VeChain Price Forecast: VET ready for a rebound after bloody correction

- VeChain price shows signs of recovery after a 32% crash.

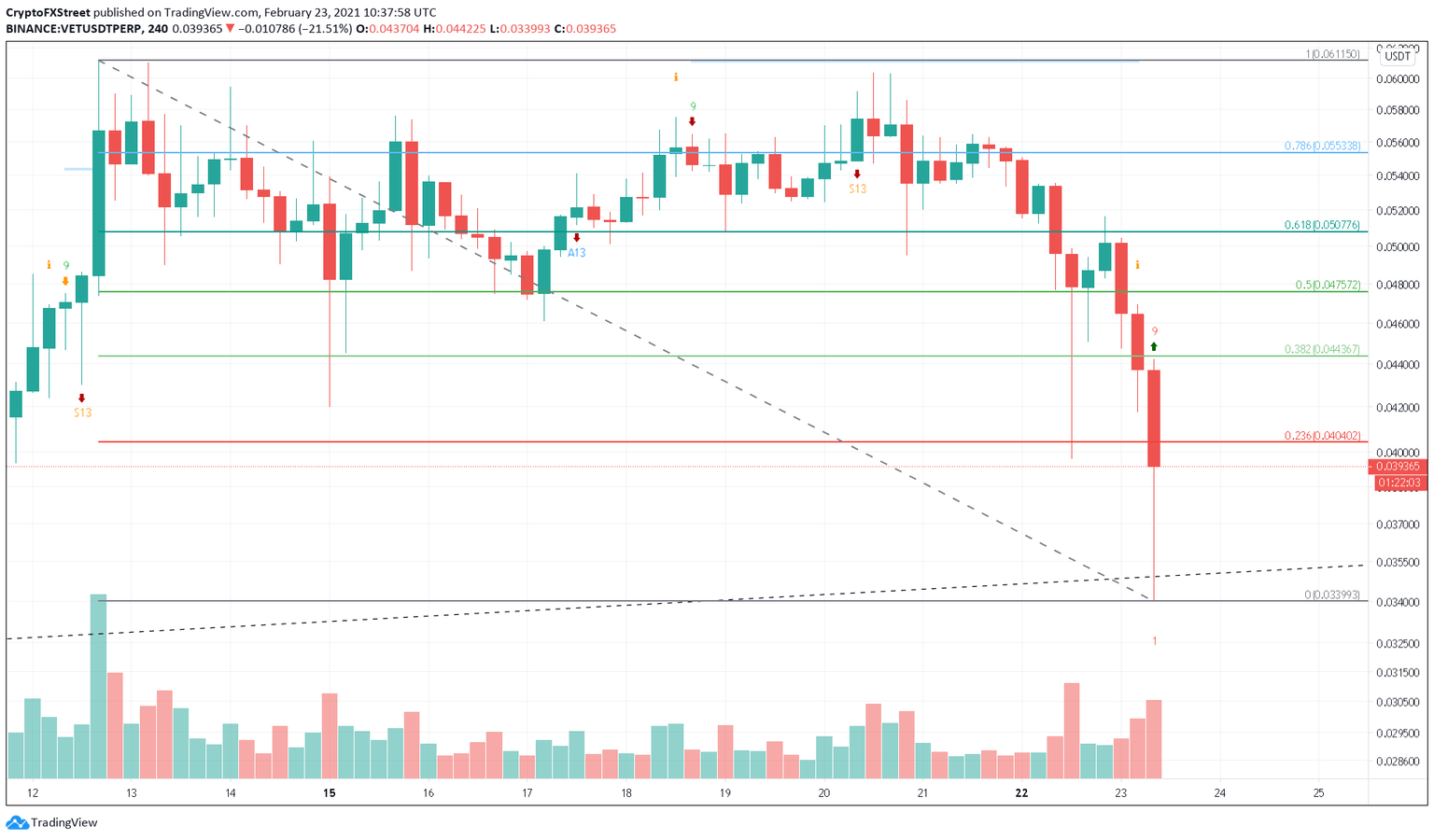

- The Tom DeMark Sequential indicator presented a buy signal on the 4-hour chart.

- A bounce from 23.6% Fibonacci retracement level could push VET by 15% to $0.047.

VeChain price witnessed a brutal 45% sell-off that kicked off on February 12. Although VET crashed as low as $0.033, market participants are aggressively buying the dips.

VeChain price could bounce higher

VeChain price began trending lower after hitting a local top of $0.061 on February 12. However, Tuesday’s trading session sealed VET’s fate as it dropped 32% in less than eight hours to hit a low of $0.033.

Despite the significant losses, the Tom DeMark (TD) Sequential indicator has flashed a buy signal in the form of a red nine candlestick on the 4-hour chart. This setup forecasts a one to four 4-hour candlestick upswing in VeChain price.

So long as VET holds above the 23.6% Fibonacci retracement level at $0.040, the optimistic outlook prevails.

In such a case, buying pressure could snowball, pushing VeChain price towards the 50% Fibonacci retracement level at $0.047, representing a 10% upswing from the current price.

VET/USDT 4-hour chart

Regardless of the buy signal, if VeChain price fails to stay above $0.040, sellers could drag it down by 15% to revisit the recent low of $0.033.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.