XRP price upholds bullish structure amid neutral spot retail activity

- XRP rally cools below record highs at $3.66 as leading altcoins strive to sustain recently accrued gains.

- Liquidations amount to $24 million over the past 24 hours amid overheated market conditions with the RSI at 81.

- XRP’s spot retail activity remains neutral despite the surge to a new record high, suggesting that there’s still potential for a breakout.

Ripple (XRP) is striving to hold onto most of the gains accrued since its June lows at $1.90, reaching a new all-time high of $3.66 on Friday. A nearly 2% drop on Tuesday sees XRP exchange hands at around $3.47. Key technical indicators suggest relatively overheated market conditions, likely to catalyze an extended pullback before XRP resumes the uptrend and begins a fresh price discovery phase.

XRP rally cools, triggering liquidations

XRP bulls are accelerating the decline toward the previous record high at $3.40, leaving bullishly aligned traders counting losses. According to CoinGlass, approximately $24 million has been wiped out over the past 24 hours. Long position holders are bearing the biggest brunt of the weakening uptrend with liquidations amounting to $18.27 million compared to $5.29 million in shorts.

The subsequent increase in trading volume to $20.22 billion over the same period suggests selling pressure is rising with leveraged positions being forcibly closed.

XRP derivatives market data

Despite the increase in liquidations, the surge in the XRP futures Open Interest (OI) to $10.94 billion shows no sign of fatigue among the bulls. Open Interest refers to the value of all the futures and options contracts that have not been settled or closed.

A persistent increase in this indicator reveals that traders are betting on XRP price steadying the uptrend and stepping into price discovery above $3.66.

XRP Futures Open Interest | Source: CoinGlass

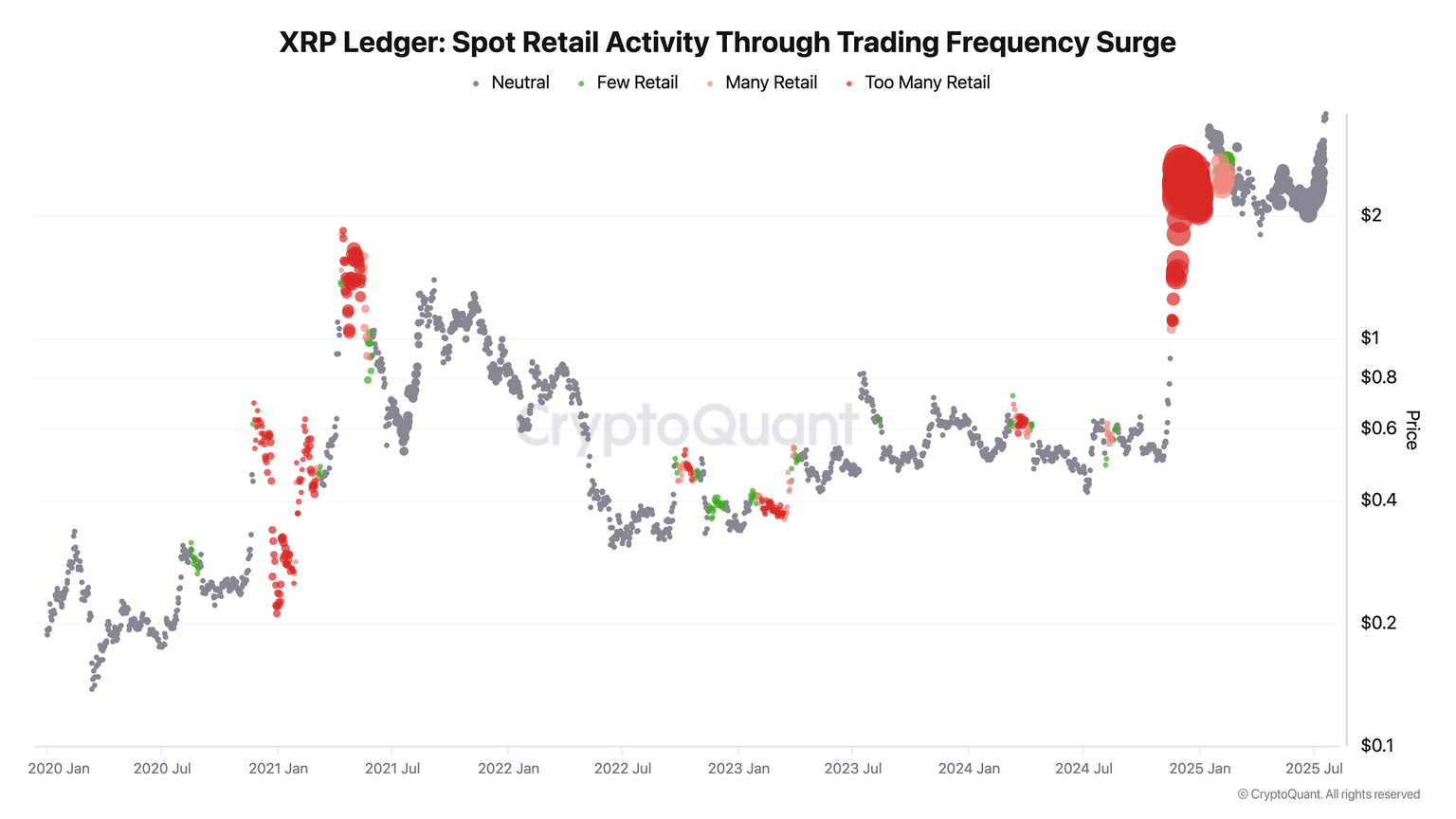

CryptoQuant’s XRP Ledger Spot Retail Activity Through Trading Frequency Surge metric indicates that retail activity remains neutral. The indicator measures the activity level of retail investors in XRP based on their trading frequency.

At the current neutral level, retail investors are still entering XRP markets, hinting at an increase in speculative demand. This means that the weakness being experienced could be temporary, allowing for profit-taking activity ahead of the next breakout.

XRP Ledger’s Spot Retail Activity Through Trading Frequency | Source: CryptoQuant

Technical outlook: XRP bullish structure is intact

XRP price is currently holding between its all-time high of $3.66 and the previous record high of $3.40. The token faces an increasing supply amid reduced buying pressure, as evidenced by the Relative Strength Index (RSI) still being overbought but dropping to 81.

If the RSI continues to decline, it will indicate that bearish momentum is building. Losses below the $3.40 level could trigger a sell-off as investors rush to protect their capital by reducing exposure.

Other key support areas traders could monitor include $3.00, which was traded as resistance last week and in early March, as well as the 50-day Exponential Moving Average (EMA) at $2.60, if declines accelerate.

XRP/USDT daily chart

Despite the short-term bearish outlook, the upward-facing moving averages in the daily time frame reinforce the bullish grip. Additionally, a Golden Cross pattern, triggered on July 13 when the 50-day EMA crossed above the 100-day EMA, suggests price momentum has shifted upward and is strengthening market sentiment. This shows that XRP still has the potential to reach higher levels despite short-term hurdles.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14, 2023: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren