Three reasons Bitcoin fell 6% in 4 hours — Is the BTC price rally at risk?

The price of Bitcoin (BTC) abruptly fell by nearly 6% in less than four hours as the new weekly candle opened on March 15.

Three factors contributed to the weakening momentum of Bitcoin, namely a new weekly open, high funding rates, and stablecoin inflows primarily driving the market upward.

New weekly candle and a reset pullback

When a new weekly candle opens, Bitcoin typically sees large volatility because the trend on Monday could dictate how Bitcoin might perform throughout the rest of the week.

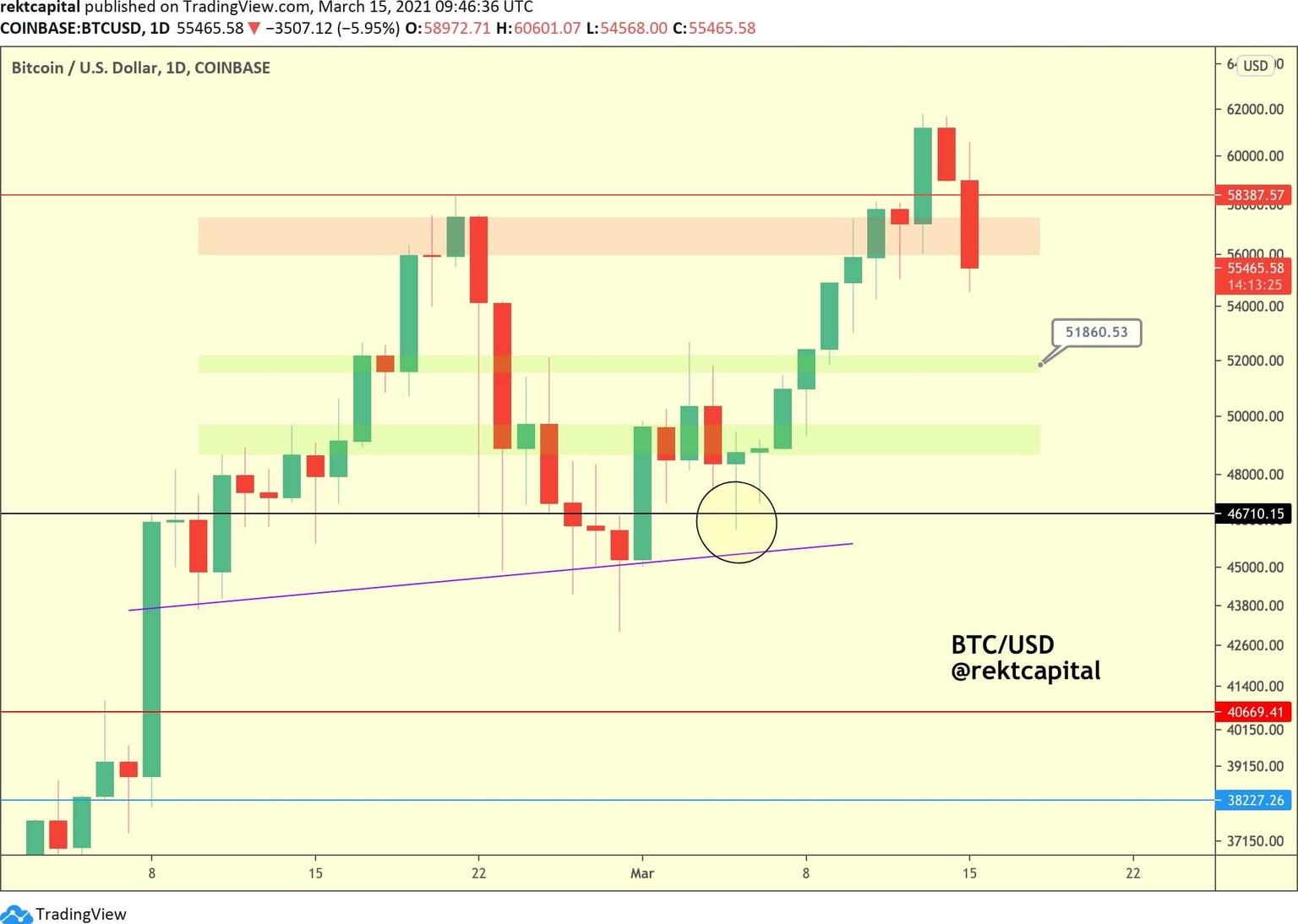

BTC/USD 1-day chart with key levels. Source: Tradingview.com, Rekt Capital

In the last few hours, as the pseudonymous trader "Rekt Capital" noted, Bitcoin saw an overextended pullback. As a result, the trader said BTC could be in the process of seeing a "volatile reset." The trader said:

"BTC has pulled back towards the red area and even overextending below it - for now The day is still young so price could still resolve itself relative to this red boxed area and turn it into support Technically, $BTC is in the process of a volatile retest."

If Bitcoin fails to rebound from the $55,000 area, the trader warned that a steep correction to the $46,700 support level becomes a possibility.

Futures market was very overheated

When the price of Bitcoin began to drop, the futures market funding rate of BTC was hovering above 0.1% across major exchanges.

This indicates that the overwhelming majority of the market was longing or buying Bitcoin, making it an overcrowded trade.

BTC long/short liquidations. Source: Bybt.com

According to data from Bybt.com, 194,541 traders were liquidated in the past 24 hours for a total of roughly $1.83 billion, the highest since Feb. 21. The futures market saw cascading liquidations as the market was extremely overheated.

This wave of liquidations eventually led Bitcoin to drop below $57,000, which Cointelegraph Markets analyst, Michael van de Poppe, identified as a key support level. He said:

"Bitcoin barely holding on to this critical level here. Needed for upwards continuation, otherwise, price drops back into the range."

Large exchange deposits and stablecoin inflows

Before the drop occurred, on-chain data analytics platform CryptoQuant pointed out large BTC deposits into Gemini.

Gemini is a leading Bitcoin exchange in the United States alongside Coinbase, and is often regarded as a "whale exchange."

Bitcoin all exchanges inflow mean. Source: CryptoQuant

Ki Young Ju, the CEO of CryptoQuant, said:

"This 18k $BTC deposit is legit as it was a transaction between user deposit wallets and Gemini hot wallet. All Exchanges Inflow Mean is skyrocketed due to this deposit. Don't overleverage if you're in a long position."

In addition to the selling pressure from whales, the recent Bitcoin rally being led by stablecoin inflows into exchanges was another bearish sign.

Ki noted that the rally was catalyzed by sidelined capital held in stablecoins rather than institutions in the U.S. He explained:

"Coinbase Premium Index was always significantly high when $BTC price breaking 20k, 30k, 40k, and 50k. It was significantly negative when the price breaking 60k. This 60k bull-run is not US institution-driven, it all came from stablecoins."

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.