XRP Price Prediction: How Colombias’ XRPL could trigger FOMO

- Ripple price has successfully breached key Fibonacci levels.

- XRP price wears optimistic market sentiment as their new NFT software has been successfully implemented.

- Invalidation of the downtrend is a breach below the June 18 swing lows at $0.28.

Ripple's XRP price shows optimistic trading signals during the first week of July. Market sentiment shines additional positive light, which could induce a bull run in the coming days.

XRP price is looking good

Ripple's XRP price could be making a run for new heights in July as the bulls have been able to breach crucial resistance levels during the New York trading session.

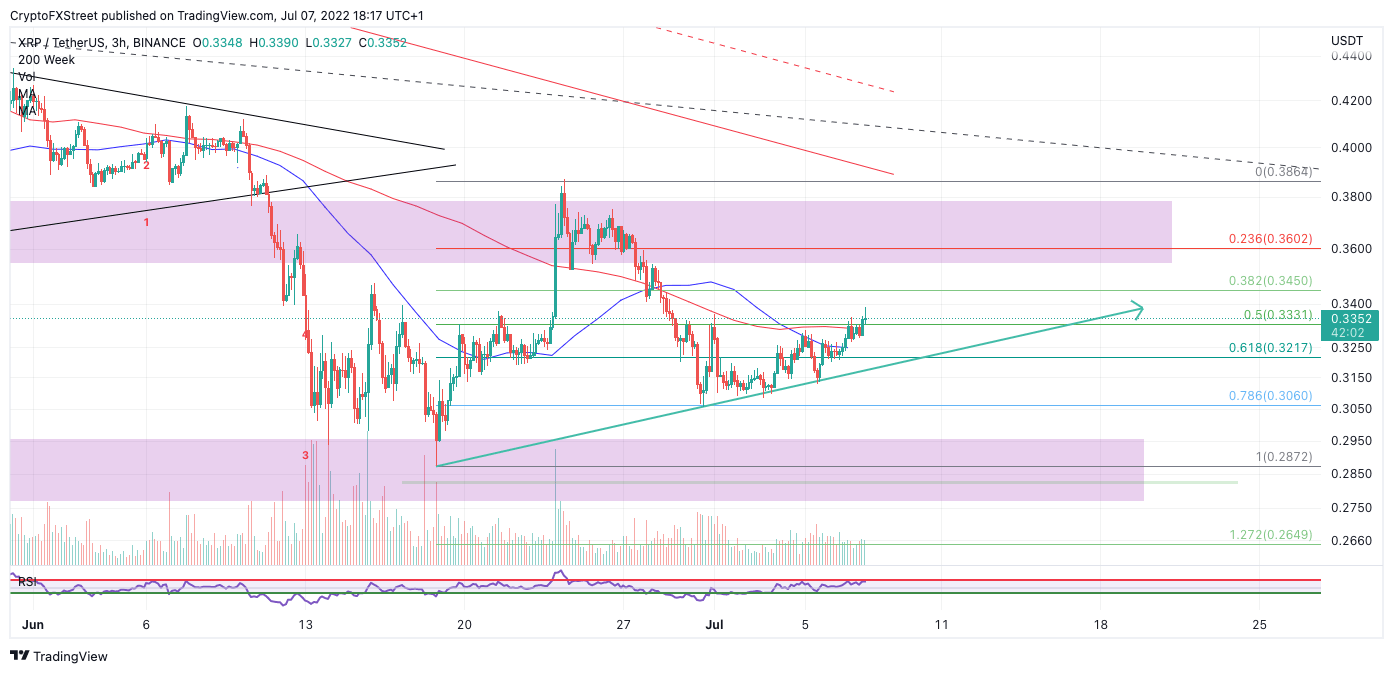

Ripple’s XRP price has printed consecutive higher lows since finding support at the $0.30 zone on the final day of June. On July 6, the bulls successfully reconquered the 61.8% Fibonacci retracement level of June's monthly low at $0.28 and monthly high at $0.38. Just an hour ago, the bulls subtly conquered the 50% retracement level, printing a bullish engulfing candle through the $0.33 barrier on the 3-hour chart.

The rise of the XRP price comes at an exciting time for the company. Developers have successfully implemented software to enable NFT artists, collectors, and investors to engage with one another. Additionally, it's been reported that Colombia will officially use a ledger designed by Ripple for their commercial and retail land inventory. As the Ripple price currently ascends to $0.34, it does appear that the stars are lining up in favor of a bull run, with June's monthly high at $0.38 as eye-candy for intraday traders.

XRP/USDT 3-Hour Chart.

Ripple’s XRP price still faces the ongoing dilemma with the SEC and has recently hired new lawyers to end the relentless feud. Keeping an invalidation below the $0.28 swing low is the safest gamble for traders looking to enter the market. The ongoing judicial rivalry has been known to trigger sudden volatility spikes, sometimes based on speculation alone.

Invalidation of the uptrend remains $0.28. If the bears breach this threshold, traders should expect a fall to $0.20, resulting in a 37% decrease from the current XRP price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.