VeChain Price Prediction: VET may correct 9% before heading higher

- VeChain price is getting wound up as it is stuck trading between two ranges.

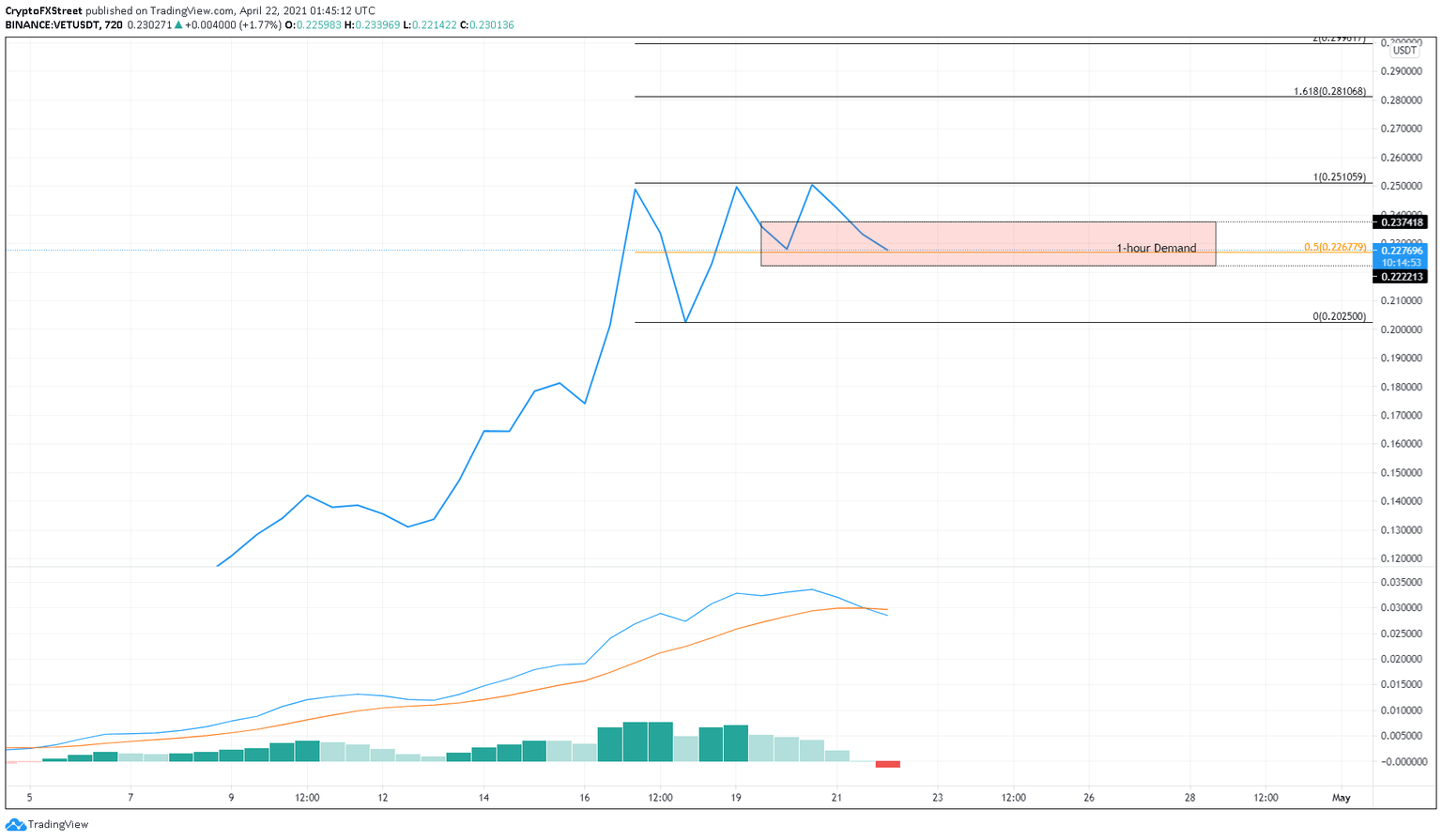

- A breakdown of the immediate demand zone ranging from $0.222 to $0.237 could lead to a 9% downtrend to $0.202.

- In case the bulls rescue VET prematurely, a retest of the $0.251 seems likely.

VeChain price shows sideways movement in play after hitting a local top recently. Now, VET approaches a critical demand area, which will decide where it is headed next.

VeChain price to remain range-bound

VeChain price surged nearly 50% between April 16 and April 17, which placed it at $0.251. Since this point, VET movement has been restricted to two barriers, $0.251 and $0.202. VeChain price faces a decisive moment as it approaches a demand barrier that extends from $0.222 to $0.237.

A breakdown of this support will result in a 9% drop to the lower range. However, a successful bounce could push it toward the local top.

The Moving Average Convergence Divergence (MACD) indicator exhibits a bearish bias on the 12-hour chart, suggesting a minor crash could be on its way. The MACD line (orange) has slid below the signal line (blue), forming a bearish crossover. Such a move depicts that the short-term bearish momentum is rising, promoting a drop.

Hence, a breakdown of the said demand will result in a retest of $0.205.

VeChain price is known to defy technical indicators and its up-only bull rally for the past three months signifies that. Hence, it should not surprise investors if VET disregards the MACD’s bearish crossover and proceeds to bounce from the demand zone to retest $0.251.

A decisive close above this level might allow VeChain buyers to propel it 12% toward the 161.8% Fibonacci extension level at $0.281 and beyond.

VET/USDT 12-hour chart

Invalidation of the bullish scenario will occur if VeChain price slices below $0.205 and trades there for an extended period. In such a case, a retest of the lower low at $0.173 seems likely.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.