What Elon Musk speech at the Qatar Economic Forum 2022 means for Bitcoin price

- This morning Elon Musk made comments during the Qatar Economic Forum

- Musk alluded that a recession is coming fast and hard and will bite into cryptocurrencies.

- Expect BTC price to still rally, but traders need to see the message from Musk as a warning sign of limited upside.

Bitcoin (BTC) price was holding its breath this morning as crypto-guru Elon Musk appeared at the Qatar Economic Forum. Speaking at the Forum, Musk said that a recession in the near-term is more likely than not and that traders and investors need to prepare for the eventuality by prudently managing their portfolios. This means that positions in Bitcoin and other cryptocurrencies should be cut short soon as Bitcoin enters a soft patch, although longer term, Bitcoin price, still nevertheless, retains some upside potential.

BTC price sees a 13% upside in a soft patch

Bitcoin price has left traders to hang out to dry over the weekend as the price tumbled below $20,000, but in the end it was able to close out the week above it. Still, this was only a warning shot of what’s to come as Elon Musk painted a dire picture of the world economy this morning and thinks a recession is just around the corner with more losses to come for cryptocurrencies. In the meantime Terra is denting the stable image of cryptocurrencies after its CEO was indicted by the US Attorney’s office.

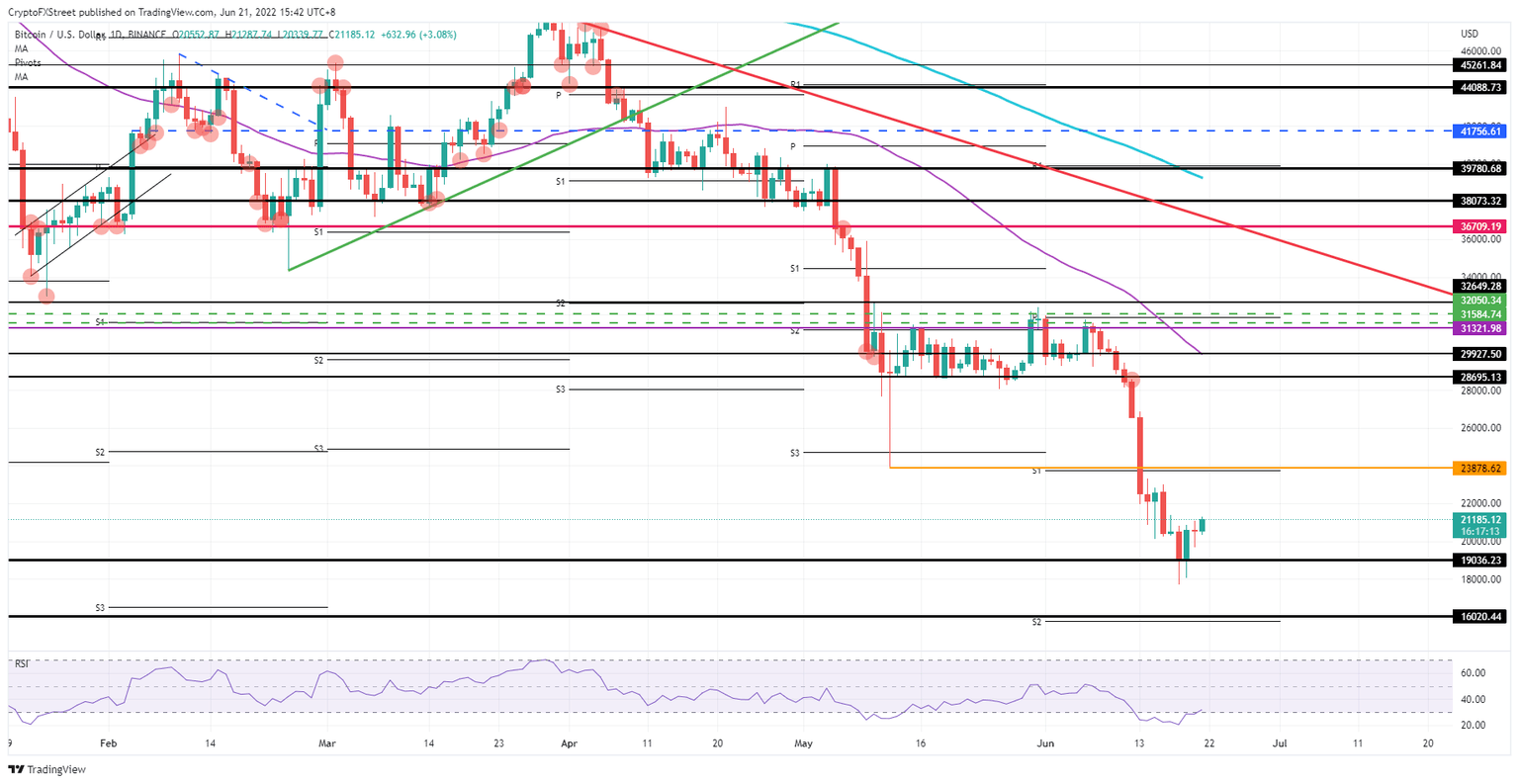

BTC price still has some room to cover before getting to $23,782.62. That means around 13% is still up for grabs before an initial upside cap is hit. That cap comes with the low of May 12 and the monthly S1 support level, which needs to be confirmed as resistance now price action has broken below it.

BTC/USD daily chart

Risk to the downside comes with Musk’s warning that a recession is just around the corner, and Tesla has already slashed its workforce by a few thousand. This is not an isolated warning, as other CEOs and business leaders are joining Musk in the recession camp. This would mean more cash outflow for cryptocurrencies, with BTC set to drop back to $19,036.23 and possibly even slip towards $16,020.44 in case the previously mentioned level does not hold, triggering a 24% correction.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.