Why Binance Coin could fall another 50% before finding support

- Binance Coin price action is the only major market cap crypto that has not completed a major retracement.

- BNB is either lagging the broader market or the new dominant leader.

- For BNB to come into equilibrium with the broader market, a return to the $130 level is likely to occur.

Binance Coin price action is a bit of a mixed bag for the overall sentiment. For bulls, BNB is a clear outperformer and an example of strength. On the other hand, BNB is an opportunity to short for bears because it has yet to make an equally impactful retracement on its chart.

Binance Coin price will need a deep retracement or clear and undeniable rally to establish a clear direction

Binance Coin price action, out of all the top ten market cap cryptocurrencies (excluding stable coins), is one cryptocurrency that has the most potential for a major collapse or rally in the near future.

From a bearish perspective, Binance Coin price is still lagging behind its peers. Nearly every major cryptocurrency save Bitcoin and Ethereum has experienced an 80% to 90% drop from their all-time highs. BNB, despite last week's flash crash and new 2022 lows, barely eeked out a 70% fall from its all-time high.

If Binance Coin price were to fall into the 80% - 90% range from its all-time high, BNB would need to return to the $130 value area – which is a high volume node in the 2021 Volume Profile.

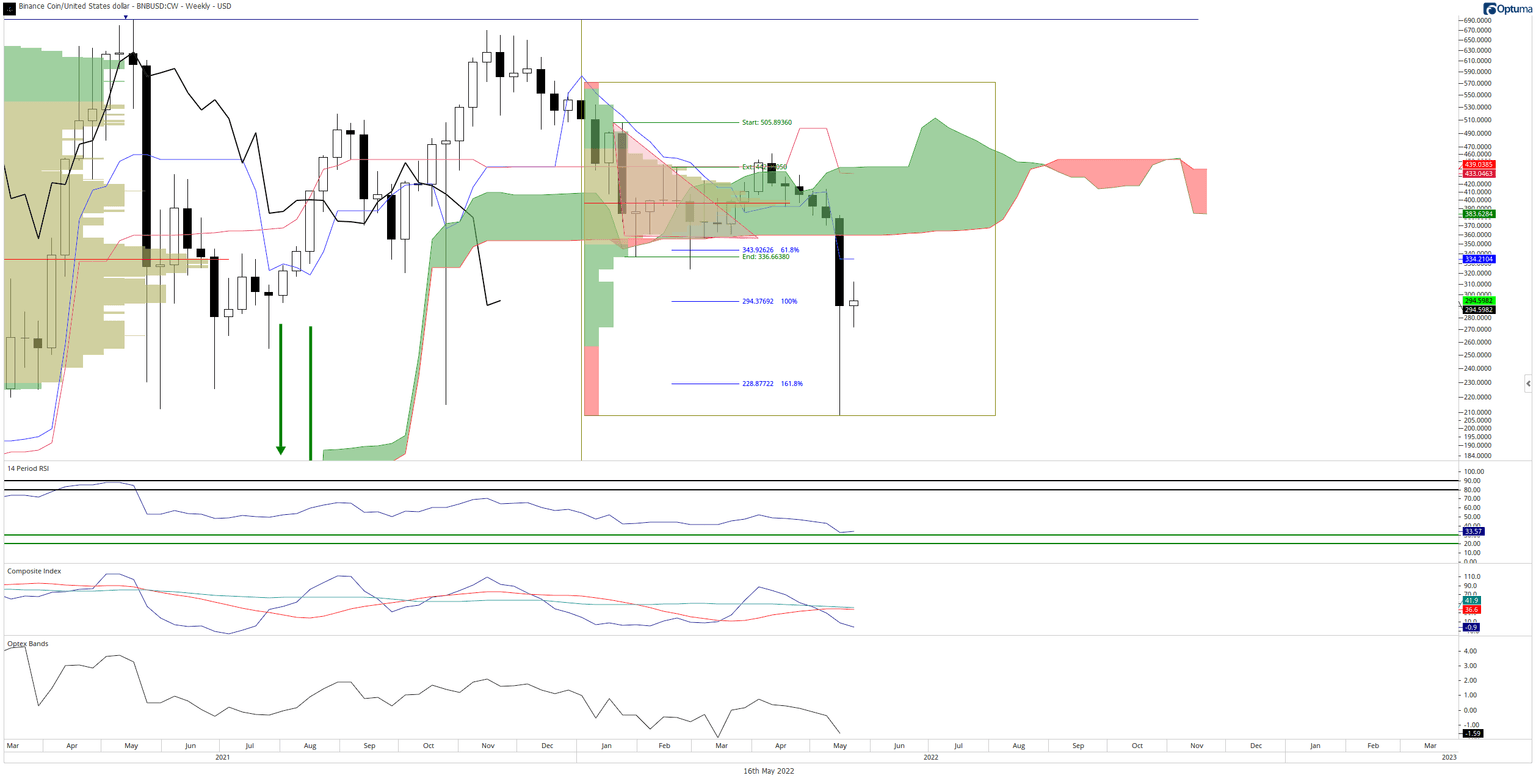

BNB/USDT Weekly Ichimoku Kinko Hyo Chart

For bulls, the interpretation of BNB's performance may be a leading indicator that Binance Coin price action may lead the broader market. For example, on the weekly Ichimoku chart, BNB just confirmed an Idea Bearish Ichimoku Breakout – but given last week's candlestick and the position of the weekly oscillators, that move may be a fakeout.

If bulls want to eliminate any further near-term downside movement, then at a minimum, they'll need to close Binance Coin price inside the Ichimoku Cloud – at or above $361. Until then, the trend for BNB is decidedly and overwhelmingly bearish.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.