Altseason to kick off in Q1 2021; here's what to buy

- Altseason is about to start in the first quarter of 2021.

- Ethereum, Litecion, and Zilliqa are the potential growth candidates.

Bitcoin outperformed the market in 2020. The pioneer digital coin gained over 300% since the beginning of the year and hit a new all-time high at $28,250 on December 27. Currently, it's a totally Bitcoin season. However, the situation may change in 2021 as traders and investors will start looking around for new opportunities and undervalued assets with strong growth potential.

In other words, 2021 may become a year of altcoins. The phenomena often referred to as altseason is a part of the cryptocurrency market cycle. Many altcoins start snowballing both against USD and BTC. The previous altseason was registered in late December 2017 - January 2018, when Bitcoin already started the correction from the record levels, while altcoins were still moving within a strong bullish trend.

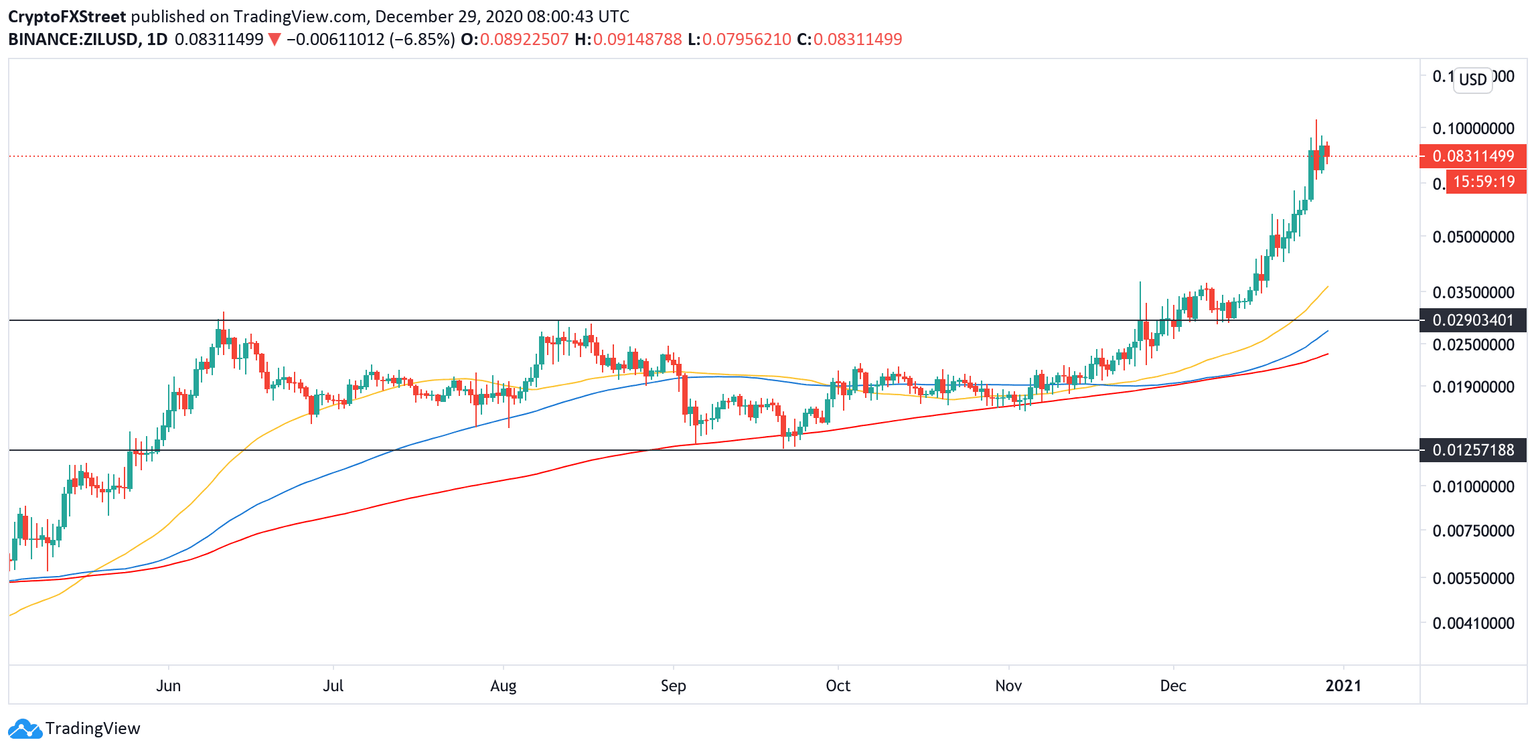

Since that time, altcoins attempted to launch a sustainable uptrend on several occasions but failed to succeed, according to the Altseason Index created by blockchaincenter.net.

Altseason Index

Below are the top three altcoins that look promising and may lead the rally in the first quarter of 2021.

Ethereum is the first candidate to drive altseason

Ethereum (ETH) is the most obvious candidate for a growth leader in 2021. The second-largest digital asset gained over 450% to become one of the best performing digital assets out of the top-10.

Despite the impressive price increase, ETH is still twice cheaper from its all-time high, reached in January 2018 at $1,500. Strong fundamentals and increased interest from institutional investors are likely to unleash ETH's bullish potential and drive the price higher in 2021.

A smooth transition to Ethereum 2.0 and piling real-life use cases for the Ethereum blockchain will attract capital flows to the asset. As FXStreet previously reported, ETH is more than just a unit of payment or a store of value; it is an ecosystem with endless innovation possibilities.

In 2021 institutional investors will start discovering ETH as a long-term investment opportunity beyond the speculative cycle. The trend has already begun, as Grayscale reports the growing interest in its Ethereum Trust from first-time cryptocurrency investors.

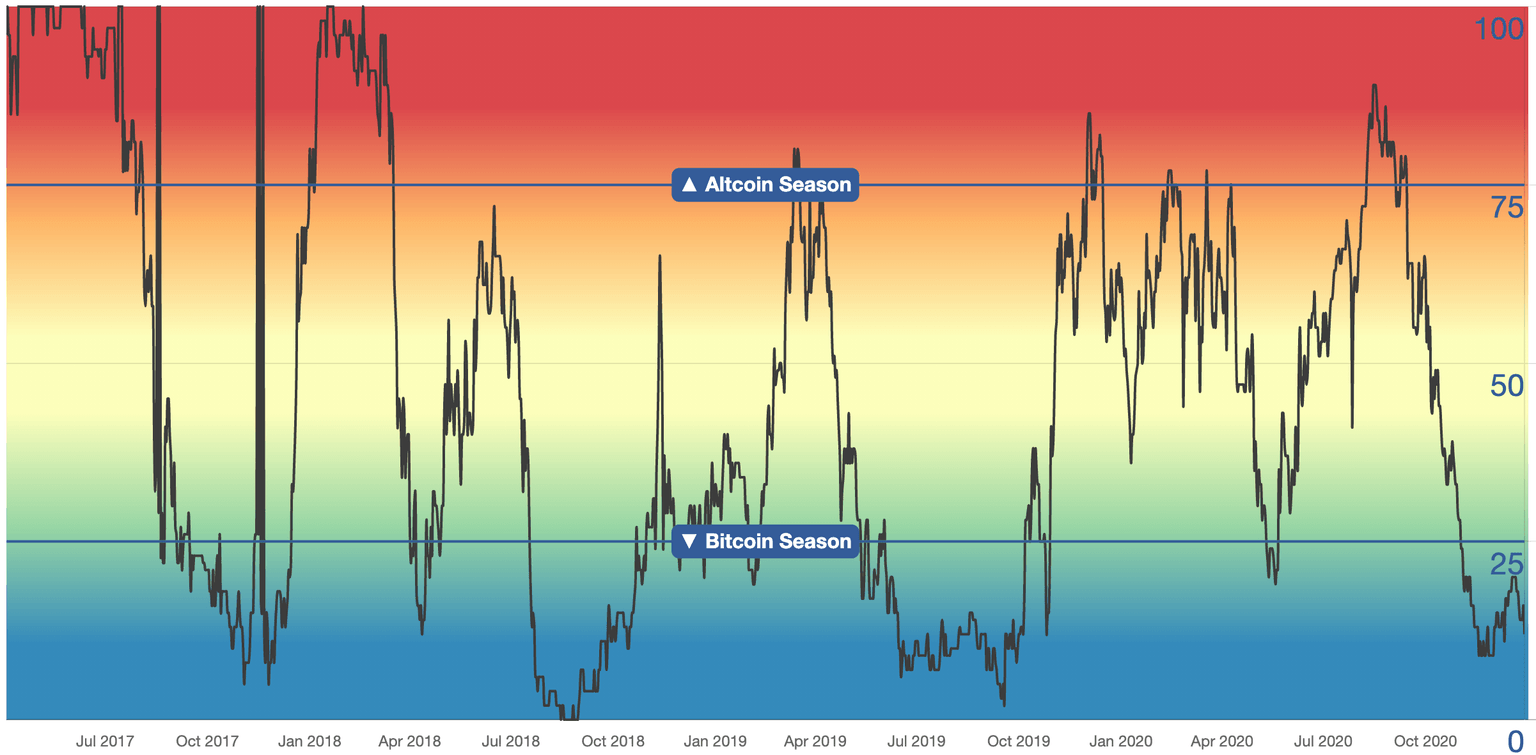

From the technical point of view, ETH is poised to retest the resistance of $800. This barrier is created by 0.5 Fibo retracement for the downside move from January 2018 high to December 2018 low. Also, it coincides with the area that limited ETH recovery attempt in April 2018 and triggered a massive sell-off towards the all-time low of $79.

ETH, weekly chart

Once this barrier is out of the way, the upside momentum will gain traction with the next stop at $950 (0.618 Fibo retracement) and psychological $1,000.

Meanwhile, In/Out of the Money Around Price (IOMAP) data confirms that there are virtually no significant barriers up until $800. On the other hand, the first minor support comes on approach to $700. IOMAP shows that over 400,000 addresses purchased $900,000 ETH around that level. If it is broken, the downside correction may be extended towards $640 as 470,000 addresses previously purchased over 7 million coins from $620 to $640.

ETH, In/Out of the Money Around Price (IOMAP)

Litecoin aims at $1,400

Litecoin (LTC) is another strong candidate for a massive rally in 2021. At the time of writing, LTC is changing hands at $126. The coin has gained over 200% since the start of the year and returned to the fifth position in the global cryptocurrency market rating. With the current market capitalization of $8 billion, it threatens to oust XRP from fourth place.

From the technical point of view, Litecoin broke up from a symmetrical triangle pattern on a weekly chart. This formation is characterized by two converging trend lines with a roughly equal slope. It often occurs during a consolidation phase, while the direction of the breakthrough defines the further momentum of the asset.

LTC, weekly chart

An estimated bullish target is equal to the distance between the initial high and low, meaning that LTC is poised for an impressive 1,800% rally with the target at $1,400. The bullish forecast will be invalidated in the price breaks below $74, the upper line of the triangle formation.

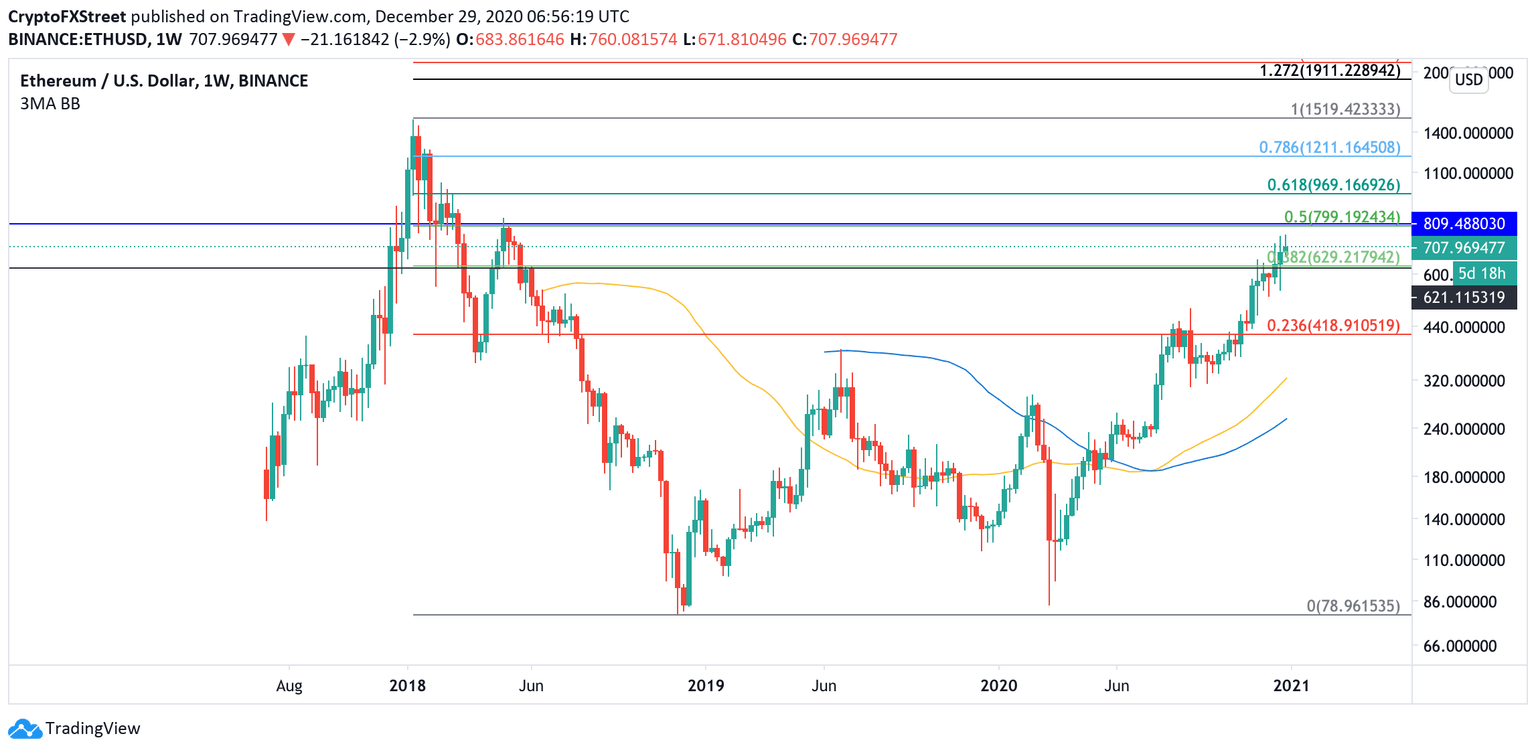

Zilliqa is ready for an explosion

Zilliqa is the 33d largest digital asset with a current market capitalization of $890 million. The coin jumped by nearly 70% in the past seven days and gained over 1,900% since the beginning of the year. ZIL tested the psychological level of $0.1 on December 27 before the correction started.

While the asset looks overbought and vulnerable to the downside correction, the long-term perspectives are still bullish. According to a famous crypto strategist and trader, Michaël van de Poppe, ZIl will experience a pullback before it shoots to the moon and hits a new all-time high above $0.23.

#Zilliqa reached the second target zone for this impulse wave.

— Michaël van de Poppe (@CryptoMichNL) December 26, 2020

A run of 300%+ and a very bullish outlook for this one for 2021.

Points of interest: $0.035 and $0.048.

The next impulse wave will most likely bring a new ATH for this one. pic.twitter.com/Rt024cURcF

The upside momentum stays intact as long as the price is above $0.03. This area served as resistance in summer and was verified as a support at the beginning of December.

ZIL, daily chart

If this critical barrier gives way, the bullish scenario will be invalidated, while ZIL will extend the sell-off towards $0.01.

Author

Tanya Abrosimova

Independent Analyst

%2520-637448255841939194.png&w=1536&q=95)