XRP price swallows sellers as Ripple marches higher

- XRP price continues to push higher despite multiple attempts to keep it down.

- A key Fibonacci level, if broken, could spike XRP towards $1.

- Downside risks remain, but threats of a major collapse dwindle.

XRP price has been performing very well over the past week, specifically over the weekend. Despite Sunday’s price action nearly wiping out of all of Saturday’s gains, buyers have been very responsive to any dips in Ripple, giving new and existing short positions a cause for concern.

Also read: Gold Price Forecast: XAUUSD could soon recover its shine

XRP price may trigger a short squeeze above $0.84

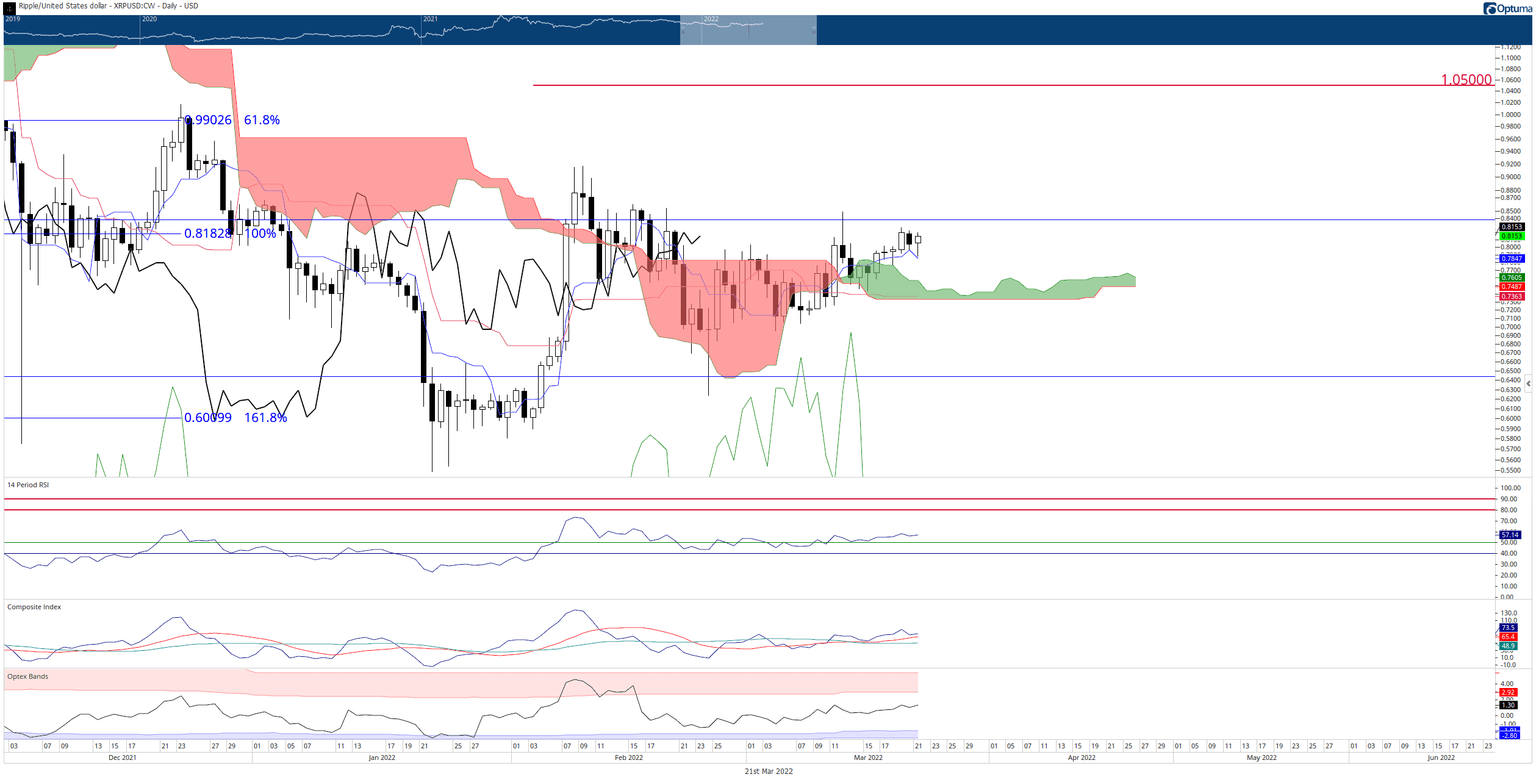

XRP price is currently below the 38.2% Fibonacci retracement (April 14, 2021 high to the low of the January 2021 strong bar) at $0.84. $0.84 has acted as the primary resistance level for XRP since first falling below it at the beginning of January 2022.

The consistent failure to push and close above $0.84 may be ending. Since Friday, many new shorts have been created. Unfortunately for bears, many of those new shorts are now out of the money. Bulls have stubbornly bought all intraday dips, recovering the 2.3% loss and converting it into a nearly 2% gain.

Perhaps the most important condition that XRP price has fulfilled since last week is the completion of an Ideal Bullish Ichimoku Breakout on its daily chart. With the Ideal Bullish Ichimoku Breakout confirmed and active, the only near-term resistance for XRP is the 38.2% Fibonacci retracement.

If bulls can close XRP price at or above $0.84, the next stop is the weekly Kijun-Sen near the $1 value area.

XRP/USD Daily Ichimoku Kinko Hyo Chart

XRP price remains below the Ichimoku Cloud and Kijun-Sen on the weekly chart, indicating that strong bearish sentiment remains a big problem. XRP may be developing a bearish continuation pattern on the weekly chart, a bear flag. Any upside outlook will be invalidated if the XRP price closes below the flag near $0.70.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.