XLM Price Prediction: Stellar edges closer to 20% gains

- XLM price is on the verge of a breakout as it approaches a critical supply barrier.

- Stellar is traversing a symmetrical triangle pattern, hinting at a quick 20% upswing.

- A long-term outlook reveals XLM could surge 120% to hit $1 under exceptional circumstances.

The XLM price is meandering inside a technical pattern vying to slice through the barrier present ahead.

XLM price gears up for higher high

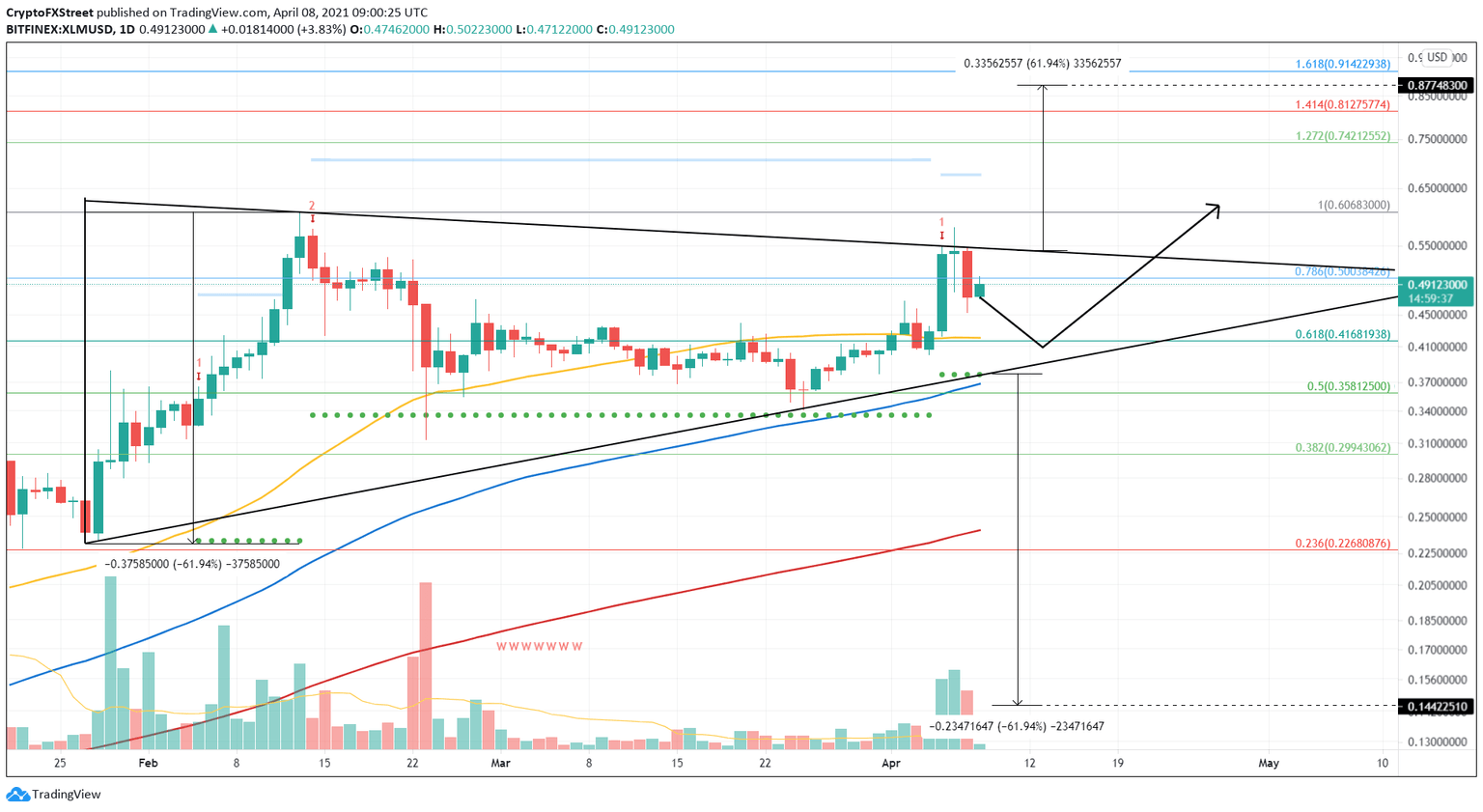

The XLM price reveals a symmetrical triangle pattern when the multiple lower highs and higher lows since January 27 are connected using trend lines. This technical formation forecasts a 62% move after successful confirmation of a breakout.

For now, Stellar looks primed after a bounce from the 50-day Simple Moving Average (SMA). If the bullish momentum persists, the XLM price could produce a decisive close above the immediate supply barrier at $0.50, coinciding with the 78.6% Fibonacci retracement level.

Following this, the remittances token could pierce the technical formation’s upper trend line at $0.54. This move would signal the start of a bullish wave. If a spike in buying pressure ensues, the XLM price could surge 25% toward the first breakout line at $0.67, set up by the Momentum Reversal Indicator (MRI).

Subsequent areas of interest include the 127.2% and the 141.4% Fibonacci extension levels at $0.74 and $0.81, respectively. Clearing these levels might open up the path to the intended target at $0.87.

XLM/USD 1-day chart

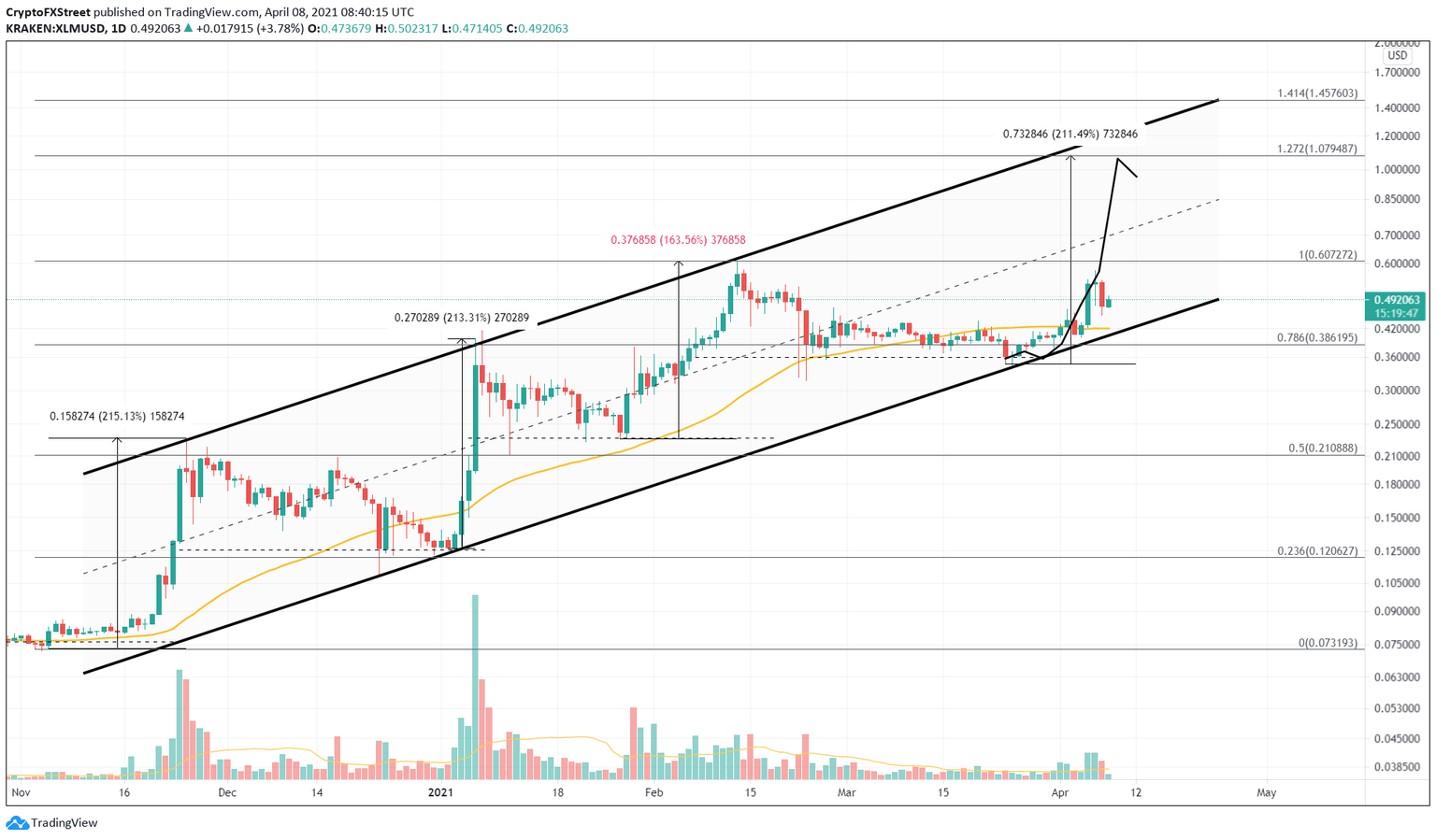

A different perspective on the bullish outlook for Stellar can be seen in the chart below. From late November 2020 to date, the XLM price has installed three higher highs and two lower lows.

An ascending parallel channel is revealed when the swing points are connected using trend lines. Interestingly, each bounce from the lower trend line that sets up the next swing high sees a 200% uptrend. The retracement that follows after reaching the upper trend line averages around 45%.

Since the XLM price has already retraced 45% from the recent highs at $0.60, the logical thing to expect here would be a massive blast off. If something similar were to happen, the remittances token could surge 120% to hit the $1 mark.

XLM/USD 1-day chart

Stellar’s bearish scenario could evolve if the symmetrical triangle’s lower trend line at $0.37 is breached. In this case, the XLM price could decline 11% toward the MRI State Trend Support at $0.33.

If the sellers push the cryptocurrency beyond $0.33 for an extended period, it would solidify the bearish outlook and open up the altcoin for more downside.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.