Why all eyes are on Ripple’s XRP price this week

- XRP price has experienced a significant movement of tokens onto active wallets and exchanges.

- XRP price has printed classical bearish divergence in recent days.

- A breach above the $0.48 level would invalidate the bearish trend.

XRP price shows large cap investors may be considering liquidating their investments. Key levels have been identified.

XRP price edges near a make-or-break situation

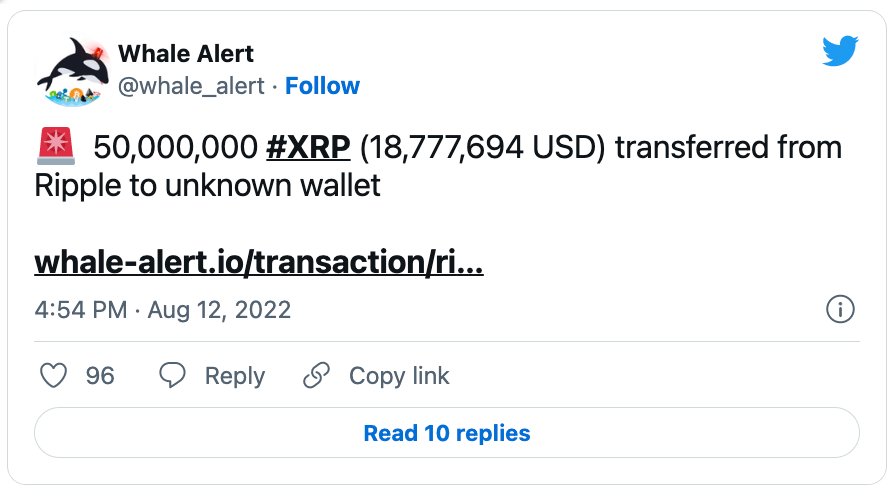

XRP price continues to show concerning on-chain analysis signals. The previous XRP outlook reported a significant increase in daily active wallets. On Monday, U.Todays’ Yuri Mulchan confounded the on-chain analysis with a breacking news piece. According to the article Nearly 300 million tokens were transferred to exchanges. Whale Alert, the notorious crypto auditor, took to twitter with more information on the sudden movements on the blockchain. Apparently, 50,000,000 of the recent transactions were directly linked to XRP and transferred to an unknown wallet.

XRP price currency auctions at $0.37, just below last week's high at $0.39. Based on historical evidence, cryptocurrencies usually witness a significant sell-off after influx of transactions occur. The large transfers of XRP tokens to active wallets is symbolic with a rifleman loading his artillery. It appears there is a substantial interest in selling the XRP token at the current time and price.

Seantiment’s Active Wallets Indicator

XRP price additionally shows subtle bearish divergences between recent trading levels on the Relative Strength Index. There is always a possibility for prices to move higher, but for the safety of our readers, it is best to adopt a reactionary investment strategy when dealing with the XRP price. A breach below $0.35 could send XRP price back to $0.24 for a 35% decline.

A breach above the $0.48 would invalidate the bearish trend and could give way to bullish surge targeting $0.75 in the short term for up to a 100% increase from the current Ripple price.

XRP/USDT 1-Day Chart

In the following video, our analysts deep dive into the price action of Ripple, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.