XLM Price Prediction: Stellar eyes 26% bull rally

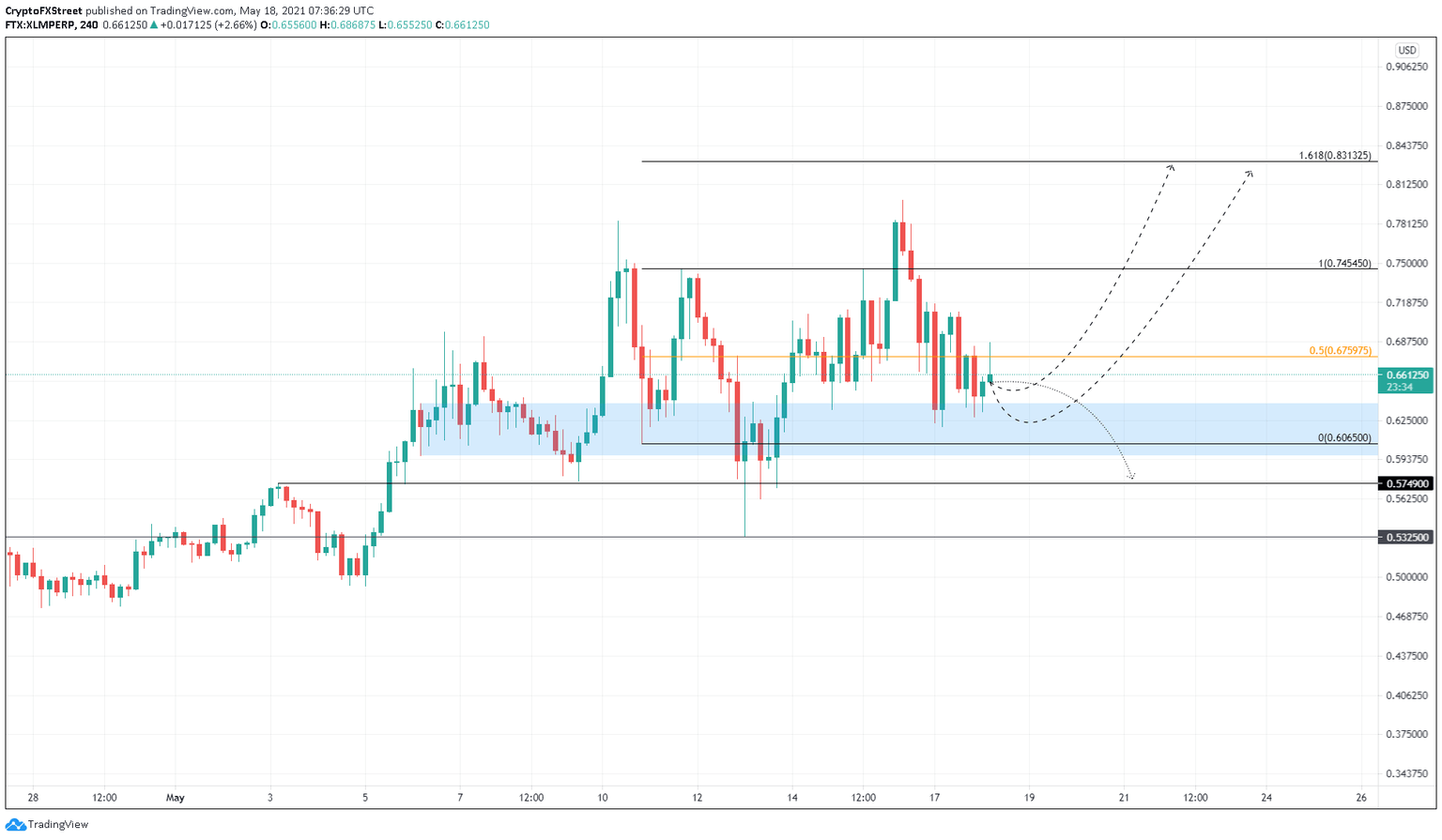

- XLM price is bouncing off the demand zone extending from $0.596 to $0.638 for the third time over the past week.

- If the overall market structure remains neutral or bullish, Stellar could surge 25% $0.831.

- A breakdown of $0.575 will invalidate the bullish outlook and trigger a downtrend.

XLM price is currently indecisive as it bounces off a crucial support area. If the buyers pile up their bid orders, the chances of Stellar surging to new yearly highs are promising.

XLM price faces a decisive moment

XLM price created a demand zone as it surged roughly 30% between May 5 and May 6. This zone helped the buyers recuperate and further propel the remittance token up by 10%. Since this point, XLM price has tested this level twice before shattering it on May 12 during the most recent market sell-off.

However, the buyers seem stubborn and pushed Stellar price above this support area on May 13. Now, this area is being tested again, and investors can expect a bounce that either retests the old swing high at $0.80 or creates a new one at $0.83, which coincides with the 161.8% Fibonacci extension level.

This move would establish an uptrend, with three higher highs and two higher lows and set the stage for further upswings.

XLM/USDT 4-hour chart

While the uptrend scenario seems likely, the demand zone detailed above has already been tested more than twice, so the likelihood of buyers coming to the rescue is very low. Therefore, the bulls’ inability that leads to a decisive 4-hour candlestick close below $0.575 will invalidate the optimistic narrative detailed above.

In that case, investors can expect XLM price to slide 7% to tag the support level at $0.533

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.