VeChain Price Forecast: VET moves closer to a 45% breakout

- VeChain price slid a consolidation period after surging nearly 85%.

- Now, VET faces stiff resistance at $0.053 that will determine where it will be heading next.

- Slicing through this critical barrier will push this altcoin’s market value by 45%, while failing to do so could lead to a 20% correction.

VeChain price seems ready for another leg up after a five-day-long consolidation period.

VeChain price prepares for new all-time highs

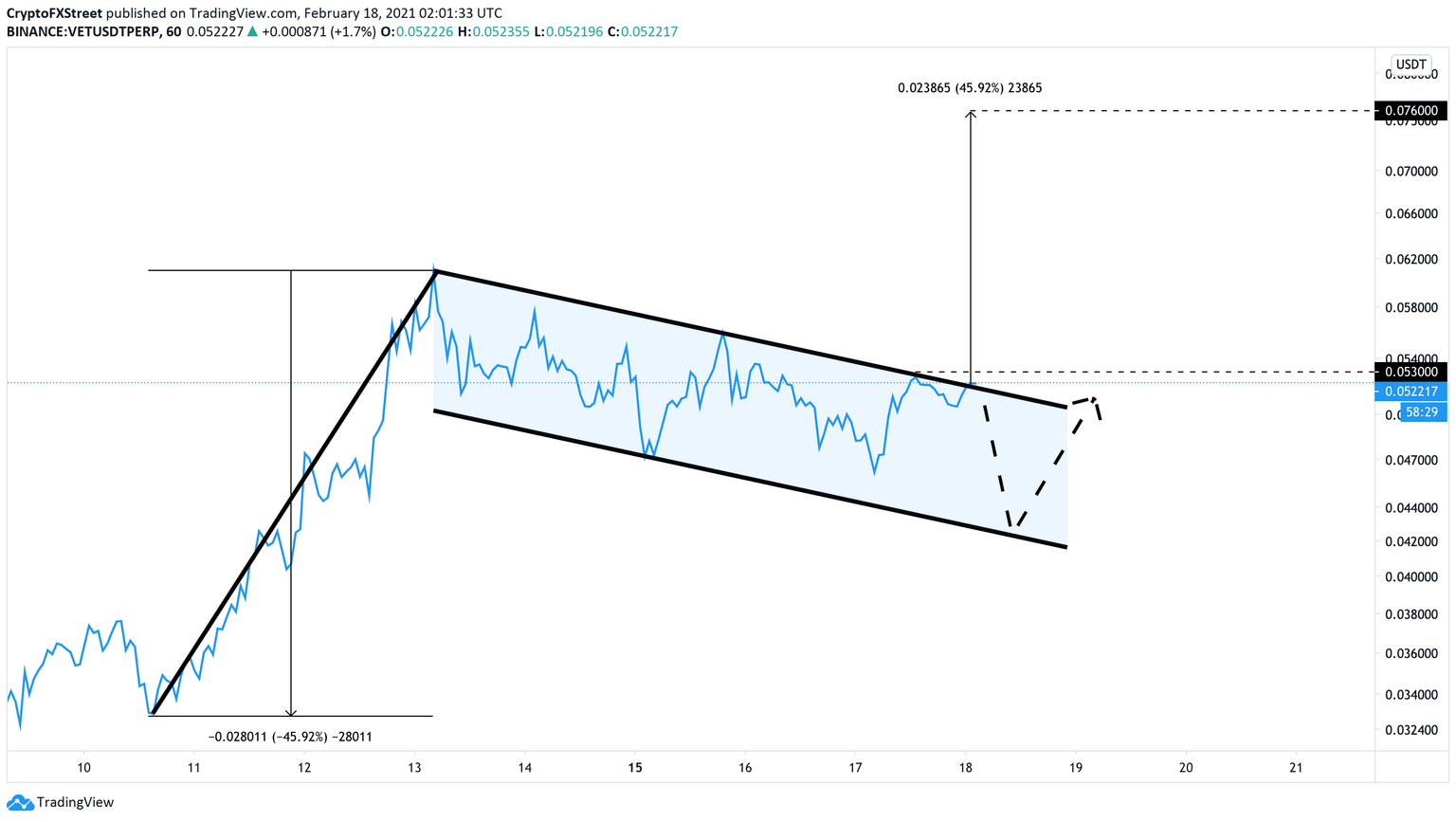

VeChain price dipped into consolidation after a brief but explosive rally. Such market behavior appears to have formed a bull flag pattern on VET’s hourly chart.

The 85% upswing that VeChain price saw between February 10 and February 13 created the “flag pole” of this continuation pattern. The series of lower highs and lower lows that followed created the “flag.”

The technical formation stipulates that slicing through the $0.053 resistance will lead to a 45% breakout. If validated, VeChain price will target $0.076.

This target is determined by measuring the flagpole’s length and adding that distance upward from the breakout point.

VET/USDT 1-hour chart

It is worth noting that if VeChain price fails to close above the flag’s upper trendline at $0.053, a rejection will likely follow.

Under such circumstances, VET could take a 20% nosedive towards the $0.042 support level before it tries to break out again.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.