Uniswap price tries to catch up with SushiSwap, but it must slice through massive supply barrier first

- Uniswap must break the resistance at $6.5 to confirm further price action to $7.5.

- SushiSwap brings down two barriers at $4.8 and $5 but must rise above the channel’s upper boundary to continue the uptrend.

Uniswap is up a whopping 15% in the last 24 hours. The decentralized finance (DeFi) token is eager to perform as well as it did in 2020, as reported. UNI is trading at $6.3 at the time of writing amid the push to break above $6.5 to validate price action to higher levels.

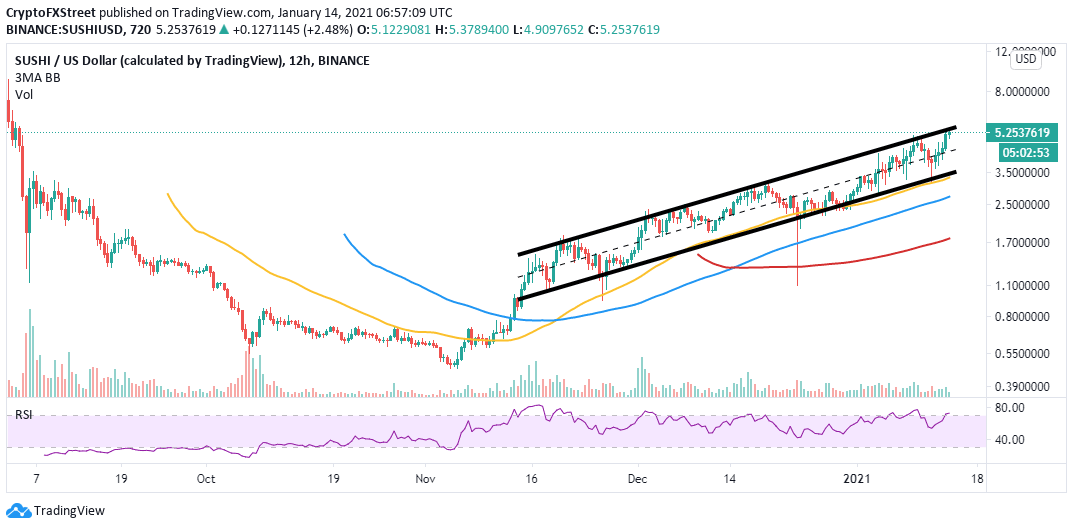

SushiSwap, on the other hand, has rallied over 17% in the same period and 35% over the last seven days. After closing the day above $4.8, the move paved the way for price action beyond $5. At writing, SUSHI is teetering at $5.2 amid the push to achieve higher highs in the short term.

Uniswap bulls target a breakout to $7.5

UNI is settling above $6 after bringing down the resistance at the 50 Simple Moving Average. However, to confirm the bullish action towards $7.5, the price must break the hurdle at $6.5. The Relative Strength Index highlights a possible sideways trend before the price action continues north.

UNI/USD 4-hour chart

The bullish outlook can also be validated by the network growth, as seen on Santiment. The number of newly-created addresses has started to rise, reflecting the increase in price over the last 24 hours. The recovery comes after a dip to 1,185 on January 12. At the moment, the number of new addresses joining the network is at 1,351.

Uniswap network growth

On the bearish side, one can bring the argument that Uniswap is likely to confirm a subtle double-top pattern as seen on the 4-hour chart. This pattern is quite bearish and signifies a possible reversal. In that case, UNI could correct towards the 50 SMA and the 100 SMA, respectively.

SushiSwap prepares for another liftoff

SushiSwap price is rallying within an ascending parallel channel, as was recently discussed. The middle boundary played a crucial role in the recovery above the former resistance at $4.8 and $5. Meanwhile, a break above the channel’s upper limit will leave SUSHI with open air for exploration. If enough buying pressure is created, UNI may extend the price action to test $8.

SUSHI/USD 4-hour chart

Simultaneously, a spike in SushiSwap’s network growth is a bullish signal. Like Uniswap, SUSHI’s number of new addresses fell on January 12 to 262 from the monthly peak of 554. Nonetheless, a recovery is underway with the newly created addresses at 427 at the time of writing.

The network growth metric illustrates user adoption over some time. It can also identify periods when the network and the token are gaining or losing traction.

SushiSwap network growth

On the other hand, a rejection at the channel’s upper boundary will see SUSHI abandon the journey towards $8 and perhaps breakdown to retest the middle barrier support. If selling activities surge, SushiSwap may extend the bearish leg to the 50 SMA, close to the lower edge of the channel.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B09.48.19%2C%252014%2520Jan%2C%25202021%5D-637462056247043790.png&w=1536&q=95)

%2520%5B10.02.55%2C%252014%2520Jan%2C%25202021%5D-637462056005475989.png&w=1536&q=95)