XLM Price Prediction: Stellar anticipates 30% spike due to this technical indicator’s ‘buy’ signal

- XLM price performance so far has stayed relatively low compared to other altcoins.

- The MRI indicator’s buy sign indicates that it might embark on a 50% parabolic upswing to $0.643.

- A breakdown of the demand barrier at $0.362 will invalidate this bullish outlook.

XLM price shows a consolidation after a technical indicator flashed a buy signal, suggesting an incoming explosive rally. A breach past a critical resistance level will confirm the start of an upswing.

XLM price coils up for a blastoff

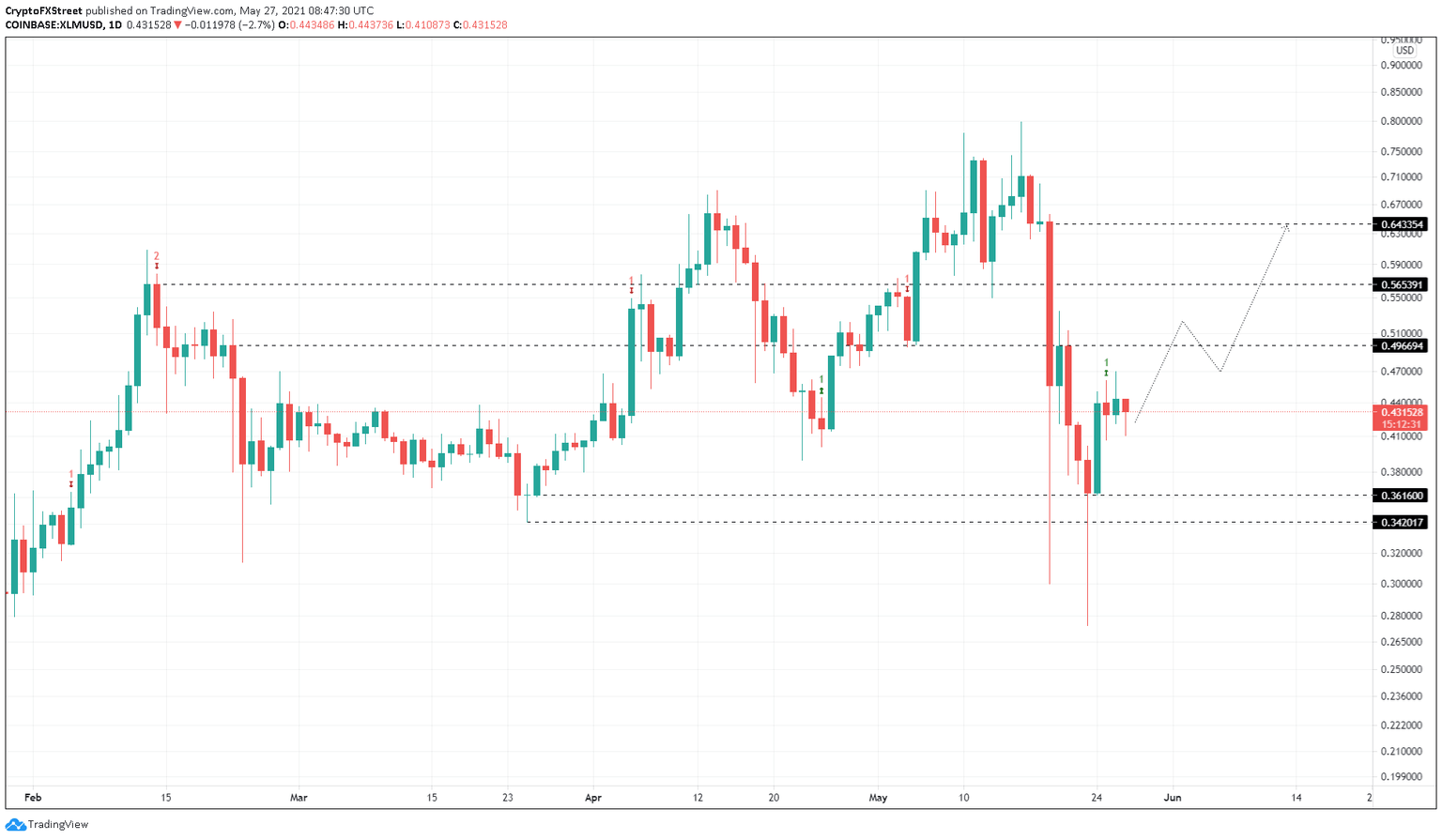

XLM price is consolidating around $0.43 after rallying 20% from May 24. In total, Stellar has surged nearly 60% from the swing low formed on May 23 at $0.274.

While this run-up is impressive, it is not even close to the performance of many other altcoins. Therefore, investors can expect XLM price to rally in the coming days.

Adding credence to this bullish thesis is the Momentum Reversal Indicator (MRI), which flashed a buy signal on May 25 in the form of a green ‘one’ candlestick. This technical formation forecasts a one-to-four candlestick upswing.

Therefore, a potential spike in buying pressure that pushes Stellar to produce a daily candlestick close above $0.497 will indicate the start of an upswing. In that case, investors can expect the remittance token to surge 30% to tag the pre-crash level at $0.643.

This appreciation of XLM price could pause around the resistance level at $0.565 before it hits the intended target at $.643.

XLM/USDT 1-day chart

While the upswing scenario appears plausible, market participants should note that a move in the opposite direction is also on the table. However, a convincing daily candlestick close below $0.362 will invalidate the bullish outlook.

If this were to occur, XLM price would likely drop 5% toward the support level at $0.342. In dire circumstances, this downswing could extend up to the swing low created on May 19 at $0.30.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.