Three reasons why Bitcoin is on shaky ground after failing to retake $60K

Bitcoin (BTC) is back testing lower levels after failing to conquer $60,000 resistance — and indicators suggest the downturn is not over.

BTC/USD bounced off $55,000 overnight on Monday, hours after hitting local highs of nearly $59,000 in bullish early trading.

With sellers still in place closer to all-time highs of $64,500, the largest cryptocurrency has a lot of work to do to exit its current broad trading range.

BTC moves back to exchanges

One metric which may soon be causing problems for bulls is the overall BTC balance on cryptocurrency exchanges.

While seeing a general steep downtrend throughout the past year, local spikes in supply — when traders send coins back to their exchange accounts for potential quick sale — tends to reflect a more selling-driven mentality entering.

This is not the case for every exchange this week. According to data from monitoring resource Bybt, 16,222 BTC has entered global leader Binance in the past seven days. By contrast, institutional platform Coinbase Pro has actually lost 11,947 BTC, conforming to the overall trend.

Yet Binance is not alone — Okex, Huobi, Bitfinex and Kraken have all seen their BTC balances tick up in the last 24 hours.

The greed is rising

As Cointelegraph reported, a familiar face from sentiment changes past is back this week — greed.

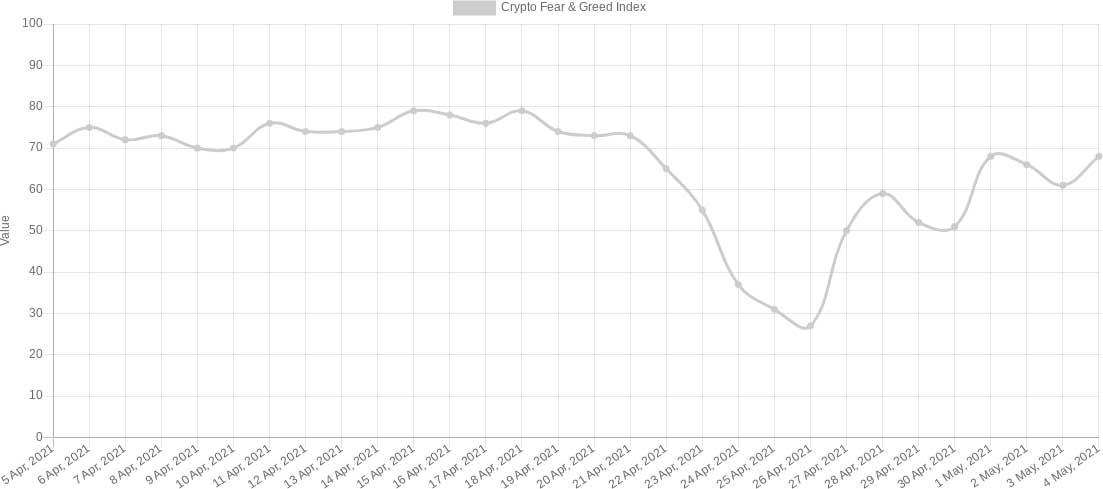

Tracked by the Crypto Fear & Greed Index, which measures trader sentiment using a basket of weighted factors, appetite for a sell-off is rising, even as price action is no longer positive.

On Tuesday, the Index gave an overall crypto market score of 68/100, corresponding to “greed” being the overall mood driver.

Crypto Fear & Greed Index. Source: Alternative.me

This is still below its mid-90s peak seen earlier in the year — a level which almost guarantees a sell-off — but volatility ensures that the Index does not stay in the same zone for long. “Greed” can turn to “extreme greed” or “extreme fear” within days or even faster.

On April 27, for instance, the Index measured just 27/100.

Dogecoin adds to altcoins’ Bitcoin pressure

Last but not least is perhaps the most conspicuous factor at play when it comes to problems for Bitcoin this week: altcoins.

At first, it was Ether (ETH), which led the pack and outshined Bitcoin with its trip above $3,000 to all-time highs on Monday.

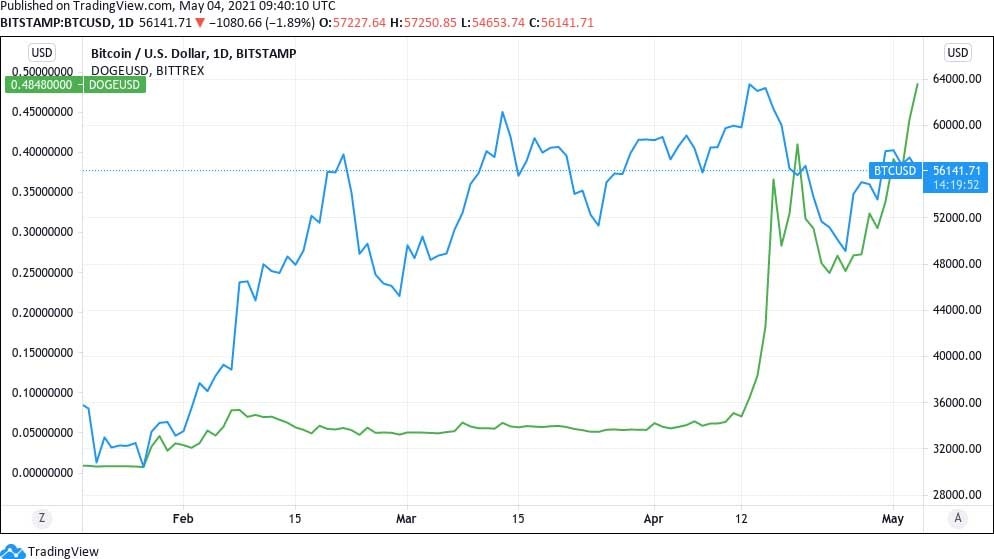

Now, however, Dogecoin (DOGE) is leaving the rest in its dust, back above $0.47 after getting integrated on popular trading platform eToro.

DOGE/USD was up 72% in a week compared with Bitcoin’s 3% at the time of writing.

BTC/USD vs. DOGE/USD line chart. Source: Tradingview

While altcoin surges come in bouts, the mood among analysts is increasingly one of a longer-term trend taking center stage before Bitcoin can claw back lost time — and market dominance.

As Cointelegraph reported, one indicator even suggests that the combined altcoin market cap could explode by more than 27,000% by the start of 2022.

“The next 2-3 months are going to be epic for alt coins,” the popular Twitter trader known as Johnny summarized to followers, also forecasting a near-term price target of $5,000 for Ethereum.

Bitcoin’s market share is currently 46.3%, falling ever lower thanks to altcoin inflows.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.