XLM Price Prediction: Stellar will host top stablecoin while prices prepare for liftoff

- Stellar price awaits a breakout post USDC integration announcement.

- A close above the $0.36 level confirms the pre-existing bullish sentiment and a chance for a 50% move.

- XLM is trading between two critical levels that will determine its future.

Stellar network utility has been on the rise. Its recent collaboration with Samsung to expand the blockchain ecosystem experience made headlines while the $5 million investment with wallet provider Abra is set to enable the protocol to provide banking services. Regardless, its most recent partnership with USDC makes the prior developments look smaller.

The second-largest stablecoin, USDC, is live on the Stellar network

In a recent blog post, the Stellar Development Foundation announced that it will integrate Circle’s stablecoin USDC for anyone to use it through integrated wallets. The partnership brings immediate value to businesses within the Stellar ecosystem and provides FinTech industry players a chance to optimize international settlements.

Users can leverage USDC’s quick settlement capabilities and liquidity along with Stellar’s tokenization and cross-border features.

With Ripple, the direct competitor of Stellar, temporarily out of the picture due to SEC’s lawsuit, this could be XLM’s opportunity to establish a strong foothold in the trillion-dollar cross-border payment sector.

XLM price is on the brink of a bullish breakout

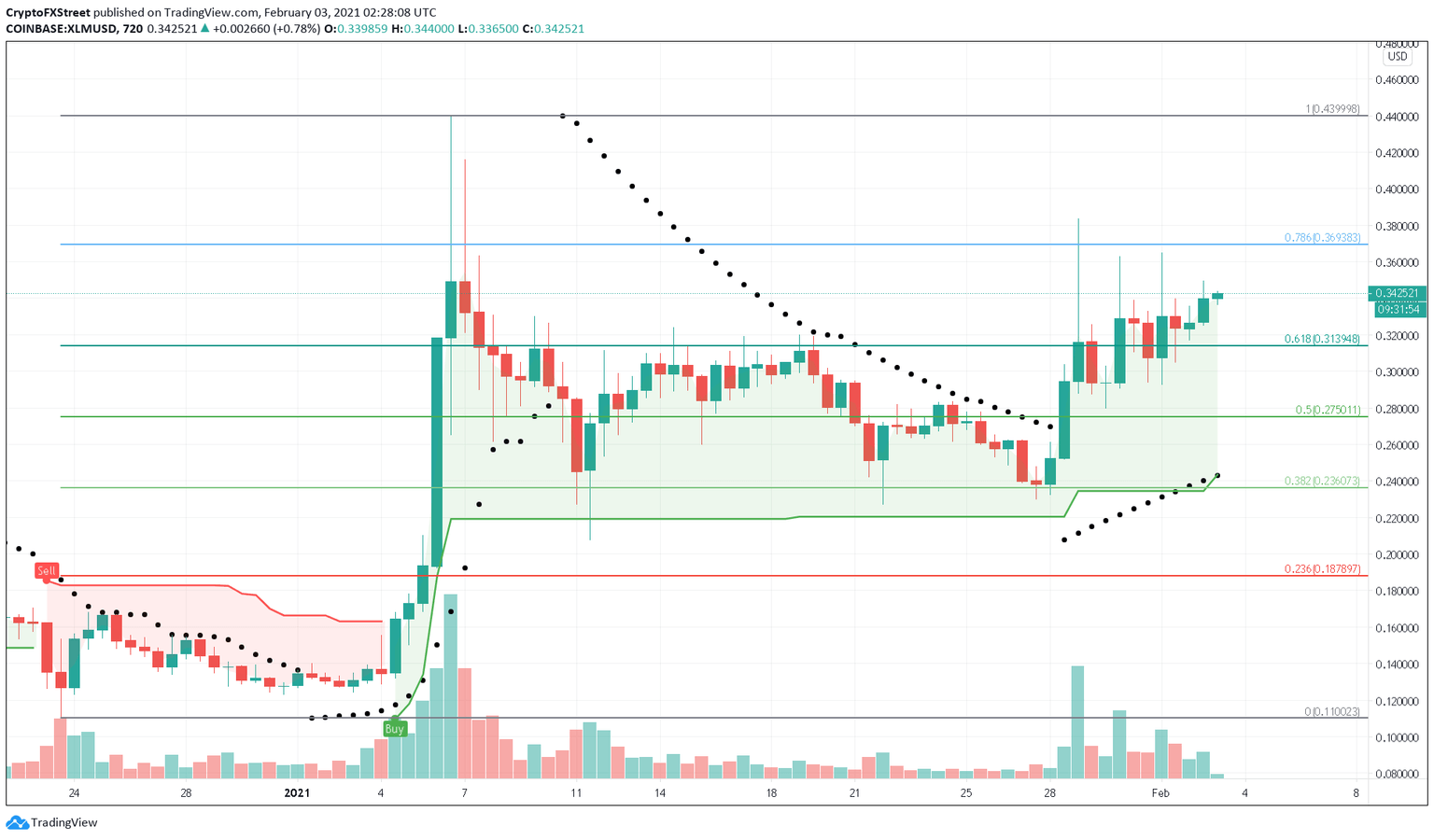

Sellar price saw a considerable uptick on January 28, as it bounced off the 23.6% Fibonacci level ($0.23) for the third time. Since then, XLM has risen by 45% and is now trading between the 78.6% and 61.8% Fibonacci retracement level on the 12-hour chart.

Despite the bullish bias painted by the SuperTrend and the Parabolic SAR, XLM price needs to break either of these critical levels to paint a clear picture of where it is heading next.

A candlestick close above the 78.6% Fibonacci retracement level would quickly propel the coin by 50% towards the $0.53 level.

XLM/USD 12-hour chart

On the flip side, a spike in selling pressure that pushes Stellar below the 61.8% Fibonacci level will invalidate the bullish outlook. If this were to happen, XLM price could take a 30% nosedive to $0.23.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.