Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bitcoin on retreat, XRP is a train wreck

- Bitcoin settled below $27,000 as bulls hit the pause button.

- Ethereum retreated from the recent high of $750 but stayed above $700.

- Ripple's XRP crashed to $0.22 as Coinbase suspends XRP trading.

The cryptocurrency market has calmed down after a roller-coaster weekend. Bitcoins slipped below $27,000 and retested $25,800 during early Asian hours. The pioneer digital asset has started a correction from overbought territory, though it is still in a green zone both on a weekly basis. ETH settled above $700, while XRP crashed to $0.22 as Coinbase announced the decision to suspend XRP trading. Other altcoins out of the top-50 are directionless.

The total capitalization of all digital assets in circulation settled at $715 billion, while an average daily trading volume came close to $210 billion. Bitcoin's market dominance is over 69% from 71% registered during the weekend. As FXStreet previously reported, the market may be ready for an altcoin season.

Bitcoin is ripe for a healthy correction

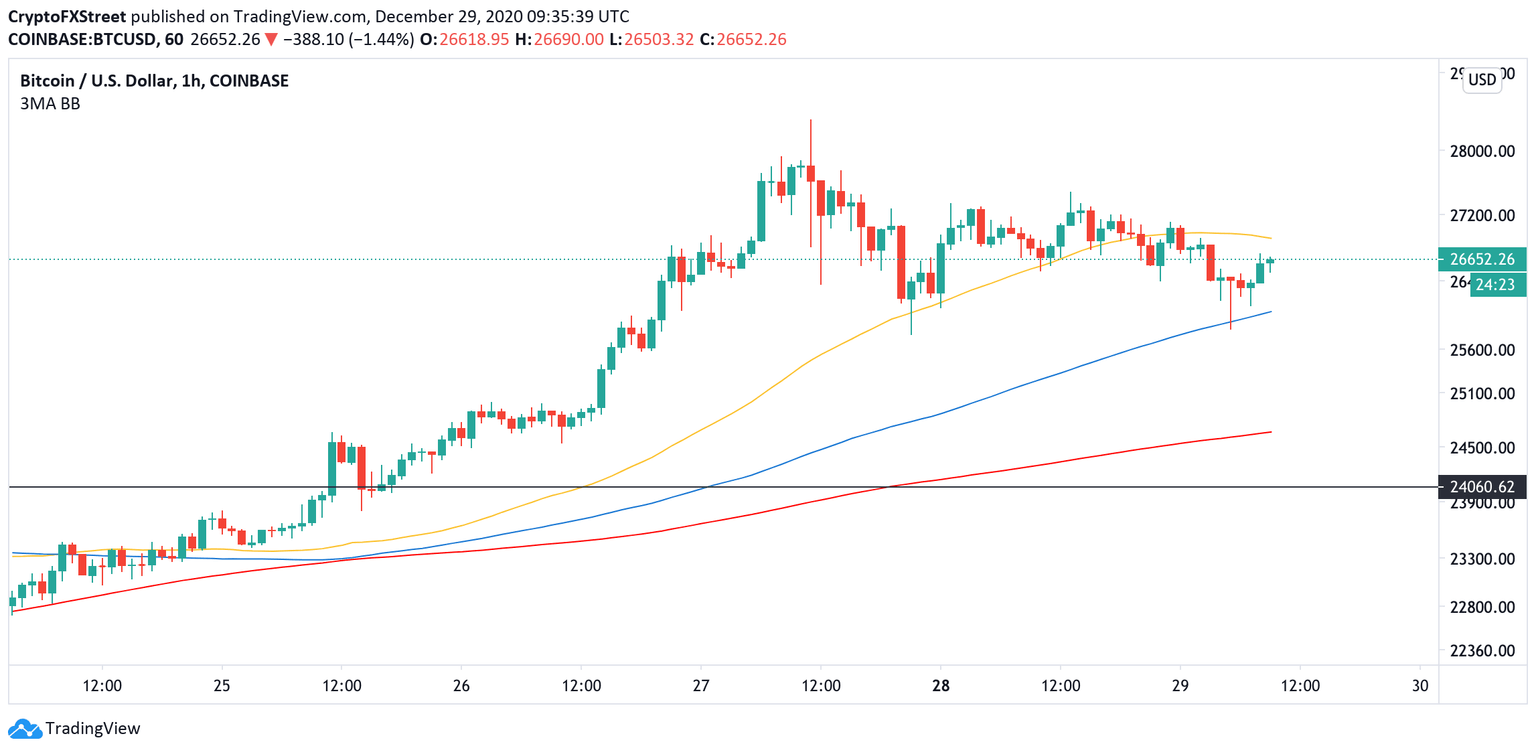

Bitcoin extended the decline from an all-time high on Monday. The coin dropped to $25,800 during early Asian hours; however, a strong buying interest pushed the price back above $26,00. By the time of writing, BTC has recovered to $26,600, though it is still vulnerable to the sell-off.

Bitcoin has slowed down the downside correction. However, a sustainable move above $27,000 is needed to mitigate the bearish pressure and bring the recovery back on track. Otherwise, the sell-off may be extended towards the local barrier of $26,000 reinforced by 1-hour EMA100. Once it is out of the way, $24,500 (1-hour EMA200 and 4-hour EMA50).

BTC, 1-hour chart

On the upside, once $27,000 strengthened by 1-hour EMA50 is out of the way, BTC recovery will gain traction with the next bullish target at the psychological $28,000, followed by the all-time high of $28,250.

A sustainable move above this area will take BTC on uncharted territory with the next primary target at $30,000.

BTC, In/Out of the Money Around Price (IOMAP)

Meanwhile, In/Out of the Money Around Price (IOMAP) data confirms that the price sits on top of a significant support area. Over 440,000 addresses purchased 313,000 BTC from $23,300 to $24,000. This area has the potential to absorb the bearish pressure and trigger another bullish wave that will take the price above $27,000.

ETH faces a brick wall

ETH bulls stumbled at a critical resistance area of $747 created by 0.5 Fibo retracement level for the downside move from January 201 high to December 2018 low. The second-largest asset retreated from the recent high and touched $688 during early Asian hours on Tuesday. By the time of writing, the price regained ground above $700, though it is still nearly 2% lower on a day-to-day basis.

On the intraday charts, ETH is supported by 1-hour EMA50, currently $700. The trend remains bullish as long as the price stays above this area. If it is broken, the sell-off will likely gain traction with the next focus on $660 reinforced by December 27 low and 1-hour EMA100.

ETH, 1-hour chart

On the upside, a sustainable move above $750 is needed for the upside to gain traction. Once it is out of the way, ETH is poised to retest the resistance of $800.

Rockbottom has a basement for Ripple

XRP's sell-off sped up on Tuesday as cryptocurrency exchanges continued delisting the coin. The latest blow came from Coinbase. The largest US-based cryptocurrency exchange introduced limitations on XRP trading, which will be fully suspended on January 19, 2021.

At the time of writing, XRP is changing hands at $0.218, down over 23% on a day-to-day basis and 50% on a weekly basis.

From the technical point of view, the price broke below the weekly EMA50 and came close to the former channel support that limited XRP's decline since the end of July. If it gives way XRP will extend the decline to the psychological $0.2 and $0.175.

XRP, daily chart

This resistance needs to be cleared to improve the short-term technical picture. The critical bullish target is $0.45. A sustainable move above this area will mitigate the bearish pressure and bring the recovery back on track with the next focus on psychological $0.5 and $0.61.

On the upside, the local barrier is created by the psychological $0.3. This resistance is reinforced by daily EMA200. Once it is out of the way, the upside is likely to gain traction with the next focus on $0.35 (daily EMA100).

Author

Tanya Abrosimova

Independent Analyst

%252029-637448349371494338.png&w=1536&q=95)