What Litecoin price will need to do to prevent the upcoming sell-off

- Litecoin price is down 5% since the beginning of October.

- The bears show several bearish cues hinting at their control of the trend.

- Invalidation of the bearish thesis is a breach above $53.50.

Litecoin price shows multiple reasons to believe in a further downtrend. Key levels have been defined.

Litecoin price points south

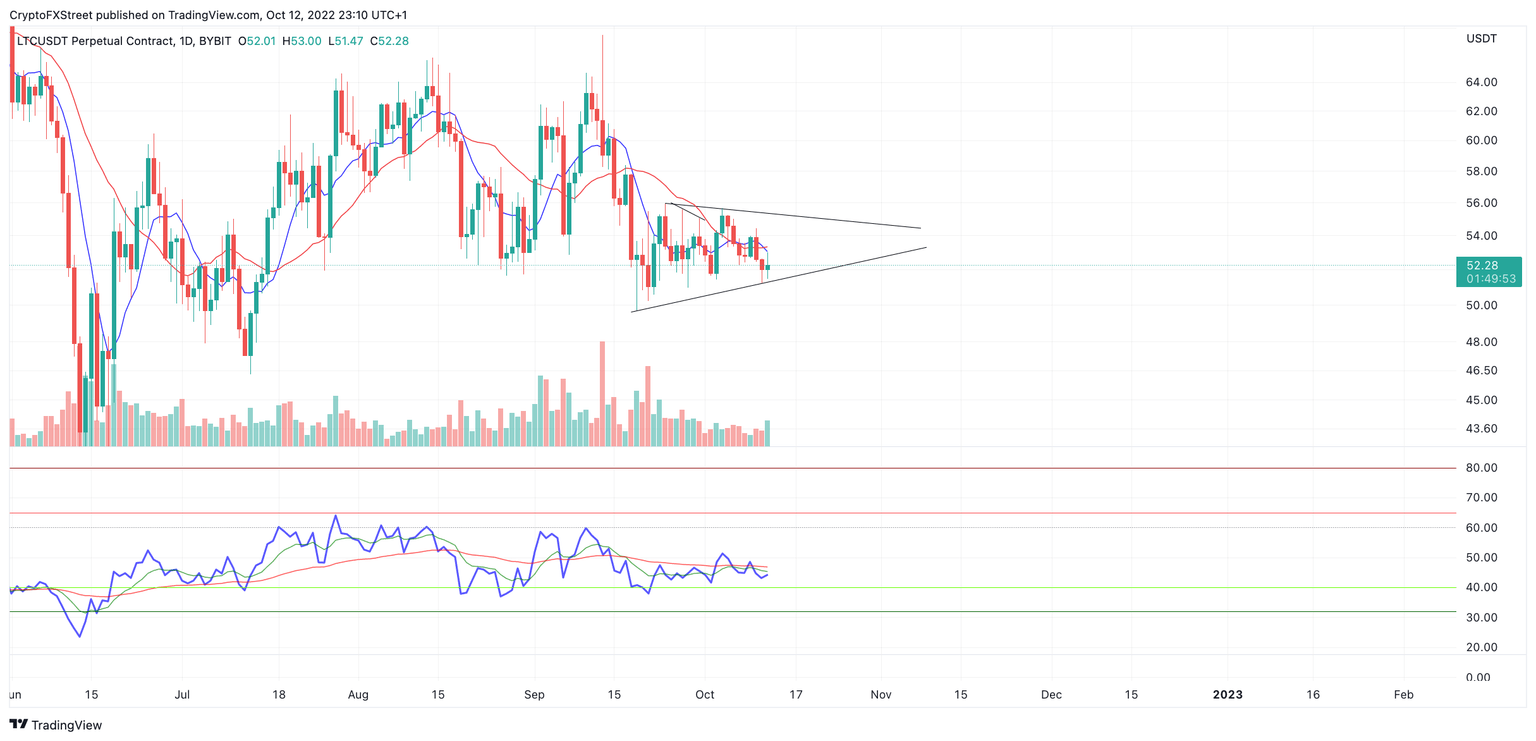

Litecoin price is down 5% on the month as the bulls are trying to maintain their position above the $0.50 barrier. A bearish death cross of the 8-day exponential and 21-day simple moving averages has been spotted in the last 24 hours, which spells a troublesome trajectory for Litecoin in the coming days.

Litecoin price currently auctions at $52.17. The largest candlestick within the current trading range belongs to the bears. The Volume Profile Indicator lacks evidence to believe that a strong retaliation from the bulls will occur. If market conditions persist, a sweep-the-lows event targeting the $48 liquidity level established in July is a potential bearish target.

LTC/USDT 1-Day Chart

A spike through the overlapping moving averages at $53.50 could invalidate the bearish outlook. The September highs at $64 could be challenged if the bulls break through the barrier once more. The said price action would result in a 25% increase from the current Litecoin price

In the following video, our analysts deep dive into the price action of Litecoin, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.