Stellar suffers outage, putting XLM price in critical condition

- Stellar Network saw several of its nodes go offline on April 6.

- This malfunction led to a temporary halt in transaction validation.

- XLM price eyes a retracement as investors book profit near the local top at $0.60.

Stellar network’s validator nodes experienced an unexpected breakdown recently. During the same period, the XLM price also hit a dead end and is eyeing a pullback.

Validators crash, but Stellar network continues operation

On April 6, several Stellar Development Foundation’s (SDF) validator nodes temporarily stopped validating transactions, which resulted in a halt for some transactions while others progressed as usual.

In a blog post, the SDT team stated:

During the entirety of the SDF node downtime, the Stellar network remained online. Because it is decentralized, and the majority of Stellar network validator nodes were still functioning, the network continued to process transactions.

Although the SDF worked to resolve the issues quickly, popular exchanges like Binance, Bitfinex and Bitstamp reported this issue as they halted withdrawals.

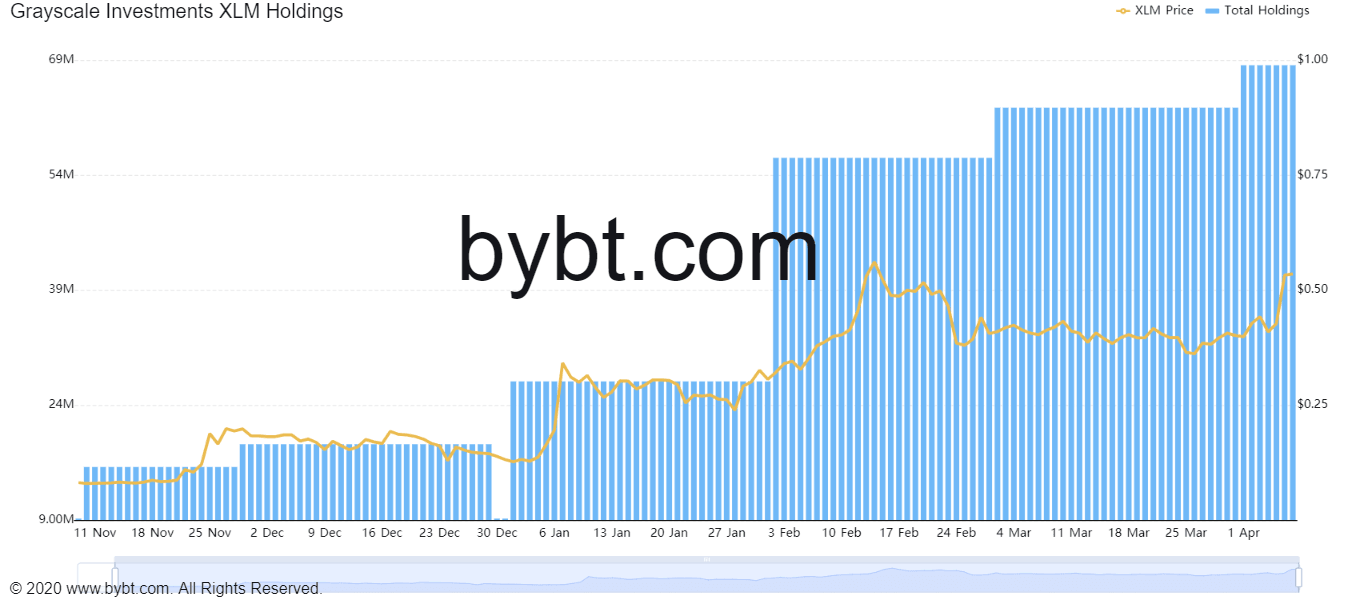

Despite the recent setback, there are also positive news surrounding Stellar, as investment company Grayscale increased its XLM holdings by purchasing 5.5 million tokens last week.

Grayscale XLM holdings chart

The recent addition brings their total holdings to 68.59 million XLM, worth approximately $37 million at the current price.

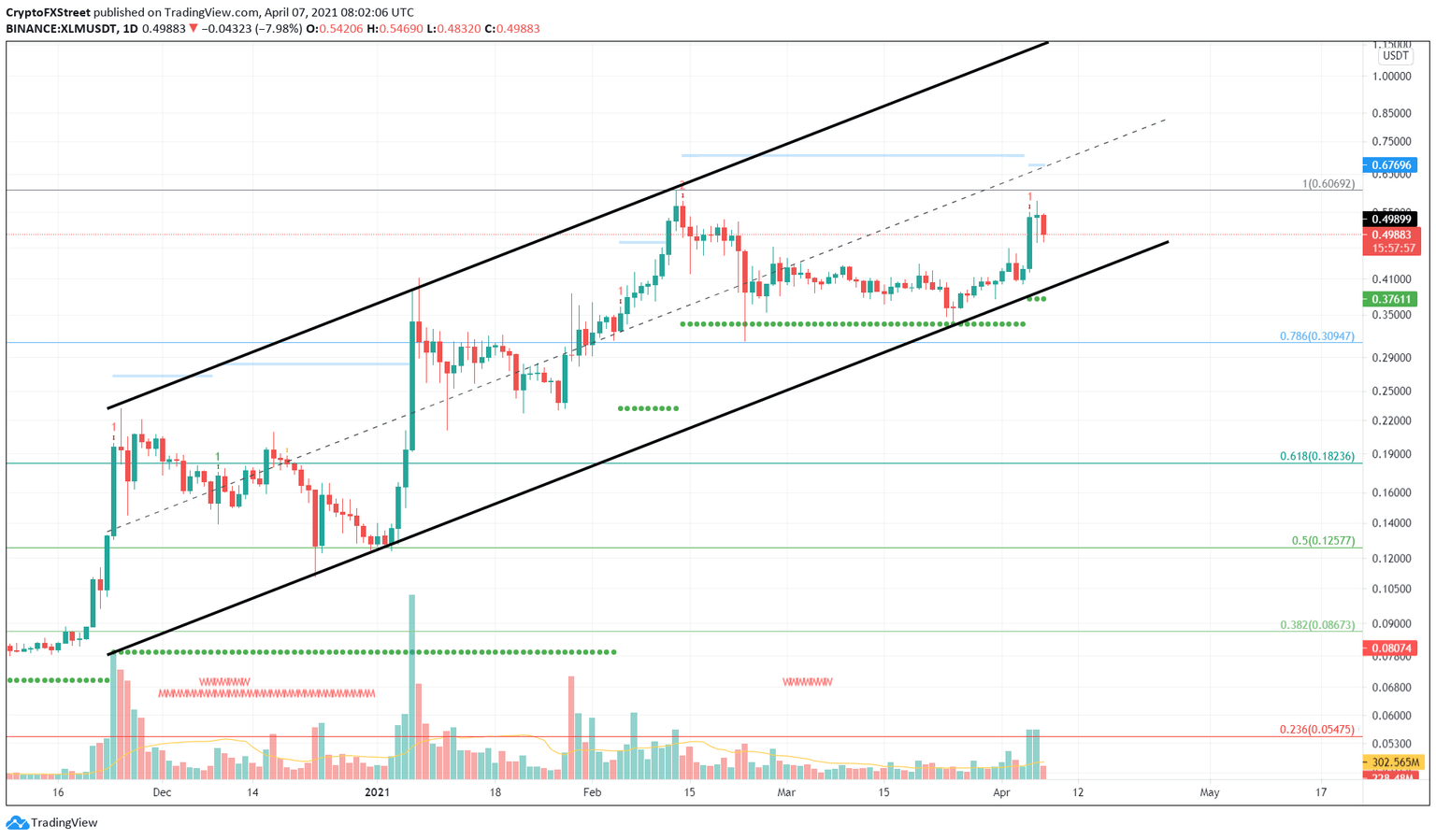

XLM price may reverse as major red flag develops

The XLM price has failed to create a higher high as it faces resistance at the ascending parallel channel middle line. The technical formation is formed as a result of higher highs and higher lows connected using trend lines.

After creating a swing low on March 25, the remittance token was on a trajectory toward the channel’s upper boundary. However, the XLM price journey faced a blockade around the previous local top at $0.60, which coincides with the middle line.

A rejection here might send the Stellar price crashing toward the lower boundary at $0.41. However, this downtrend will likely face exhaustion after a 22% drop to $0.37, which is the State Trend Support set up by the Momentum Reversal Indicator (MRI).

If sellers overwhelm the level mentioned above, the XLM price could slide another 10% to a subsequent demand barrier at $0.33.

Adding credence to the bearish outlook is the recently spawned cycle top signal presented in the form of a red-one candlestick on the 1-day chart. This setup forecasts a one-to-four candlestick correction.

XLM/USDT 1-day chart

A potential spike in buying pressure that would push the XLM price above the MRI’s breakout line at $0.70 might catalyze the buyers to pile up. Such a move would provide the remittance token a chance to surge toward the ascending parallel channel upper trend line around $1.42.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.