Week Ahead: Why this week's Nonfarm Payrolls is critical for cryptos

There are two significant events that need to be addressed when encompassing things that are likely to transpire this week:

- End of 2023’s first quarter and expectation for the next quarter.

- Alt season possibility while BTC cools down.

- This week’s Nonfarm Payrolls (NFP) and why it is important to this bull rally.

Welcoming the second quarter of 2023

2023’s first quarter was extremely bullish for crypto participants but not so much for traders in the traditional finance markets. The below chart shows the performance of Bitcoin (BTC), Ethereum (ETH), S&P500, NASDAQ100 and Gold. Clearly, BTC and ETH are the winners in terms of returns amid the ongoing global banking crisis.

Considering the historical performance of Bitcoin, the article attached below takes a look into the significant levels for BTC from a weekly, daily and four-hour timeframes. While the overall outlook for the pioneer crypto continues to be bullish, a minor retracement is likely, which would be a blessing for investors looking to accumulate BTC.

Read more: Bitcoin Weekly Forecast: Breaking down key BTC levels to accumulate for Q2, 2023

Additionally, Bitcoin Dominance, which is the percent share of BTC’s market capitalization with respect to the total crypto market capitalization, is at a critical hurdle. A decline in Bitcoin dominance could lead to profits rotating to altcoins, which could lead to an alt season.

The concept of capital rotation in cryptocurrencies, alt season and which category of altcoins are likely to pump is explained in detail in the article attached below.

Read More: Here are top three altcoin categories that are likely to pump the hardest in the 2023 alt season

Nonfarm Payrolls and why it is important for Bitcoin’s 2023 bull rally

The Unemployment Rate and NFP events are scheduled to take place on March 7 at 12:30 GMT, which will set the tone for the US Federal Reserve’s next step – raise interest rates or pause.

Nonfarm Payrolls FAQs

What are Nonfarm Payrolls?

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

How does Nonfarm Payrolls influence the Federal Reserve monetary policy decisions?

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation.

A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls' result, on the either hand, could mean people are struggling to find work.

The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

How does Nonfarm Payrolls affect the US Dollar?

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls' figures come out higher-than-expected the USD tends to rally and vice versa when they are lower.

NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

How does Nonfarm Payrolls affect Gold?

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls' figure will have a depressing effect on the Gold price and vice versa.

Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold.

Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Sometimes NonFarm Payrolls trigger an opposite reaction than what the market expects. Why is that?

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components.

At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary.

The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the "Great Resignation" or the Global Financial Crisis.

In early March, the positive correlation between BTC and the stock market plunged due to growing concerns about the state of banks. As a result of this turmoil, crypto markets saw a massive inflow of capital, which catalyzed a continuation of the bull run that began in January 2023.

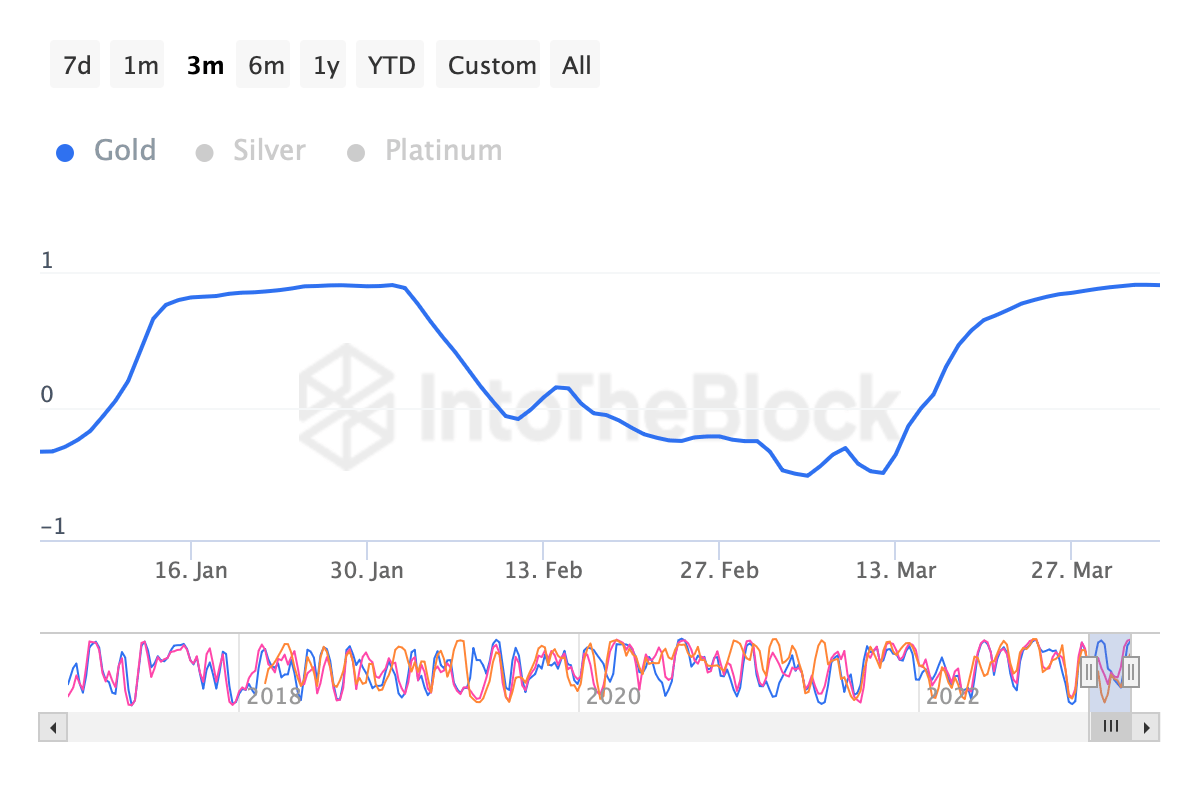

In parallel, the correlation between BTC and Gold saw an uptick and went up from -0.5 to 0.92 between March 12 and April 3, strenghtening the case for both assets to recover their safe-haven status. As the bullish momentum exhausts, Bitcoin’s rally has come to a standstill, which has caused the aforementioned correlation to plateau.

BTC vs. Gold correlation

Recently, the correlation between Bitcoin price and S&P500 has bounced back, rising from -0.25 on March 6 to 0.49 as of April 3.

BTC vs. S&P500, NQ100 correlation

So, it will be interesting to see how Bitcoin price reacts to upcoming macroeconomic events like the unemployment rate and NFP numbers.

The consensus for NFP is 240k, which is much lower than the previous report of 311k. Depending on how much the deviation is and in what direction, Bitcoin price could either tank or have an opportunity to continue its ascent from here.

A positive surprise of a larger magnitude could be interpreted as bullish for the US Dollar by the market, which could set off a quick sell-off. On the contrary, a negative surprise with a large enough magnitude could catalyze a move to the upside.

Top3 reads: BTC, ETH, XRP

Is Bitcoin price primed for a 15% retracement this week?

Ethereum price shows sign of rally, will Ethereum climb to $2,000?

XRP price coils up for 25% breakout as Ripple bulls issue ‘hurry-up signal’ to Judge Torres

Important reads

Is Bitcoin price primed for a 15% retracement this week?

Will Bitcoin hit its $35,000 target in April: BTC deep dive

Dogecoin whales are buying the dip: Will DOGE lead a meme coin price rally?

Why Vitalik Buterin is bullish on ZK coins

Controversy surrounds Arbitrum Foundation's AIP-1 proposal amid concerns over its financial impact

Will MATIC price conquer the bullish target of $2 again?

Why exchange tokens Uniswap, Synthetic and Thor are rallying despite regulatory hurdles

XRP holders jittery over SEC v. Ripple lawsuit outcome: Will XRP price recover?

Elon Musk supports DOGE holders after $258 billion Dogecoin lawsuit

LUNA Classic price dips to August 2022 lows as Terra founder Do Kwon may face five years in prison

CFTC-linked self-regulatory organization issues new rules for members handling digital assets

Chainlink Price Prediction: A 25% rally is likely only when LINK holders continue doing this

Jim Cramer would not do business with Binance, bull news for BNB?

Shiba Inu Price Forecast: SHIB needs to hold above this level to sustain upward momentum

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.