What Quant QNT traders need to watch out for when chasing 100% gains

- Quant QNT yielded 100.6% gains for holders over the past thirty days, hitting a high of $224.60.

- Quant’s Market Value to Realized Value (MVRV) hit its highest point in six months, indicating that QNT is overvalued.

- Large wallet investors across top exchanges shed their QNT holdings in the past two days, QNT price retracement is likely.

Quant (QNT) has decoupled from the broader crypto market and yielded 450% gains in four months. The altcoin has garnered attention from crypto traders for its massive rally and is currently “oversold” according to market indicators.

Also read: Chainlink ready to break the internet, is CCIP a global open-source standard?

Ranked in top 30, Quant yields massive returns for holders

In the ongoing crypto bear market, Quant QNT has decoupled from Bitcoin, Ethereum and the broader crypto ecosystem. The interoperability-focused Quant Network has yielded 65.6% gains in the last two weeks.

The native token of the interoperability focused Quant Network has witnessed a spike in its popularity in the last few weeks. The call for Central Bank Digital Currencies (CBDCs) and their increasing mention has made Quant QNT more relevant than ever.

Gilbert Verdian, CEO of Quant is a well-connected member of the crypto and financial world. Verdian took a seat at the European Central Bank alongside the Central Bank of Italy, the Central Bank of Lithuania, and the London Stock Exchange. The project has emerged as a leading one offering holders double-digit profit in the last two weeks,

Quant QNT skyrocketed, hitting a high of $224.60

Analysts believe Quant QNT is carried by an extremely large hype, reflected in the Relative Strength Index (RSI) which is currently close to 75. An RSI above 70 indicates an overheated market and that price has increased too high, too quickly. Jake Simmons, a crypto analyst and trader believes Quant QNT price could fall to the $133 level.

Based on data from TradingView.com, Quant QNT is currently writing its fifth weekly green candle and the asset is 49.5% away from it's all-time high of $427.42. QNT price yielded nearly 17% gains to holders overnight and ranks among the top cryptocurrencies outperforming Bitcoin.

Quant QNT enters overbought zone, signals distress?

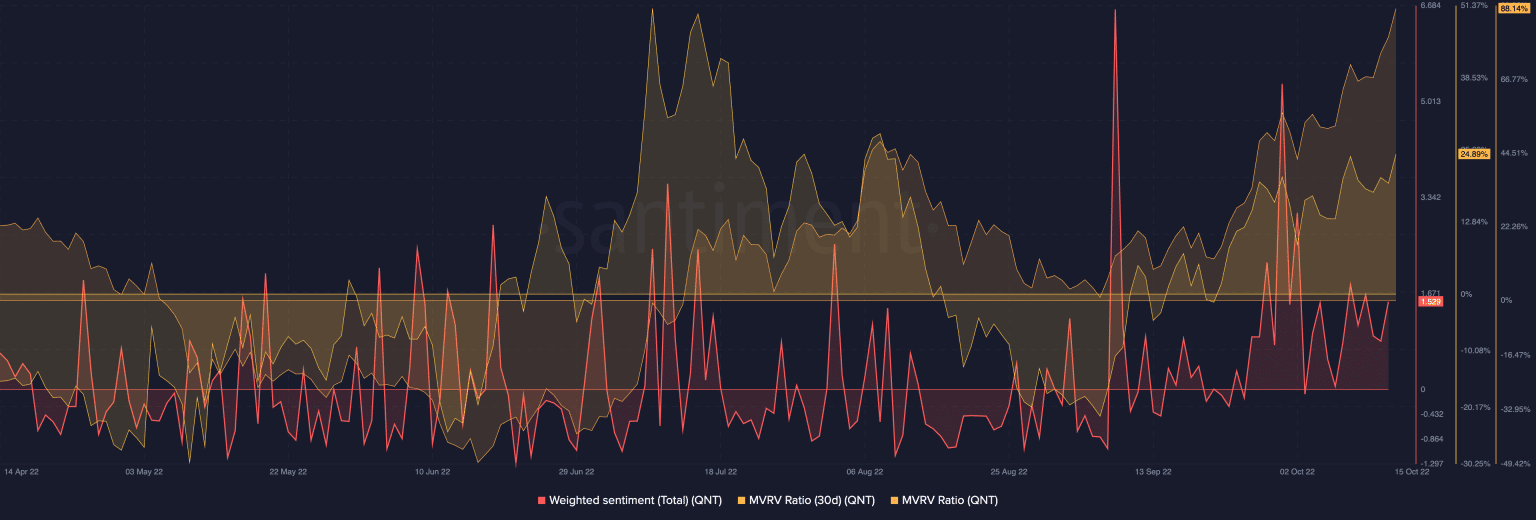

Quant’s massive price rally has resulted in many holders taking profits on their gains. Data from on-chain analytics platform Santiment indicated that Quant’s Market Value to Realized Value (MVRV) is at its highest point in the last six months.

At press time, MVRV is 88.14% and this indicates several holders have registered gains on their investments. A 30-day moving average of the indicator reveals 24.89%. QNT has enjoyed a positive bias among crypto traders over the past four weeks.

Quant (QNT) MVRV

Over the past two days, QNT holdings in whale wallets across exchanges have declined. This indicates profit-taking by large wallet investors and proponents believe a retracement in Quant price is likely in the short-term.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.