VeChain price presents buy opportunity before VET hits $0.20

- Vechain price positioned for an early entry that will likely trigger the move to $0.20.

- Near-term short entry opportunities exist too, as downside risks remain.

- Expect volatile price action during the US Thanksgiving holiday and weekend.

VeChain price downside risk remains elevated, but oversold readings in the oscillators indicate that risk is limited. A strong bullish entry opportunity would likely return VeChain to a push towards new all-time highs.

VeChain price could shock bears with a powerful spike higher, despite temping short entry opportunities

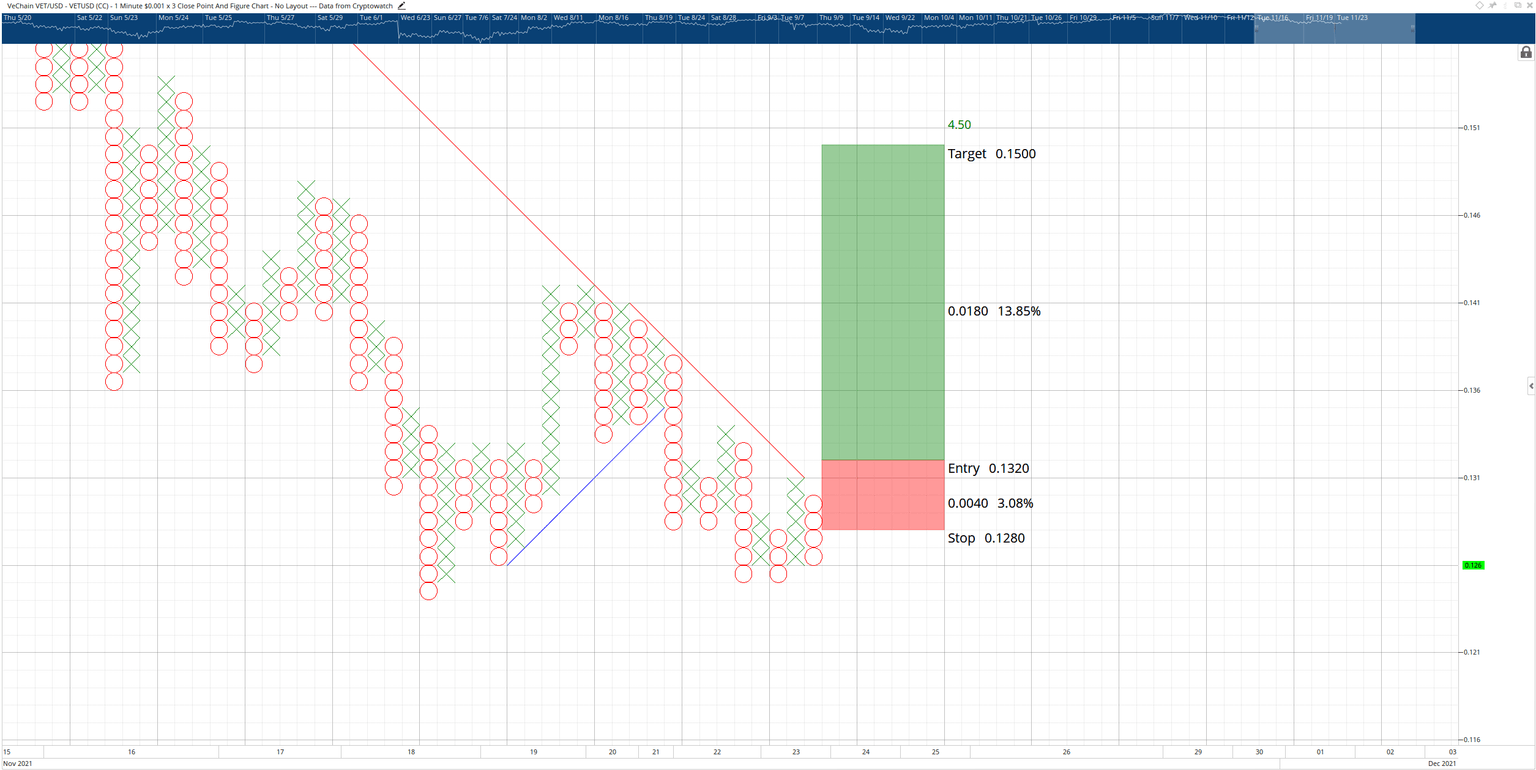

VeChain price has two trade setups on its $0.001/3-box Reversal Point and Figure Chart. The first is a theoretical long entry with a buy stop order at $0.132, a stop loss at $0.128 and a profit target at $0.150. This entry would simultaneously break a double-top pattern and breakout above the dominant bear market trendline (red diagonal line).

VET/USDT $0.001/3-box Reversal Point and Figure Chart

The theoretical long trade idea will be invalidated if the short idea identified below is triggered.

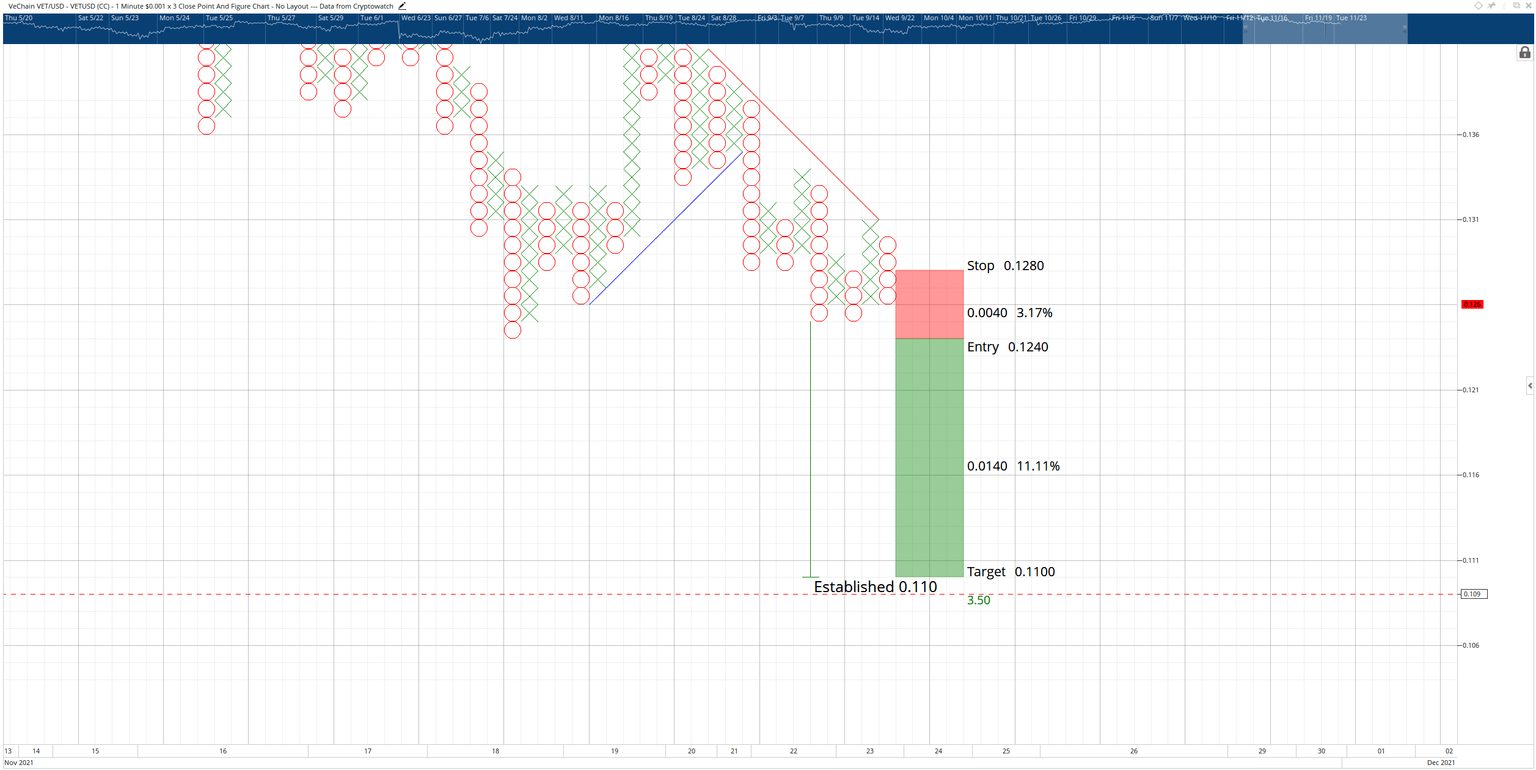

The hypothetical short set for VeChain price is a sell stop order at $0.124, a stop loss at $0.128 and a profit target at $0.110. The short entry is an overwhelmingly tempting and bearish setup. The entry at $0.124 breaks below a triple-bottom while also confirming a powerful Point and Figure bearish pattern known as a Bullish Fakeout.

VET/USDT $0.001/3-box Reversal Point and Figure Chart

However, the daily Optex Bands oscillator levels indicate extreme oversold conditions and do not support an extended drive south. The hypothetical short entry is invalidated if VeChain price moves to $0.132.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.