Vechain Price Prediction: VET ready for 40% upswing amid strong bullish momentum

- Vechain price is trading inside an ascending parallel channel on the 12-hour chart.

- A breakout above the upper boundary of the channel will lead VET to new all-time highs.

- VET has been trading inside a robust daily uptrend for the past two months.

Vechain established an all-time high at $0.121 on April 7, continuing to trade inside the daily uptrend that started in mid-February. VET bulls defended a significant support level in the past 48 hours and are now aiming for a new leg up to new all-time highs.

Vechain price primed for significant upswing if key barrier is cracked

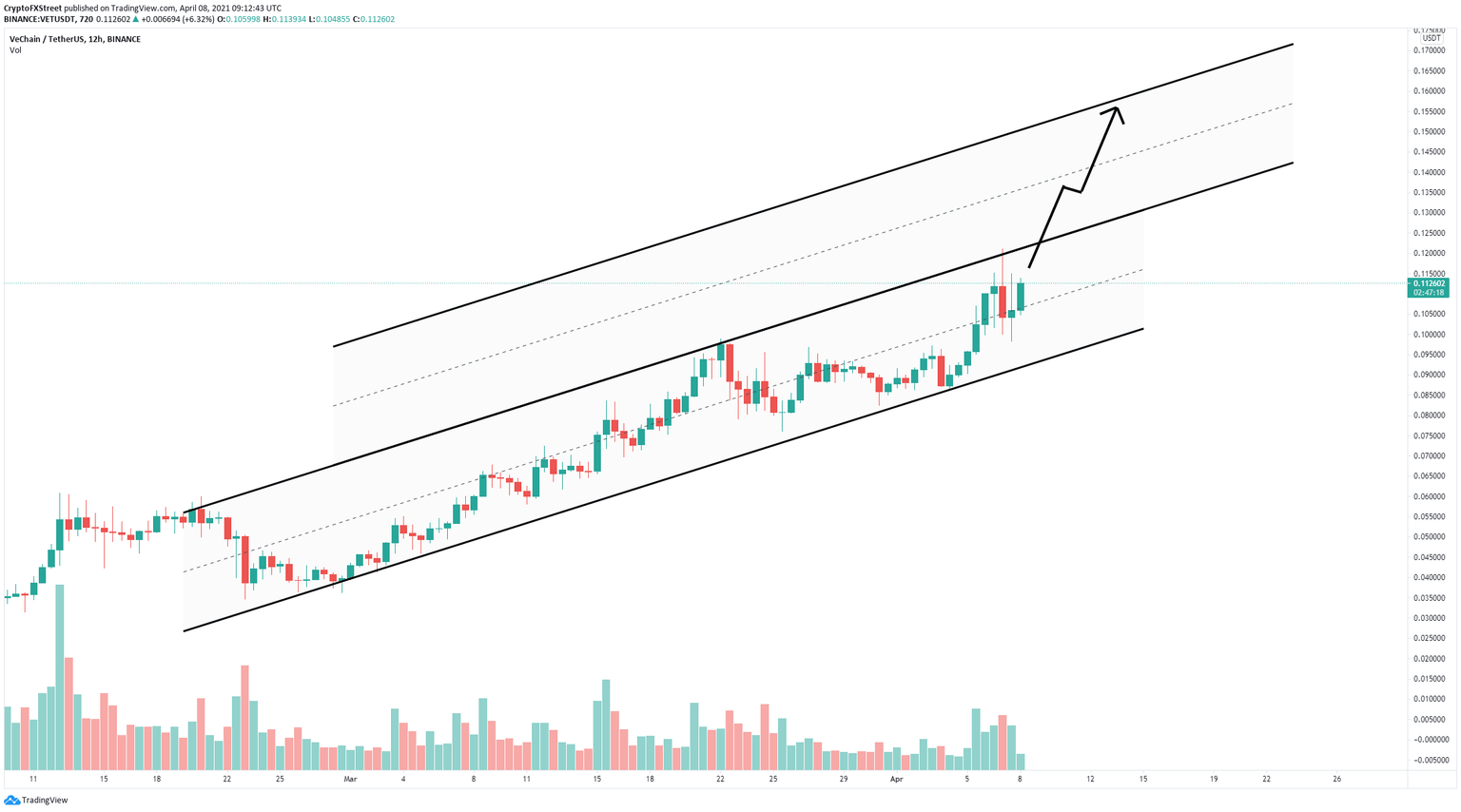

On the 12-hour chart, Vechain has established an ascending parallel channel that can be drawn by connecting the higher highs with a trendline and the higher lows with another one.

VET/USD 12-hour chart

VET has managed to stay above the parallel channel's middle trendline and aims for a breakout of the key resistance at $0.123. After a move above the upper boundary, a new channel can be drawn, projecting the next price target at $0.14, followed by $0.16 in the long-term. There is practically no real resistance ahead as Vechain is in price discovery mode.

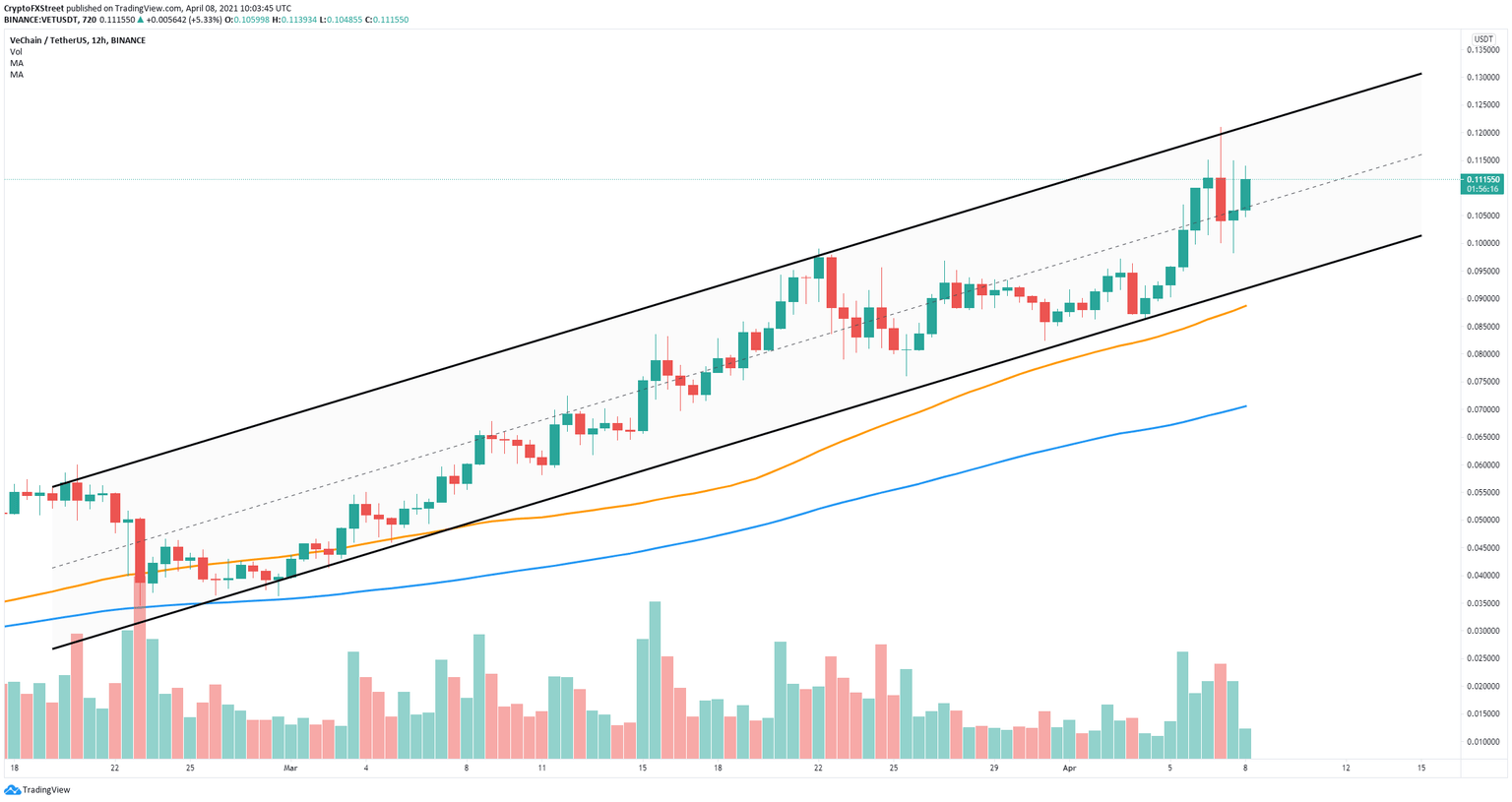

VET/USD 12-hour chart

To invalidate the bullish outlook, bears need to push Vechain below the middle trendline at $0.108. This breakdown will lead VET down to the parallel channel's lower boundary at $0.09, coinciding with the 50-SMA support level.

Losing this key support point would be notable, with the potential to drive Vechain price down to the 100-SMA support level, located at $0.07 at the time of writing.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.