VanEck to launch BNB ETF with staking feature for US investors

- Asset manager VanEck has filed with the US SEC to list the first US-traded ETF tracking BNB, Binance's native token.

- The registration statement indicates the BNB ETF may include a staking feature, allowing corporate investors to earn additional yield.

- BNB price remains subdued under $600, with 1% gains, as the SEC recently postponed decisions on altcoin ETFs until June.

VanEck has filed to launch the first US ETF tracking Binance Coin (BNB), potentially offering staking rewards to investors.

VanEck files for first US-traded ETF tracking Binance’s BNB token

VanEck, the $116.3 billion asset manager, has filed with the US Securities and Exchange Commission (SEC) to launch the first American-listed exchange-traded fund (ETF) directly tracking Binance Coin (BNB), the native token of the BNB Chain.

If approved, the VanEck BNB ETF would provide institutional and retail investors with direct exposure to BNB’s price performance through a regulated product.

The filing, submitted on May 2 under Form S-1, represents the latest addition to VanEck’s expanding crypto ETF portfolio, which already includes products tied to Bitcoin, Ethereum, Solana and Avalanche.

VanEck also registered a Delaware trust for the ETF in April, laying the legal groundwork for what could become the first US-based BNB fund.

The proposed ETF’s ticker has not yet been disclosed. However, the move could further legitimize BNB in US markets, where Binance itself faces regulatory scrutiny and limited dominance in local spot crypto trading.

VanEck’s BNB ETF fund may offer staking yield to corporate investors

Notably, VanEck’s prospectus reveals that the BNB ETF could integrate staking functionality, allowing investors to earn yield on their BNB holdings, subject to exchange and SEC approval. The firm indicated that staking services may be provided through trusted third-party validators or possibly through VanEck-affiliated entities.

VanEck Binance Coin (BNB) Filing Prospectus | Source: SEC.gov

If authorized, the staking feature would mark a first among US-listed ETFs, introducing an income-generating mechanism to a traditionally passive investment vehicle.

BNB staking currently supports various applications across the BNB Chain, such as network validation and DeFi services, offering annual yields that appeal to long-term holders.

Incorporating staking into the ETF would significantly differentiate it from Bitcoin and Ethereum spot ETFs, which do not yet offer native yield options in the US market.

It may also appeal to institutional investors seeking blockchain exposure with yield-enhanced structures.

However, the US SEC’s stance on staking in registered investment products remains under skepticism.

The agency had previously targeted similar features in other projects under securities law interpretations, making regulatory approval of the BNB ETF staking feature far from certain.

BNB price struggles under $600 resistance as SEC delays trigger skepticism

BNB, currently the fifth-largest cryptocurrency by market cap, has shown limited price reaction following the ETF filing.

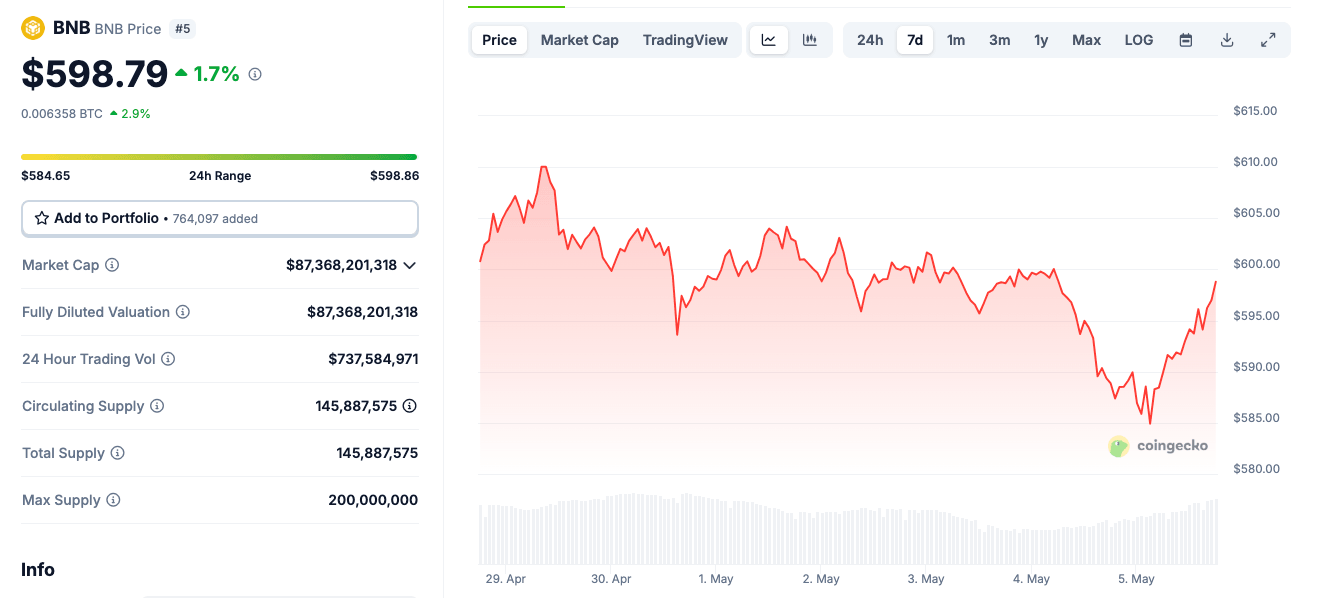

At press time on Monday, BNB trades around $598.79, up 1.7% on the day, with its 24-hour range between $584.65 and $598.86, according to Coingecko data.

On the weekly chart, BNB remains largely flat, gaining just 0.3% in the past seven days.

BNB price action, May 5, 2025 | Source: Coingecko

The subdued market response likely reflects broader uncertainty around altcoin ETFs, with the SEC recently delaying decisions on multiple filings until June 17.

BNB powers transactions and smart contracts on the BNB Chain and is widely used across the Binance ecosystem.

With ETF interest now expanding beyond Bitcoin and Ethereum, BNB’s inclusion in a regulated fund could improve liquidity and broaden its appeal among US investors.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.