This best-case scenario for Litecoin price forecasts a 20% drop

- Litecoin price has broken down out of the bear flag formation identified last week, suggesting the start of a downtrend.

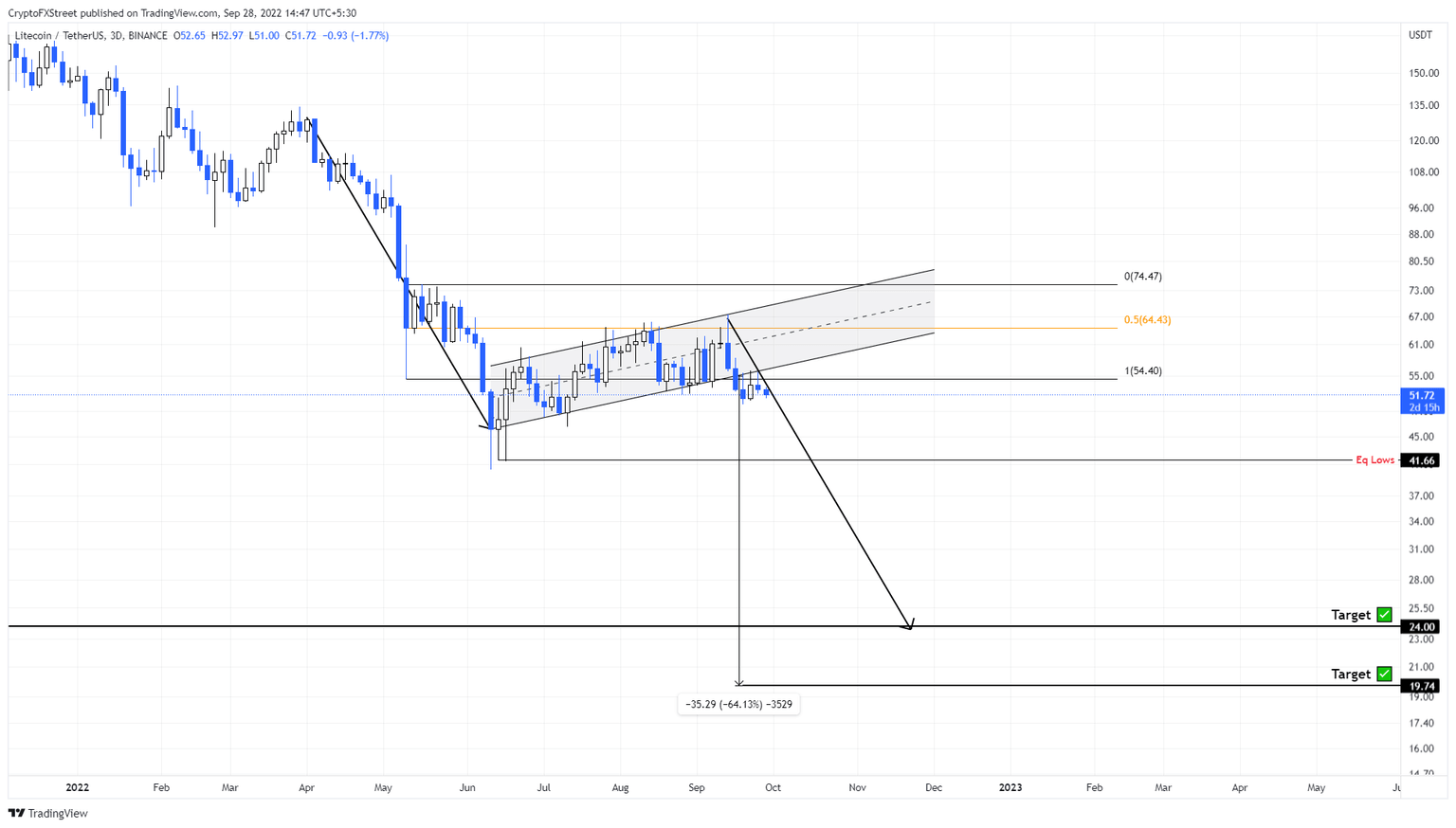

- Although theoretical forecasting methods hint at a 64% nosedive, investors can expect stabilization after a 20% crash.

- If LTC produces a daily candlestick close above $64.43, it will invalidate the bearish thesis.

Litecoin price action over the last few weeks paints a bearish picture, as discussed in our previous article. Since then, LTC has triggered a breakout and is likely to continue heading lower.

Litecoin price and potential plays

Litecoin price created a bear flag setup, which is a bearish continuation pattern. This technical formation contains a massive sell-off that looks like a flagpole and is often followed by a tight consolidation that resembles a flag.

In the case of Litecoin the setup forecasts a 64% downswing in LTC price to $19.74, determined by adding the height of the flagpole to the breakout point at $55.03.

Since Litecoin price broke out of the flag on September 16, it has dropped nearly 7% and is currently hovering at $52. Going forward, investors need to pay close attention to market influencer Bitcoin’s price for clues as to what might happen to LTC, which is also looking ready for a quick correction.

Although the bear flag forecasts a 64% crash, a nosedive of this extent is unlikely to happen without Bitcoin falling equally hard. Hence, as things stand, investors should prepare for a more moderate 20% crash to $41.66 instead.

LTC/USDT 1-day chart

While things are looking bearish for Litecoin price, this could change if Bitcoin price triggers a premature run-up. In such a case, if LTC produces a daily candlestick close above $64.43, it will invalidate the bearish thesis.

This development from Litecoin price could see it climb higher and a retest of the range high at $74.47.

Note:

The video attached below talks about Bitcoin price and its potential outlook, however, this is still relevant as it is likely to influence Litecoin price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.