Why Solana price could fall an additional 25%

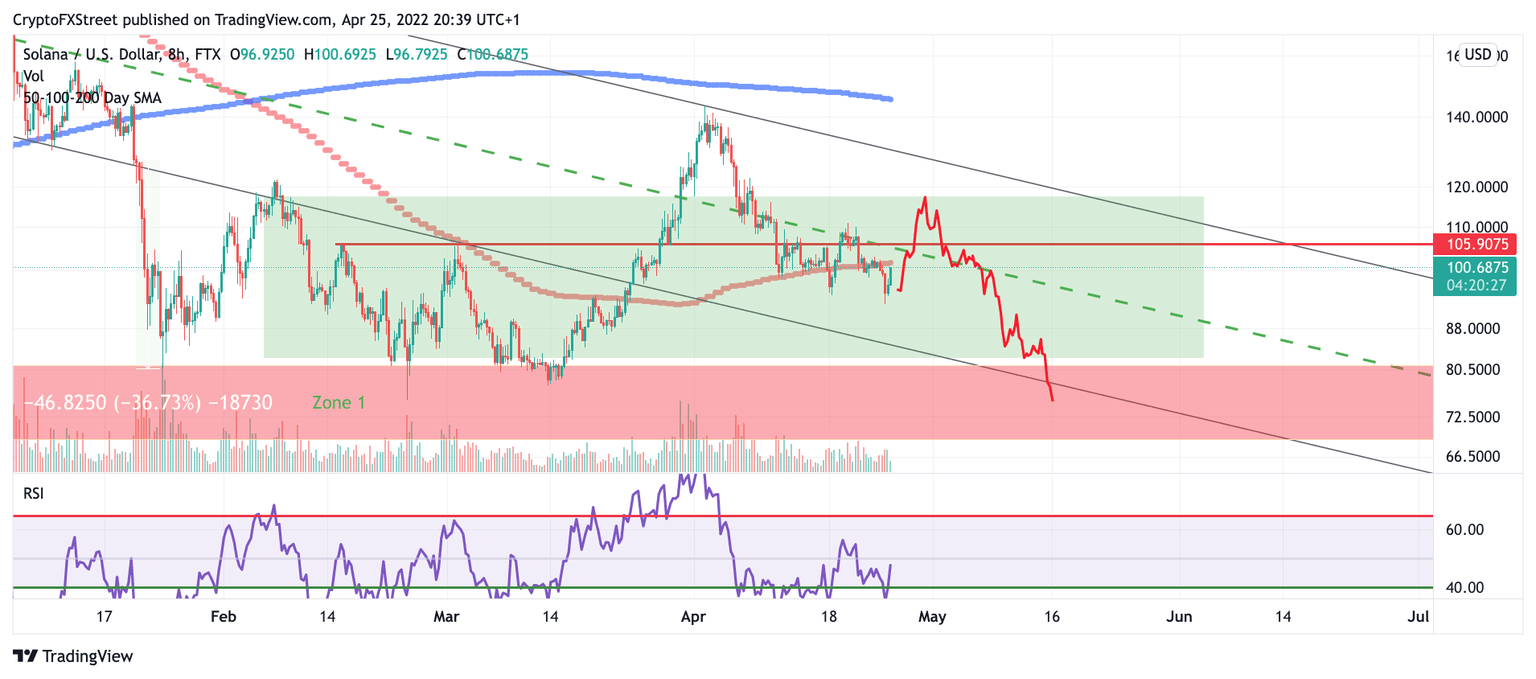

- Solana price fails to find support at the 50-day moving average.

- SOL price is submerged below the parallel channel median line.

- Invalidation of the bearish thesis is a close above $128.

Solana price could see more downside as the bulls fail to establish support on multiple key levels.

Solana price is failing to find strong support

Solana price could fall an additional 25% into the $78 zone as the bulls failed to hold support following the breakout on March 30th. Following the first sell-off, the bears have managed to push the price through the parallel channel median line and the 50-day moving average. If market conditions persist, investors seeing the Solana price action could begin scaling out of their position.

Solana/USDT 8-Hour Chart

Solana price could see one more counter-trend movement before the larger sell-off occurs. For this reason, it is best not to consider a sincere uptrend scenario until the parallel channel is breached with solid volume.

Thus, the current bearish thesis will be invalid by a settling close above the parallel channel, currently priced at $128. If the bulls can club towards this area, the next price target will be the 200-day moving average at $145, resulting in a 40% increase from the current Solana price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.