XRP price could retest $0.371 as this on-chain metric records a huge uptick

- XRP price is consolidating midway through its recent breakout.

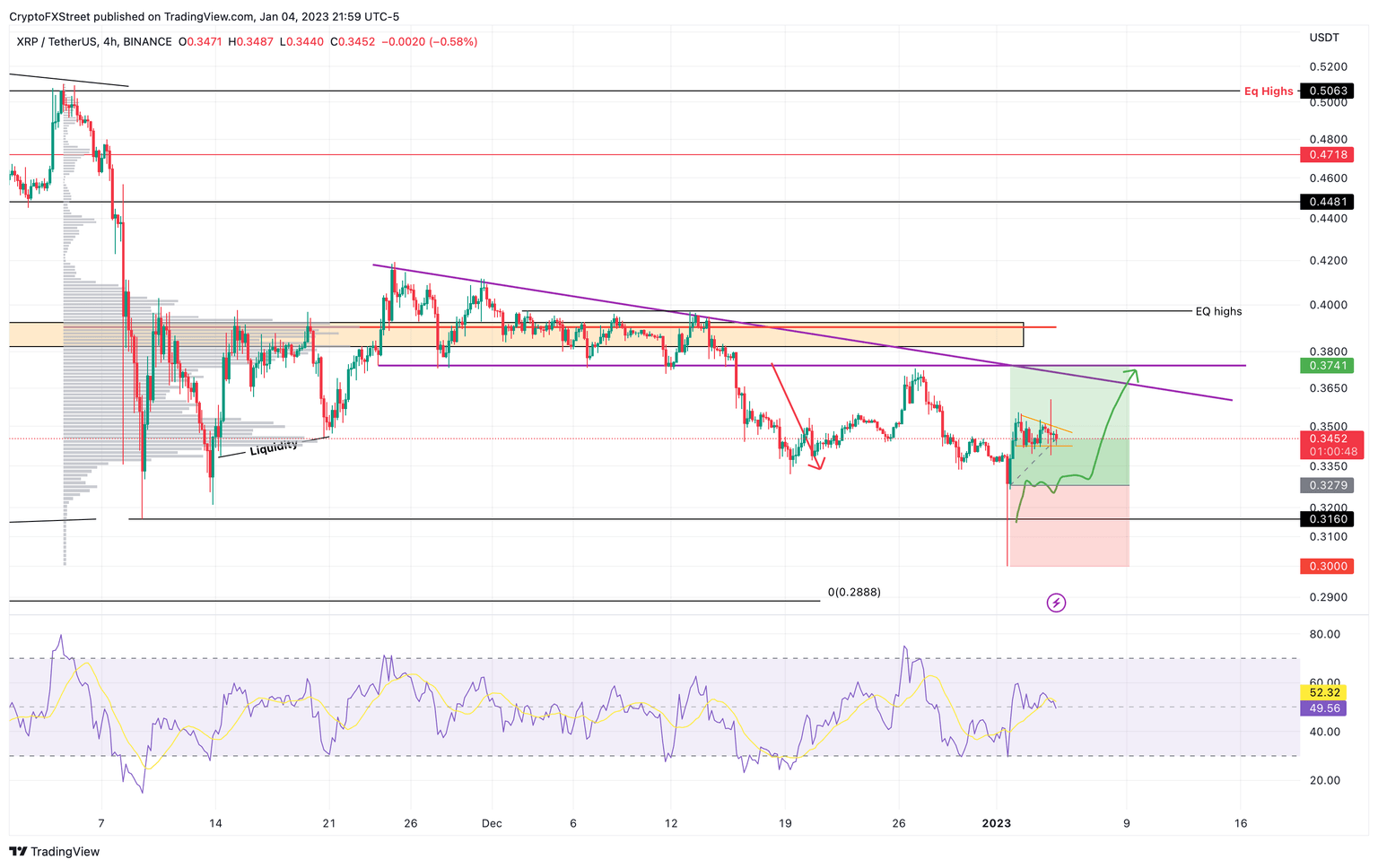

- A breakout from this tightening could result in an explosive move to $0.374.

- Invalidation of the bullish thesis will occur if Ripple loses the $0.316 support level.

XRP price shows a tight consolidation after a recent upswing, indicating that it is building up momentum for its next up-leg. Investors need to be patient and allow Ripple bulls to make their move.

Ripple price remains still

Ripple price had a slow start to its rally on January 1 as it slide 13% and formed a local bottom at $0.300. But XRP has recovered nicely since then. As the altcoin continues to auction at $0.344, investors need to be patient and watch the momentum indicator - Relative Strength Index (RSI).

The RSI is hovering above 50, which means the bulls are defending their stance. Hence, the uptrend is still intact. Therefore, a breakout from this consolidation is likely to result in a move that tags the $0.374 hurdle.

Depending on the momentum, the remittance token could retest the equal highs at $0.397.

XRP/USD 4-hour chart

Adding credence to the potential upswing is the Active Addresses metric, which has seen a quick uptick in the last few hours. Specifically, the number of 1-hour active addresses has noted a huge increase from 2000 to 17,140.

This sudden uptick indicates that investors are interested in XRP at the current price level. Due to the ongoing consolidation, this spike could indicate accumulation for the remittance token.

XRP 1-hour active addresses

While things are looking up for Ripple price, a sudden drop in Bitcoin price could cause altcoins to slide lower as well. In such a case, if XRP price produces a four-hour candlestick close below $0.316, it will create a lower low and invalidate the bullish thesis.

This development could see Ripple slide lower and retest the $0.288 support floor.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%2520%5B08.29.19%2C%252005%2520Jan%2C%25202023%5D-638084852399274500.png&w=1536&q=95)