Watch for a possible reversal around the $1.83 area. A recovery from this zone may signal the beginning of wave ③ in the bullish direction.

-

-

Risk management:

-

Critical level:

-

If the price falls below $1.613, the current wave structure becomes invalid and must be reassessed.

-

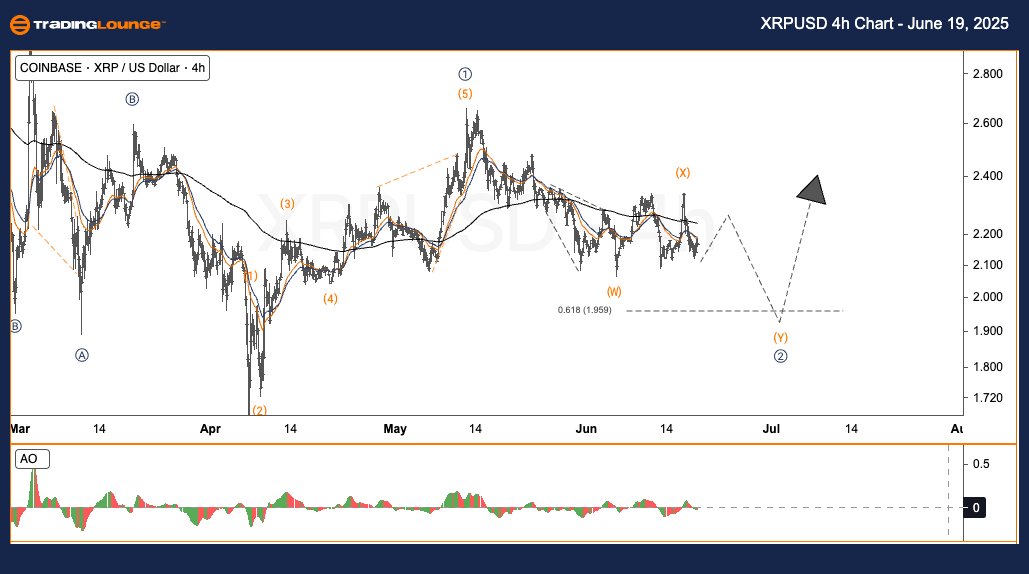

XRP/USD Elliott Wave technical analysis – Four-hour chart

-

Function: Follow Trend.

-

Mode: Motive.

-

Structure: Impulse.

-

Position: Wave 2.

-

Direction next higher degrees: Pending confirmation.

-

Wave Cancel Invalidation Level: $1.613.

XRP/USD trading strategy

Following XRP's surge to $2.656 in May, a corrective movement has been unfolding. This correction, in Elliott Wave terms, is part of wave ② of a broader bullish trend and appears to be approaching its concluding stage within wave (C).

Trading strategies

-

Strategy outline:

-

For Short-Term Traders (Swing Trade): Consider a potential buy opportunity if a reversal occurs near the $1.83 area, aligning with the next upward wave ③.

-

-

Risk management:

-

Critical level: A move below $1.613 nullifies the current wave scenario, requiring immediate reassessment.

-

Ripple Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.