VeChain Price Forecast: VET pattern gives new energy for a test of the all-time high

- VeChain price knocked to the technical ground but closed yesterday with a bullish hammer candlestick pattern.

- Weekly Relative Strength Index (RSI) is still overbought.

- VeChainThor is enabling companies to build high-quality and expandable decentralized projects.

VeChain price mounted a tremendous rebound yesterday, but collective weakness in the cryptocurrency market may lead to some residual selling in VET over the next couple of days. However, the channel’s upper trend line should contain the selling.

VeChain price to retake relative strength leadership

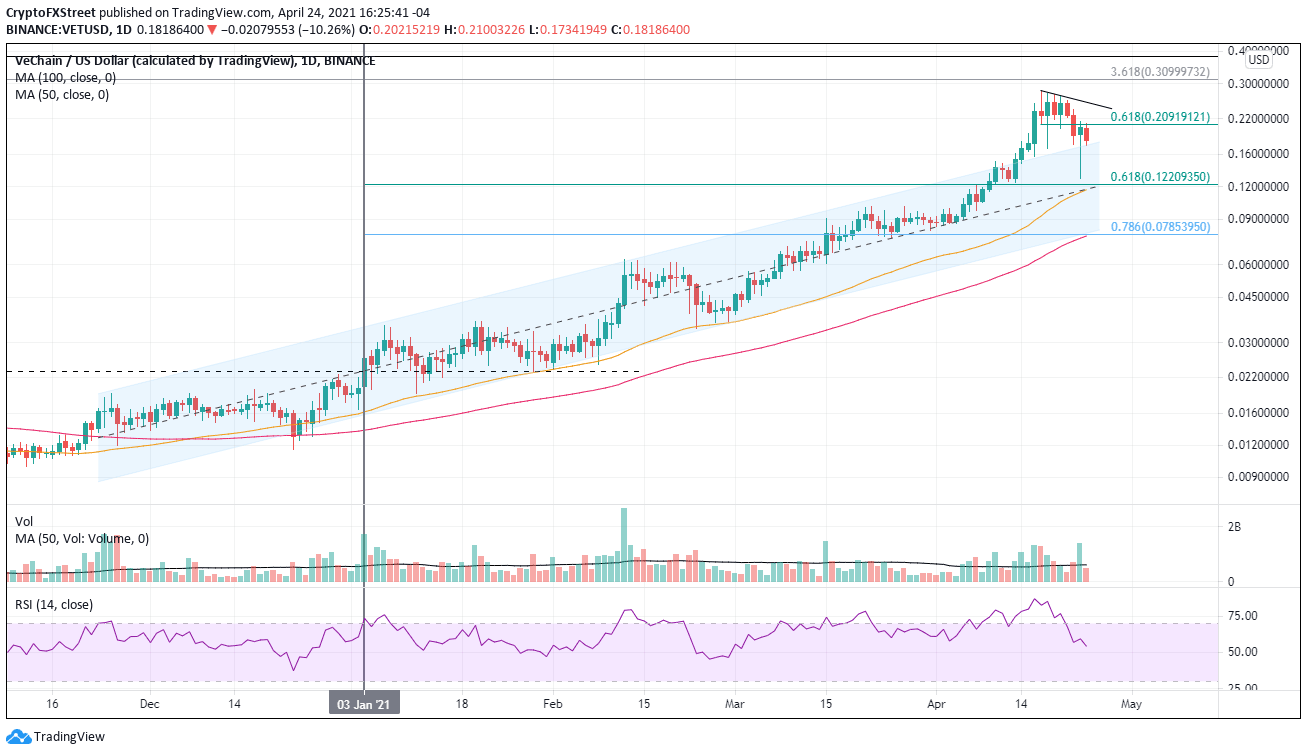

VET advanced in a rising channel from late November 2020 until mid-February before going parabolic earlier this month. The collective sell-off in the market halted the advance, sending VET lower.

The decline culminated in yesterday’s massive bullish hammer candlestick pattern. The low of the day nearly touched the 61.8% Fibonacci retracement of the cup-with-handle pattern breakout on January 3 and was built on the fourth largest daily volume in 2021, raising the odds it was the end of the 50% implosion.

Most major sell-offs experience some residual selling after rebounding, and it is anticipated over the next couple of days. A trade above yesterday’s high at $0.214 will confirm a new VET rally that should carry it to the all-time high of $0.282. Along the way, the digital token will confront some resistance at $0.220 and $0.253.

One caveat to the bullish thesis is the current high readings on the daily and weekly RSI. Flash-like declines never release the overbought conditions that often suffocate sustainable rallies, so a bearish momentum divergence can be anticipated when VET price reaches new highs.

VET/USD daily chart

For the thesis to be invalidated, it would require a complete retracement of yesterday’s rebound, which is highly unlikely considering the daily chart framework.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.