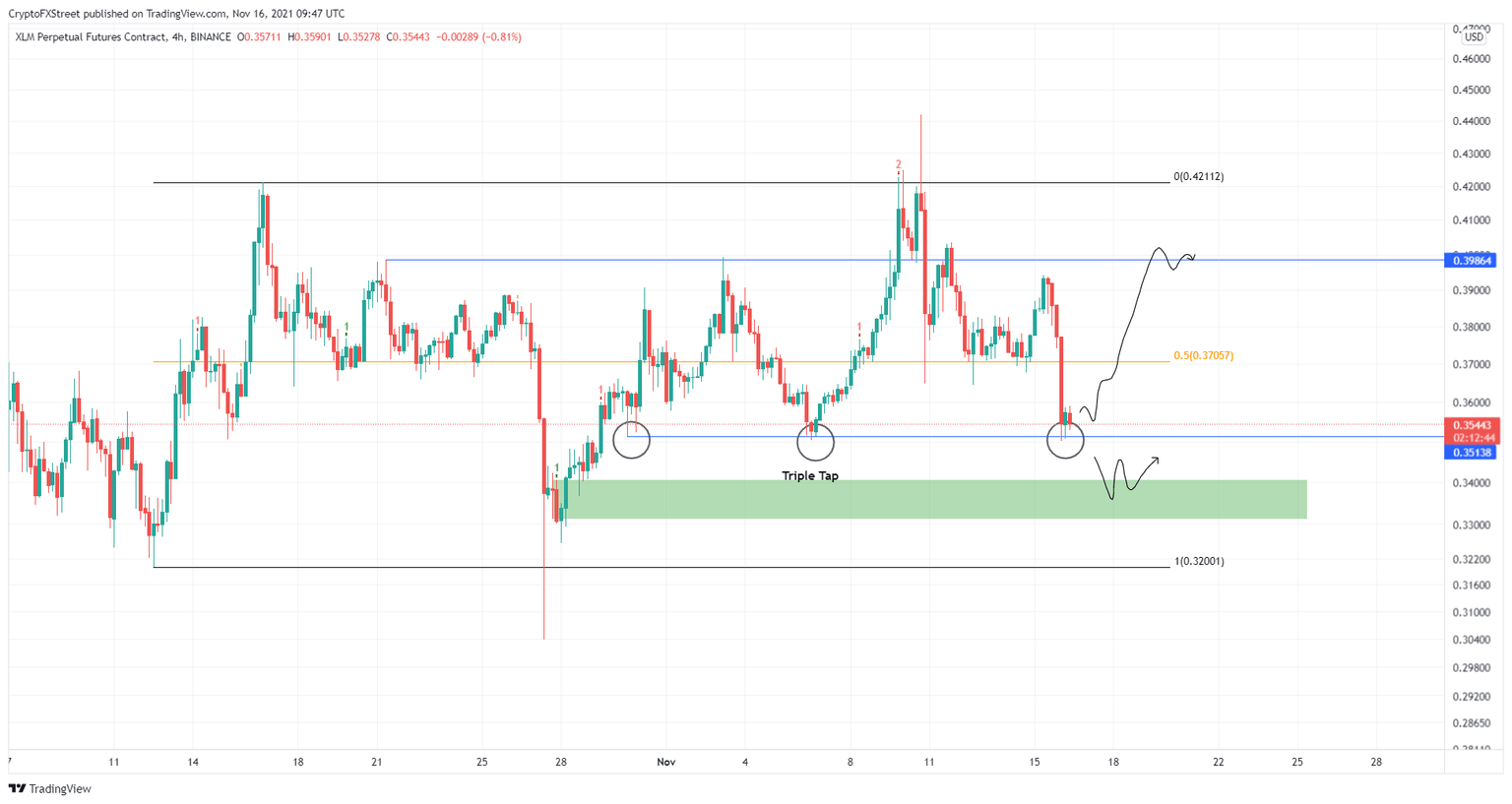

XLM price forms bottom reversal pattern, targets $0.40

- XLM price looks ready for a move higher as it bounces off the $0.35 support level for the third time.

- The triple tap setup suggests a move to $0.40 in a conservative scenario and $0.42 in an optimistic outlook.

- A breakdown of the range low at $0.32 will invalidate the bullish thesis.

XLM price has dropped sharply after failing to slice through a crucial resistance level on the daily time frame. The recent drop is the last piece needed to complete a bottom reversal pattern, suggesting investors can expect Stellar to make a comeback.

XLM price to make a comeback

XLM price failed to break above the $0.42 barrier three times over the past month. The recent failure on November 10 led to a 20% downswing and created a swing low at $0.35, which is the third consecutive low since October 30.

The 4-hour price chart is now showing that the remittance token has formed a triple tap setup, also known as a bottom reversal technical formation. Market participants can now expect XLM price to reverse and make a run to the immediate barriers.

The 50% retracement level at $0.37 is the first hurdle Stellar will encounter on the way up. Clearing this level will push it toward $0.40, constituting a 13% advance. In a very bullish case, the upswing could overextend towards $0.42.

While further gains are possible, the short-term bullish outlook is capped at $0.45. Investors should expect a decent correction after XLM price retests $0.42 or $0.45.

Another scenario that traders should expect is a retest of the demand zone, ranging from $0.33 to $0.34 before the reversal occurs.

XLM/USDT 4-hour chart

While things are looking up for XLM price, a breakdown of the said demand zone at $0.33 will create a lower low and invalidate the bullish thesis. In this situation, Stellar will likely revisit the range low at $0.30.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.