Will Solana and SUI fall behind ETH as Ethereum Foundation deploys $120M DeFi investment?

- Ethereum Foundation invested 45,000 ETH ($120M) across major native DeFi protocols.

- Increased traction across Ethereum native projects raises concerns for rival networks like Solana and SUI.

- Technical indicators on Solana and SUI price charts hint at prolonged consolidation phases.

Ethereum Foundation deployed 45,000 ETH, valued at approximately $120 million, into leading DeFi protocols to reinforce Ethereum’s position as the dominant decentralized finance network. The move reflects a significant strategic shift, signaling the foundation’s commitment to bolstering DeFi liquidity without relying on ETH sell-offs.

Ethereum Foundation’s $120M DeFi investment sparks concerns for SOL, SUI

On February 13, the Ethereum Foundation’s multisignature wallet transferred 4,200 ETH to Compound, 10,000 ETH to Spark, and 30,800 ETH to Aave. At an average ETH price of $2,600, the allocation amounted to $120.4 million, reinforcing Ethereum’s DeFi ecosystem with additional liquidity.

Ethereum Foundation announces 45,000 ETH DeFi Investment, Feb 13, 2025 | Source: X.com

Aave founder and CEO Stani Kulechov labeled this as the foundation’s most substantial DeFi investment, reinforcing the belief that “DeFi will win.” Market participants hailed the move as an alternative to foundation sell-offs, reducing downward pressure on ETH while increasing stability in Ethereum-native lending markets.

Why ETH DeFi Resurgence Impacts Solana and SUI

Ethereum’s aggressive investment in its DeFi ecosystem raises concerns about whether competing networks like Solana and SUI can sustain momentum.

By reinforcing its dominance as the leading smart contract and DeFi platform, Ethereum may trigger capital outflows from alternative ecosystems as liquidity migrates toward Ethereum-native protocols.

Solana, despite its rapid adoption, continues to grapple with network congestion, raising doubts about its reliability in high-volume transaction environments.

While its DeFi ecosystem has grown significantly, Ethereum’s deeper liquidity and institutional support offer a competitive edge that Solana has yet to match. SUI, as a newer entrant, remains even more vulnerable, lacking Ethereum’s extensive developer network and established capital inflows.

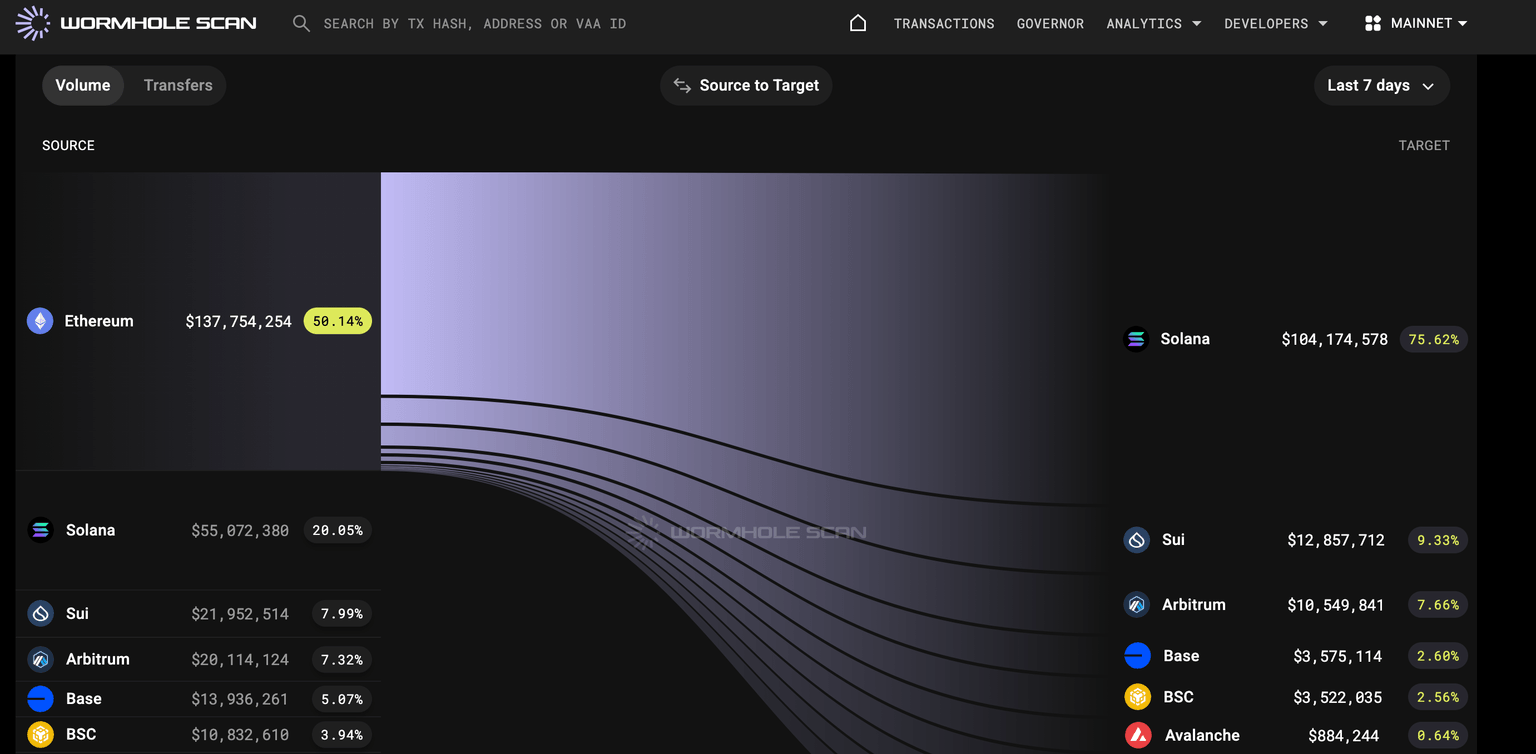

Ethereum on-chain bridge flows, Feb 2025 | Source: Wormhole

However, data from Wormhole Bridge suggests Solana and SUI are still capturing significant market share. Over the past 30 days, Solana attracted $2.1 billion in inflows, representing 65% of Ethereum’s outflows, while SUI accounted for $570 million, or 17%.

This suggests that while Ethereum’s resurgence strengthens its position, rival networks continue to see strong adoption—at least for now.

Solana Price Forecast: Recovery potential hinges on $220 resistance break

Solana price is showing early signs of a potential recovery, trading at $194.95 after a brief consolidation. The Elliott Wave structure suggests a completed corrective wave (a), implying a possible shift toward an upward retracement.

The Fibonacci projections indicate key resistance levels at $221.71 (0.382), $235.86 (0.5), and $250.01 (0.618), where bulls could face selling pressure.

The Parabolic SAR dots remain above the price, signaling an active downtrend, but a breakout above $217.50 could invalidate the bearish bias.

Solana Price Forecast

Momentum indicators present mixed signals. The MACD remains bearish, with the signal line and histogram deep in negative territory, suggesting selling pressure is still dominant.

However, the gradual flattening of the histogram hints at weakening downside momentum. If Solana reclaims $200, it could confirm a bullish reversal toward the 0.5 Fibonacci level.

Failure to breach immediate resistance could see renewed downside pressure. A rejection at $217.50 may drive SOL back toward $180, reinforcing the broader bearish trend until a decisive breakout confirms trend reversal.

SUI Price Forecast: Bulls eye breakout as $3.5 resistance looms

SUI price is attempting to recover from its prolonged downtrend, currently trading at $3.4668. The recent bullish push has led to a 21.29% gain over six sessions, with price action stabilizing above key support. Bollinger Bands show price pushing toward the upper band at $3.5183, indicating increasing volatility and potential breakout momentum.

However, the 50-day moving average at $4.1811 remains a key resistance level that bulls must overcome for sustained upside.

SUI Price Forecast

Volume Delta shows a net positive shift, indicating growing buy-side momentum, while ADX at 38.77 suggests a strong trend in play. If SUI clears $3.50, it could trigger an extended rally toward $4.00.

However, failure to maintain momentum could result in a pullback toward the lower Bollinger Band support at $2.8464.

For bulls to take full control, SUI must confirm a breakout above the 50-day moving average.

Until then, the recovery remains fragile, and any rejection from current levels could extend consolidation or trigger renewed selling pressure.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.