Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC bears to go extinct beyond $53,000

- Bitcoin price looks overextended as it grapples with the 50-day SMA and the weekly resistance barrier at $42,816.

- Ethereum price pierces through the bearish breaker and approaches the 50-day SMA at $3,242.

- Ripple price approaches the $0.757 to $0.807 supply zone that could cut the uptrend short.

Bitcoin price has seen tremendous gains over the past three days as it attempts to overcome a massive hurdle. While altcoins like Ethereum and Ripple have corresponded to this bullishness, investors need to exercise caution with fresh investments as a retracement could be around the corner.

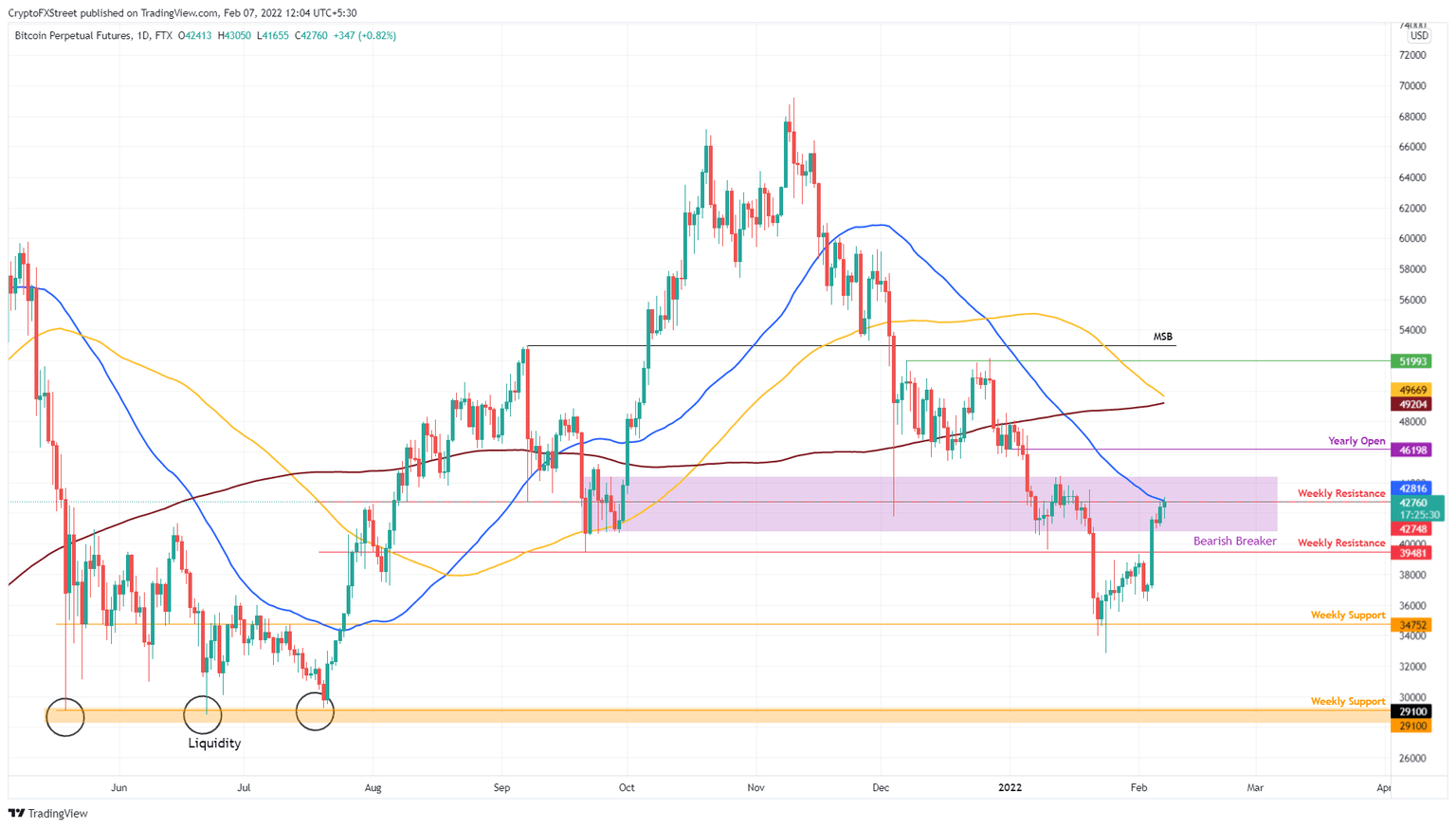

Bitcoin price faces a decisive moment

Bitcoin price has risen 18% over the past four days and is currently hovering below the 50-day Simple Moving Average (SMA) and the weekly resistance barrier confluence at $42,816. If this uptrend is a bull trap, BTC is likely to see rejection followed by a retracement to the immediate support level at $39,481.

A breakdown of the said barrier will knock the big crypto down to $34,752. In an extremely bearish case, Bitcoin price could revisit the $30,000 psychological barrier and collect the liquidity resting below it.

BTC/USD 1-day chart

If BTC produces a daily candlestick close above the breaker’s upper limit at $44,387, however, it will invalidate the bearish thesis. While this development will alleviate the sell-side pressure, it does not mean that Bitcoin price has flipped bullish.

A daily candlestick close above $52,000 will produce a higher high and suggest the possible start of an uptrend.

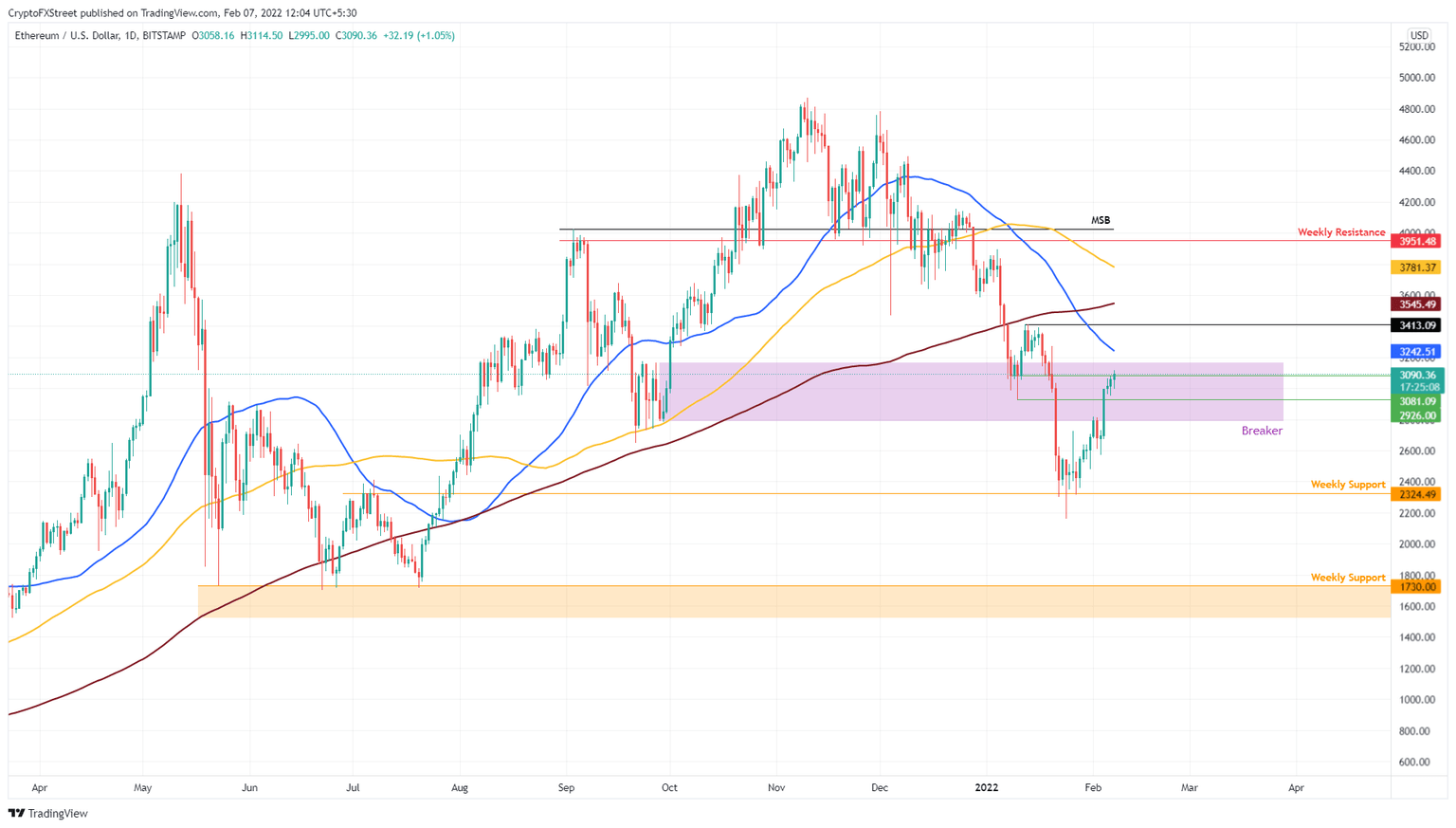

Ethereum price slithers close to bearish thesis invalidation

Ethereum price has followed the big crypto and pierced the bearish breaker, ranging from $2,789 to $3,167. Any further bullish momentum will push ETH to climb higher and retest the 50-day SMA at $3,242.

Assuming BTC retraces, investors can expect Ethereum price to face rejection at $3,242, leading to a 25% pullback to the weekly support level at $2,324.

In a highly bearish case, Ethereum price could revisit the $1,730 weekly support level and collect the sell-side liquidity resting below it.

ETH/USD 1-day chart

Regardless of the bearish outlook, the Ethereum price can invalidate the short-term bearish outlook if it produces a daily candlestick close above the $3,167 resistance zone. A bullish scenario could be kick-started, however, if buyers push ETH to produce a swing high at $3,413.

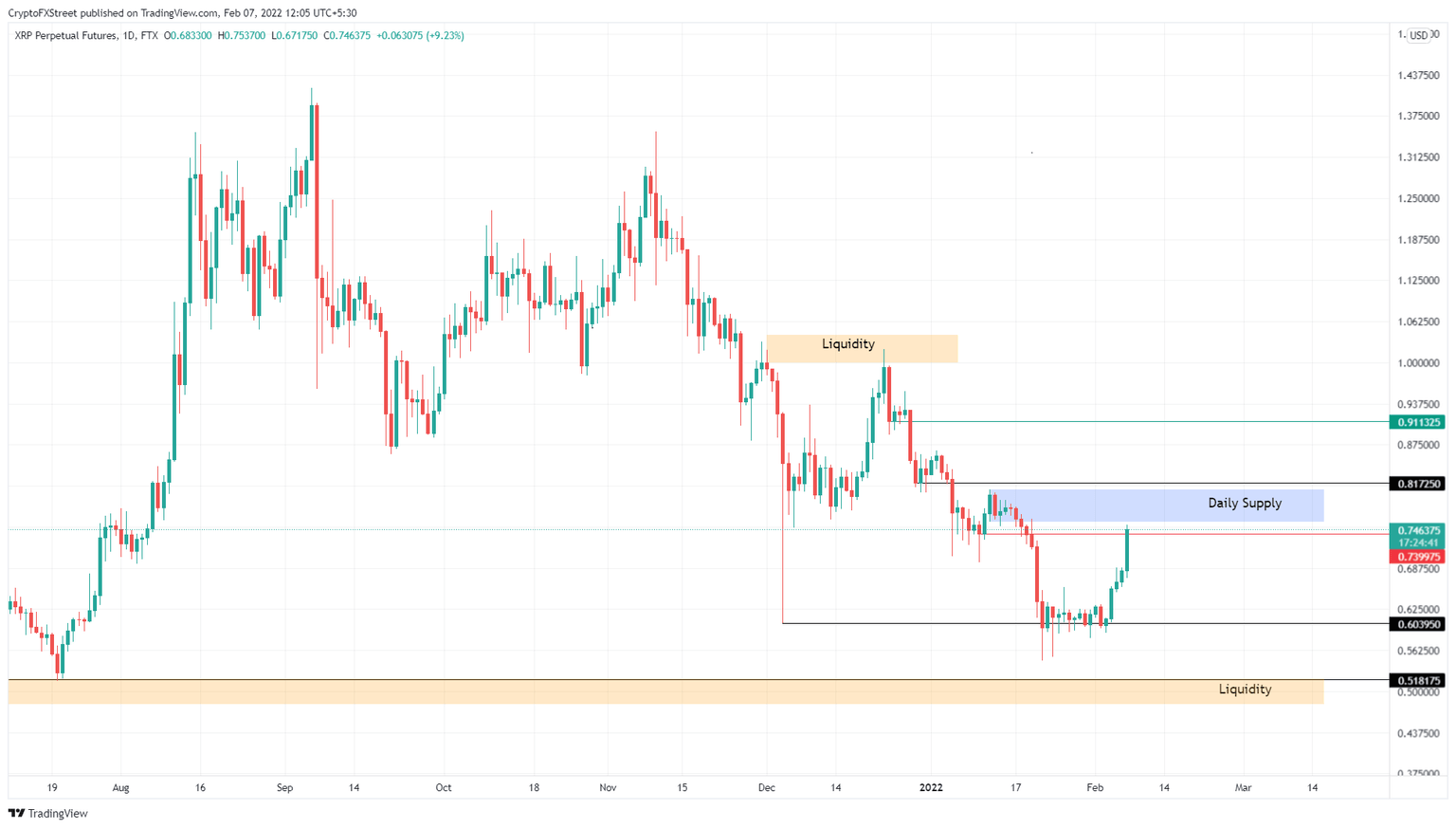

Ripple price faces a blockade

Ripple price broke out of its consolidation and rallied 25% from $0.604 to $0.754. This impressive move is currently retesting the weekly resistance barrier at $0.740, which rests below another hurdle that extends from $0.757 to $0.807.

Rejection at this multi-resistance zone seems likely considering the situation in which Bitcoin is in, and investors can expect the Ripple price to retrace 16%, returning to the consolidation zone at $0.628.

XRP/USD 1-day chart

A daily candlestick close above the supply zone’s upper limit at $0.807 will signal a resurgence of buyers and indicate their willingness to move higher. In this case, Ripple price could set up a higher high by rallying 12% to $0.911.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.